There has been much debate among investors about whether to invest in “sin” stocks or not. Many people decide to stick to their morals and use their investment dollars elsewhere, while others realize that “sin” stocks like tobacco stocks are not harmful to their portfolios and can benefit them greatly. With their reliable and attractive dividend payments, investors have been flocking to tobacco stocks, realizing that these companies may be some of the best investments around.

High Yields

Many tobacco stocks have been known to offer attractive dividend yields, and these stocks have shown no signs of cutting dividends anytime soon. The stocks listed below have some of the highest dividend yields in the industry.

Altria Group (MO ) is the parent company of Philip Morris and is the owner of the world’s most popular cigarette brand, Marlboro. MO typically offers a dividend yield between 4% and 5%.

Philip Morris (PM ) has been increasing its dividend every year since it began paying dividends in 2008. The company usually offers a yield between 4% and 5%.

Reynolds American (RAI) is the second largest tobacco company in the country and is known for its brands including Camel, Kool, Pall Mall, Winston, Salem and Doral. RAI has been consistently increasing its dividend since 2010. It’s yield is usually between 4% and 5%.

Lorillard Inc. (LO) is known for its popular menthol brand Newport and is also one of the largest tobacco companies in the U.S. In 2014, LO was acquired by Reynolds American. LO’s dividend yield is typically around 4%.

British American Tobacco (BTI ) could be a foreign stock option for some investors. The company is known for its Dunhill, Kent, Pall Mall and Lucky Strike brands, which are continuously gaining market share. BTI receives three quarters of its sales from developing markets. The stock usually yields between 4% and 5%

.

Globalization of Tobacco Companies

The U.S. has certainly made it difficult for tobacco companies in the past years with regulations and taxes, but tobacco companies have been able to continue their earnings growth.

Emerging markets have played a significant role in the success of tobacco companies. Since smoking has declined in the U.S. and Western Europe, tobacco companies have been concentrating on regions like Asia, Africa and the Middle East for earnings growth. These companies have benefited greatly from countries like China and India, where there are large populations of smokers.

As the number of anti-smoking bans have increased in the U.S., international exposure for these companies has helped offset declining sales and lower demand.

Cash Flow

Quality tobacco stocks have brought in significant returns for investors. These companies have maintained their earnings growth by cutting expenses, seeking income abroad and making M&A deals.

These factors have brought enough cash into these companies to offer investors attractive dividend yields and growing stock prices. These reliable high yield stocks can make great investments for dividend investors.

Mergers & Acquisitions

One way that tobacco companies grow their businesses is by acquiring other companies. Below are the visual histories of some of the biggest names in tobacco.

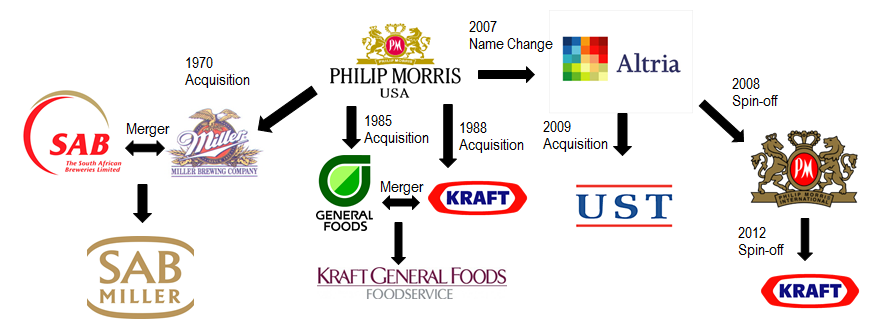

A Visual History of Phillip Morris & Altria

Phillip Morris USA was founded in 1835 in London. By 1902, the company had expanded to the United States when it opened a shop in New York City. Although the company began as a tobacco product company, it acquired General Foods and Kraft Foods (KRFT) in the 1980s. The company also acquired alcohol companies Miller Brewing Company and The South African Brewers.

In 2007, Philip Morris USA changed its named to Altria. A year later, Altria spun-off Philip Morris International, which later spun-off Kraft Foods. In 2009, Altria acquired the United States Tobacco Company (UST).

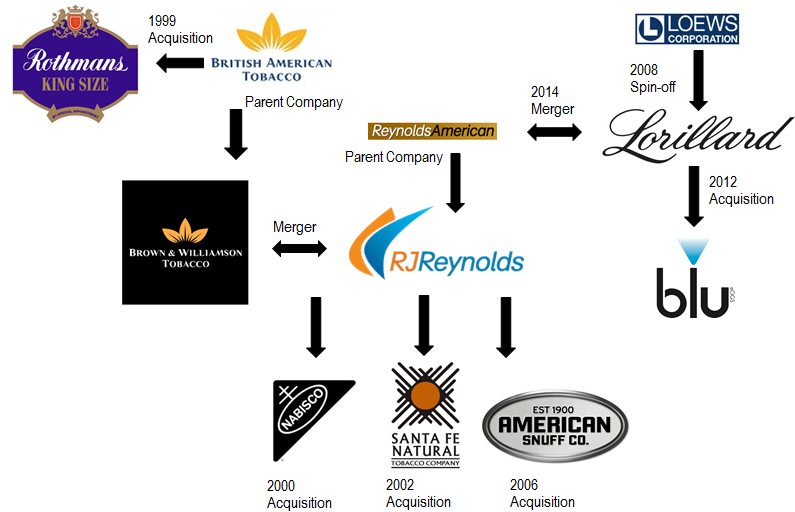

A Visual History of Reynolds American & Lorillard

British American Tobacco announced in 1999 that it would acquire Rothmans. In 2004, BTI’s subsidiary Brown & Williamson Tobacco agreed to merge with RJ Reynolds, which was a subsidiary of Reynolds American. In the early and mid 2000s, RJ Reynolds acquired three major companies: Nabisco, Santa Fe Natural and American Snuff.

By 2008, insurance company Loews Corp (L ) had spun-off its tobacco company Lorillard. Four years later, LO became the first company to offer e-cigarettes when it acquired Blu.

In 2014, Reynolds American and Lorillard announced that they have agreed to merge. See also: Post-Merger/Acquisition: Where Are the Biggest Mega-Deals Now?

The Bottom Line

Although investing in “sin” stocks may not be for everyone, it is a good idea to consider a dividend investment in the tobacco industry. On average, tobacco dividend stocks pay very consistent and attractive dividends and can be a great source of income for investors.