Thanks to last year’s bond rout and the Fed’s continued path of monetary tightening, there are plenty of compelling opportunities in a variety of fixed income sectors. Yields haven’t been this high in over a decade, while lower return expectations for other asset classes have pushed bonds into the spotlight. Investors certainly have plenty of choice when it comes to fixed income.

But according to asset manager T. Rowe Price, one bond variety takes the cake.

Municipal bonds offer a compelling opportunity for investors – one that doesn’t just include investors in higher tax brackets. According to the asset manager, there are five great reasons why munis should be in your portfolio today.

Setting the Stage

Thanks to pandemic-era issues, the Fed has undergone one of the fastest paces of monetary tightening of all time. As inflation rose due to pandemic stimulus efforts as well as supply chain issues due to surging demand, the central bank raised rates by a total of 525 basis points. This boosted the Fed’s fund rate of 5.25–5.50%.

As a result, bonds suffered greatly in 2022 when the hikes started, with the Bloomberg Aggregate Bond Index falling by over 13%.

But within that drop, continued rate hikes and flat return environment, bonds are looking pretty good. And some segments of the market look better than others.

T. Rowe Price Suggests Munis

For asset manager T. Rowe Price, one of the more attractive segments of the fixed income world could be municipal bonds. The IOUs issued by state and local governments offer a wonderful combination of attributes and value among the current fixed income landscape. According to portfolio strategist, Dawn Mueller, there are five big reasons why investors should consider municipal bonds for their portfolios.

1. High Yields

For starters, munis offer some of the highest yields in decades. Bonds of all kinds have an inverse relationship with interest rates. So, as the Fed raises rates, bond prices fall. Municipal bonds are particularly susceptible to these increases to rates as many munis are longer-dated bonds. With that, the Fed’s path to tightenening has pushed yields to above averages. Over the last ten years, muni bonds have averaged about a 2% yield. Today, that number is closer to 3%.

2. Tax Advantages

Higher than 10-year average yields only tell half the story. The beauty of municipal bonds remains their tax advantages. To help spur state/local investment, Uncle Sam gives investors a break on taxes when it comes to municipal bonds. Aside from a smaller sliver of bonds that are subjected to the AMT, most munis are free from Federal taxes. And depending on the state of residency and issuing municipality, they can be free from state and local taxes as well. This has made them a powerful tool for higher income individuals. When factoring in taxes, muni bonds’ current high yields get even better.

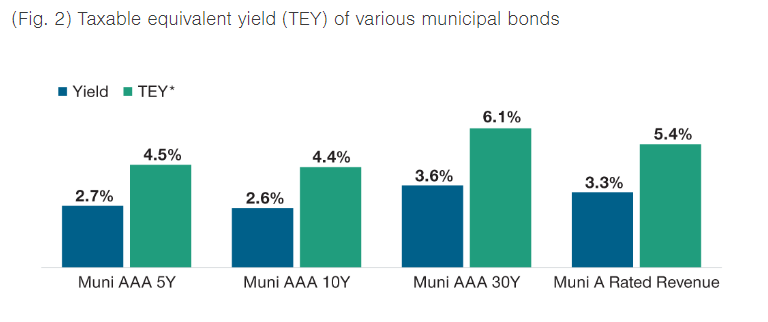

Looking at this chart from T. Rowe Price, you can see that taxable equivalent yields (TEY) for investors in the highest tax bracket. That’s what an investor would have to earn to match a muni’s yield on an after-tax basis.

Source: T. Rowe Price

The win is that even investors in lower tax brackets still win out with municipal bonds taxable equivalent yields versus other similar bonds of credit quality and duration.

3. Credit Quality

Speaking of that credit quality, municipal bonds have continued to get stronger over the last few years. Thanks to pandemic-era stimulus cash, programs to support states and investor gains, rainy day funds for most states are now sitting at the highest levels ever. T. Rowe Price cites two examples in New Jersey and Illinois. N.J. was able to fully fund its pension obligations for the first time in 25 years, while the ‘Land of Lincoln’ improved its credit rating and moved it up from near junk to investment grade.

