The debt ceiling has been a recurring debate within U.S. politics since the financial crisis, with Republicans and Democrats locking horns over Washington’s unsustainable spending practices. Back in September, President Trump reached a controversial deal with Democrats to not only raise the debt ceiling, but also keep the government funded through the fall. This eventually led to the passing of the 2018 budget outline, which many believe is a precursor to substantial tax reform.

In reality, the recently passed budget blueprint is a vision of what the GOP majority wants to accomplish moving forward. Getting there is another matter entirely, given that the Republican-led House barely overcame an internal revolt to pass the blueprint with a vote of 216-212.

Against this backdrop, investors are interested in taking a deeper dive into the concept of debt ceiling and how it may impact the financial markets.

Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Dividend Stocks by Yield page.

The Debt Ceiling and Its Implications

The debt ceiling is the statutory limit on the amount of Treasury debt that remains outstanding. It is the limit that Congress imposes on how much debt the federal government can hold at any given time. When the ceiling is reached, the Treasury Department can no longer issue Treasury bills, notes or bonds. Its only available action is to pay bills via tax revenue. If tax revenue isn’t enough to offset the costs, then the Treasury Secretary must choose which federal functions will continue to operate. The choice often comes down to paying federal employees, Social Security benefits or interest on the national debt. For this reason, the debt ceiling raises concerns about the federal government shutting down.

As one might expect, the debt ceiling has changed substantially over the years. Analysts count more than 100 changes since 1944, with the vast majority of adjustments resulting in a higher limit. The debt ceiling was raised 18 times under Ronald Reagan, 10 times each by Jimmy Carter and Lyndon Johnson, and nine times by George Bush Senior.

The debt ceiling is considered a signaling device as well as a fiscal tool to bring government spending under control. The debt ceiling is often referred to as a ‘crisis’ because U.S. national debt is already at $20 trillion, which is more than what the domestic economy is capable of producing in terms of gross domestic product (GDP). As it currently stands, about $14 trillion of the national debt is held by the public via the credit markets. Roughly $6 trillion is held by government agencies.

Excessive debt creates a myriad of challenges for policymakers and the nation. It can not only impede economic growth, but also limit the government’s ability to invest and reduce taxes. A failure to raise the debt limit can disrupt the economy in various ways, including reducing government services and stoking instability in the financial markets. According to analysts, one of the first casualties is a selloff of U.S. Treasury bonds, thereby raising interest rates across the board. As we know, higher interest rates place a bigger burden on consumers, especially during times of economic or financial hardship.

From a financial market perspective, failing to raise the debt limit would trigger market panic and a run on money markets. This could impact several sectors of the financial markets, and even gold (in the event that government defaults on its assets). Even if Congress resolves the impasse, the long-term effects could be substantial as credit rating agencies could downgrade the U.S. debt. This would not only reduce the U.S. economy’s global standing, it could also impact the dollar’s attractiveness as a reserve currency.

Check out what investors are currently most interested in by visiting our Most Watched Stocks page.

Trump Avoids Debt Ceiling, But Angers Republicans

President Trump alienated members of his own party in September by striking a deal with Democrats to raise the debt ceiling and keep the government funded through December 15. The deal also included important relief aid to Texas and other regions impacted by Hurricane Harvey. The deal was previously rejected by GOP House Speaker Paul Ryan and other Republican allies, who sought a longer-term debt limit increase.

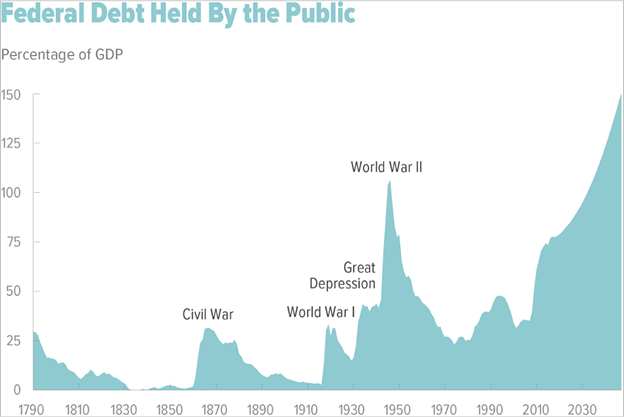

Analysts are concerned that the deal simply pushes Washington’s most predictable crisis further down the road. Long-term projections by the non-partisan Congressional Budget Office show that the federal debt held by the public will essentially double over the next 30 years to reach 150% of GDP. As the following chart illustrates, the federal debt held by the public has increased substantially since the 1990s.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

The Bottom Line

Investors have grown accustomed to hearing about the debt ceiling year in and year out. This is unlikely to change anytime soon as lawmakers continue to implement stopgap spending measures to keep the government functioning. Solutions are available, but political wrangling and an inadequate institutional framework have made it exceedingly difficult to bring about change.

Start your free trial to Dividend.com Premium account here.