As one of the largest states in economic prowess and population, it stands to reason that California is one of the largest issuers of municipal debt. As such, it features prominently in many national municipal bond funds. At the same, as a high tax state, California munis are a top draw for investors living within the Golden State’s borders. So, when concerns about California’s finances creep into the news, it makes sense that investors get nervous.

But they may not have anything to worry about.

California is on some of the surest footing in decades. A hefty rainy day fund, high tax receipts and other factors make it an ideal destination for muni investors. Whether that be those who reside in-state or out of state.

Surplus to Deficit

When it comes to municipal bonds, there are a small handful of states that can tip the market. Texas, New York and California represent the largest three issuers, and that makes sense given that these are the three largest states in the country. California is the largest of them all – with more than $668 billion in total issuance.

So, when California’s finances feature a hiccup, investors tend to take notice – and that’s just what is happening right now.

Thanks to the pandemic, the rebounding economy and plenty of stimulus cash, California entered last year with more than $98 billion in budget surplus. However, last year’s rout of the tech sector and commercial property market hit California hard, causing that surplus to quickly turn into a deficit. In January, California saw a $22.5 billion budget deficit and is now projecting a $31.5 billion deficit for 2024.

The reasons for the hit come down to a couple of points. For starters, California features some of the highest earners in the nation. With the market volatility of 2022, capital gains taxes for the state were lower. At the same time, the broad tech layoffs hit the number of high income workers in the state. Finally, delayed tax filings for families impacted by winter flooding and wildfires have pushed income off into the sunset. Add in lower property tax receipts from falling commercial real estate values and you can see how California has been hurt on the budget front.

Investors have responded in kind. On a total return basis,-which includes interest payments, the S&P Municipal Bond California Index is up about 4% this year. When you subtract coupon payments, the return is slightly negative.

Better Than It Appears

However, investors may not want to give up on California just yet. In fact, the state could offer a good buy when it comes to munis.

For one thing, the state has a huge rainy day fund. Particularly, when looking at historical data. Thanks to higher tax receipts during COVID-19 and more than $36.5 billion in federal aid from the CARES and ARPA stimulus packages, California’s rainy day fund has swelled to $22.2 billion, which is the maximum allotment allowed under current California law. As for the budget itself, California legislators were proactive in cutting spending before it became a problem. Overall, the state can run for 60 days on its rainy day fund alone. This puts it in a good position versus other states.

As for worries about property taxes, California’s Prop 13, which has existed since the late 1970s, caps the amount that a property’s taxable value can only increase by 2% annually. That is, unless it changes hands via a sale. This has provided a cushion of property tax that is unaffected by current market conditions, which has worked in previous downturns. For example, in San Francisco during the Great Recession, property values technically slumped by 20%. However, California saw its property tax receipts jump by 23%. 1

As for income tax receipts, California may be bouncing back. Tech layoffs have slowed, while the stock market has trended higher over the last year. Given the number of high-income earners in the state, this is a huge boon to its potential future tax revenues. Market volatility has increased trading, while tech culture trends – like crypto and NFTs – seem to be bouncing back.

California Bonds Are Attractive

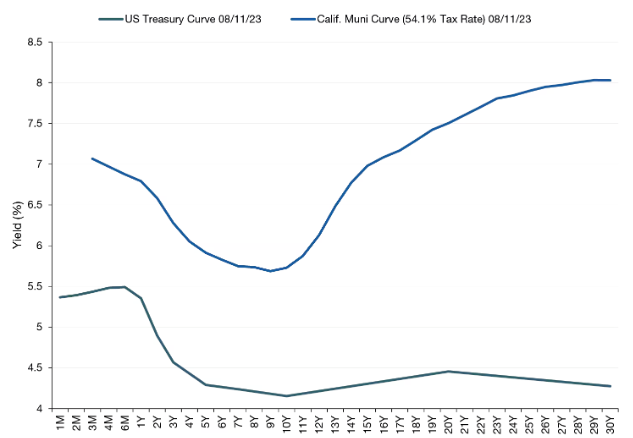

Despite the worries, California may not be in as bad of shape as first predicted, making its muni bonds a big buy. This is especially true when looking at their tax equivalent yields to Treasury bonds. As you can see by this chart from Lord Abbett, California’s muni bonds offer huge yields for those in high-tax states. And for those investors in California, they are a no brainer allowing them to bypass state and local taxes as well.

Source: Lord Abbett

The beauty is that getting exposure is pretty easy. As the largest issuer of muni bonds, California-focused funds are plentiful. For those looking for indexed exposure, the iShares California Muni Bond ETF is really the only game in town. With $2 billion in assets, low fees and a wide range of holdings, it’s not a bad choice at all.

However, munis remain a top draw for active management. As such, the number of choices here are wider, allowing investors to buy broad funds across the short, intermediate and long ends of the curve. For example, the Fidelity California Limited Term Tax-Free Bond Fund can be used for the short end of the curve, while the Schwab California Tax-Free Bond Fund provides broad exposure.

California Municipal Bond ETFs & Mutual Funds

These funds were selected based on their low-cost exposure to various California muni bonds and are sorted by their YTD total return, which range from 1.3% to 2.7%. They have expenses between 0.17% to 0.78% and assets under management between $135M and $4.65B. They are currently yielding between 1.90% and 3.60%

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PCTIX | PIMCO California Municipal Bond Fund - Institutional | $138M | 2.7% | 3.60% | 0.45% | MF | Yes |

| VCITX | Vanguard CA Long-Term Tax-Exempt Fund - Investor | $4.65B | 2.3% | 3.3% | 0.17% | MF | Yes |

| SWCAX | Schwab California Tax-Free Bond Fund | $387M | 2% | 2.8% | 0.41% | MF | Yes |

| LCFIX | Lord Abbett California Tax Free Fund - A | $514M | 1.90% | 3.3% | 0.77% | MF | Yes |

| PBCAX | PGIM California Muni Income Fund - A | $223M | 1.90% | 2.5% | 0.78% | MF | Yes |

| CMF | iShares California Muni Bond ETF | $2.2B | 1.80% | 2.3% | 0.25% | ETF | No |

| FCSTX | Fidelity California Limited Term Tax-Free Bond Fund | $522M | 1.30% | 1.90% | 0.29% | MF | Yes |

Overall, California bonds represent an interesting play in the muni market. As the largest issuer, investors often trade on the headline number. In this case: its budget woes. But digging deeper, California’s fiscal situation is strong, making bonds a big buy for portfolios – especially those in the state.

The Bottom Line

California’s budget woes have recently dented its bonds. However, its fiscal condition is strong. A big rainy day fund, rising tax receipts and provisions for property taxes have increased the state’s overall financial picture. This could make its muni bonds a big-time buy – especially for those investors in-state.

1 Lord Abbett (August 2023). An Update on California’s Fiscal Picture for Muni-Bond Investors