This has many municipal bonds having credit ratings above similar corporate bonds. Moreover, default rates for high-yield munis have continued to decline, while default rates for regular junk bonds have increased.

4. Value & Opportunity

Another reason to consider munis? Pockets of opportunity.

Municipal bonds have long been a pretty sleepy and boring market. They mostly attracted large investors such as pension funds, high-net-worth individuals, and insurance funds. However, the last year has increased the volatility in the sector and broad selling by former yield tourists has opened up pockets of opportunity.

5. Historical Resilience Amid Market Downturns

The final reason to own municipal bonds?

They do really well during downturns. Thanks to the ability of states to cut funding and raise taxes, municipal bonds have often provided strong returns compared to other asset classes during times of economic duress. This includes events such as the Great Recession, 2013’s taper tantrum and even the pandemic. According to T. Rowe Price, the broad municipal index has only experienced three years with negative total returns in the last 23 years. One of them was last year’s rate environment.

With recession worries growing and economic uncertainty rising, municipal bonds could offer a great steady play amid any potential carnage. This is especially true when factoring in their current high starting yields.

Buy Munis Today

With these factors in tow, T. Rowe Price suggests that municipal bonds are the best play in fixed income. Ultimately, municipal bonds provide a great combination of attributes that make them very attractive in the current environment. Buying individual munis remains a more difficult proposition given that they are traded on the OTCBB. To that end, funds remain the best way to score muni bonds.

Indexing is easy and there are plenty of choices. The biggest two remain the iShares National Muni Bond ETF and the Vanguard Tax-Exempt Bond Index Fund. Both feature robust trading volumes, billions in assets, good yields, low costs and exposure to a wide range of investment-grade municipal bonds. The SPDR Nuveen Bloomberg High Yield Municipal Bond ETF offers an indexed approach to high-yield muni bonds.

There may be another way to get muni exposure. And that’s to get active. Here, investors can take advantage of the opportunities within the sector. While buying individual munis may be difficult for you and me, it’s not so for a dedicated bond desk. T. Rowe Price offers several funds within the sector including Tax-Free High Yield Fund and Tax-Free Income Fund, which feature high ratings. As do funds from PIMCO and Invesco. The key is to find managers that offer index-beating returns on a consistent basis.

Municipal Bond ETFs & Mutual Funds

These funds were selected based on their YTD total return, which ranges from 3.3% to 5.9%. They have expenses between 0.05% and 1.30% and AUM between $78M and $35B. They are currently yielding between 2.8% and 5.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| ORANX | Invesco Rochester Municipal Opportunities Fund | $8B | 5.9% | 5.1% | 1.30% | MF | Yes |

| MINO | PIMCO Municipal Income Opportunities Active ETF | $78M | 5.5% | 3.8% | 0.49% | ETF | Yes |

| OPTAX | Invesco AMT-Free Municipal Income Fund - A | $2.28B | 5.1% | 3.7% | 0.88% | MF | Yes |

| HYMB | SPDR Nuveen Bloomberg High Yield Municipal Bond ETF | $1.9B | 4.2% | 4.2% | 0.35% | ETF | No |

| PRTAX | T Rowe Price Tax-Free Income Fund | $2.19B | 4.1% | 3.2% | 0.59% | MF | Yes |

| PRFHX | T Rowe Price Tax-Free High Yield Fund | $3.25B | 3.9% | 3.7% | 0.77% | MF | Yes |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 3.5% | 3.1% | 0.05% | ETF | No |

| JMUB | JPMorgan Municipal ETF | $669M | 3.4% | 3.2% | 0.18% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34.2B | 3.3% | 2.8% | 0.07% | ETF | No |

The Bottom Line

There are plenty of opportunities amid fixed income, but municipal bonds could be the best. According to T. Rowe Price, their high yields, strong credit quality and ability to navigate downturns make them a compelling buy today. Whether investors index or buy active funds, munis should be on their menu.