The municipal bond market was in great shape prior to the COVID-19 outbreak. After the passage of the Tax Cuts and Jobs Act in 2017, the combination of strong investor demand for yield and a limited supply of tax-exempt issues led to a compression in quality and sector spreads. Of course, the COVID-19 outbreak led to a sudden disruption of financial markets, including muni markets.

Let’s take a look at how the muni bond market changed following the COVID-19 pandemic.

Be sure to check out our Education section to learn more about municipal bonds.

COVID-19’s Impact on Munis

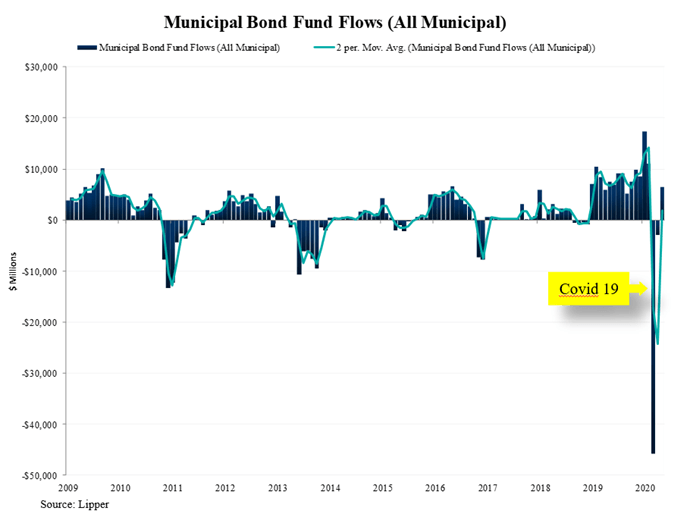

The U.S. COVID-19 outbreak in March sparked a rapid sell-off across financial assets. In the municipal bond market, $40 billion in redemptions in just three weeks caused a severe liquidity crisis, particularly as leveraged funds were forced to sell. Quality and sector spreads also widened as investors sought out safe-haven assets, such as general obligation bonds.

Municipal Bond Fund Flows – Source: SeekingAlpha

The Federal Reserve cut interest rates to zero by mid-March and introduced the Municipal Liquidity Facility (MLF) – a $500 billion emergency lending program for state and local governments – in early April. In subsequent months, the central bank expanded the scope and duration of the program, which helped stabilize the market from a liquidity standpoint.

While the initial sell-off was driven by a demand for liquidity, the long-term concern stems from deteriorating credit quality as key revenue streams dry up. The $2.2 trillion CARES Act provided relief to individuals, businesses and hospitals, as well as set aside $150 billion in federal fiscal support for state and local governments, which helped stabilize the medium-term outlook.

The combination of Federal Reserve liquidity and fiscal support has helped the market recover to a large extent, but there are several areas that remain vulnerable. For example, revenue bonds that rely on mass transit and airports may have a lower debt coverage ratio and an increased risk of default over the coming quarters.

Use our Screener to find the right municipal bonds for your portfolio.

What It Means for Investors

Municipal bonds have recovered to a large extent over the past couple of months as investors have re-entered the market. In fact, the tax-exempt status of muni bonds has made them an attractive alternative to conventional fixed income investments in a low interest rate environment while many analysts believe that equity valuations are stretched.

Despite the recovery, investors shouldn’t be complacent about municipal credit because the COVID-19 pandemic could lead to permanent behavioral changes. State and local governments with weak balance sheets could find themselves under pressure over time as government and central bank support measures begin to phase out into next year.

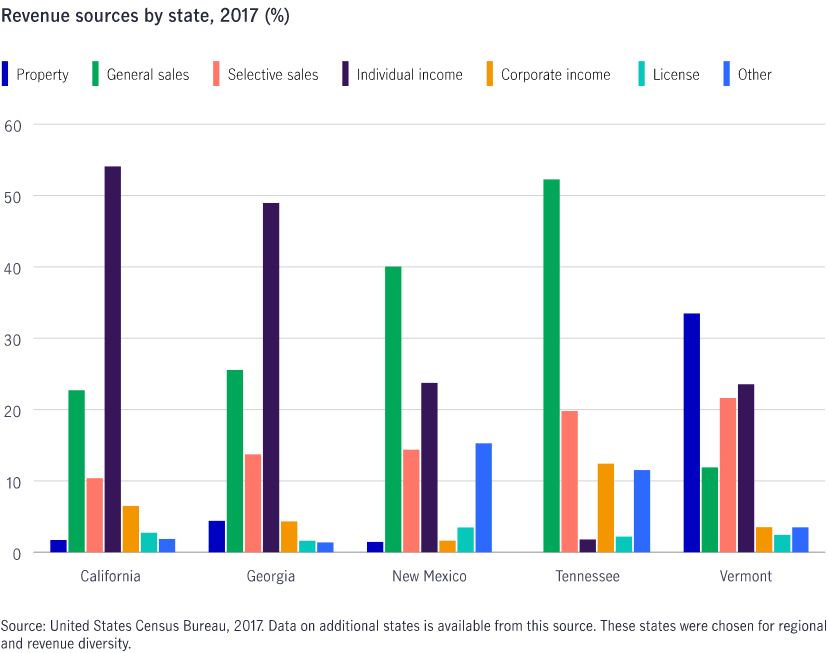

Revenue Sources by State in 2017 – Source: JH Investments

In the above chart, differences in revenue sources by state show the vulnerability to specific sectors. California generates most revenue from income taxes while Tennessee relies on sales tax – the latter could be more vulnerable to budget shortfalls stemming from lockdowns.

The best opportunities in the market may be tobacco, electric, water and sewer revenue bonds, which provide higher yields than general obligation bonds with relatively low risk compared to airport, mass transit and other types of revenue bonds that may experience more volatile revenue streams that increase their risk of default.

General obligation bonds could continue to be a safe-haven asset class in most cases since state and local governments have taxing authority to help support payments. While defaults have remained low thus far, bondholders should keep an eye on state and local government reserves. A decrease in tax income could lead to a decline in reserves, which could be a leading indicator of trouble repaying bonds.

Don’t forget to check out this article to know more about the future of American cities beyond 2020.

The Bottom Line

The municipal bond market has robust support from the Federal Reserve in the form of the Municipal Liquidity Facility, which hasn’t been extensively tapped thus far, except by small and low-quality issuers. While the short-term risk remains low, investors should be wary of at-risk revenue bonds and keep an eye on fiscal reserves in state and local governments.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.