Since the start of the COVID-19 pandemic, the United States government has distributed over $6 trillion in economic relief funds, entailing everything from direct economic impact payments, state and local government aid, extended unemployment benefits and financial help to small businesses – amounting to roughly over 25% of the annual U.S. Gross Domestic Product (GDP).

This spending also includes the most recent legislation signed by President Biden in March 2021 for $1.9 trillion, called the American Rescue Plan Act (ARPA). While the majority of the American Rescue Plan Act is geared towards bringing the pandemic under control and enabling local and state governments to craft a cohesive vaccine distribution strategy, there is $350 billion of allocation in assistance to states, counties, municipalities and other levels of governments to cover expenses and make up for lost revenue.

In this article, we will take a closer look at the different components of this most recent relief act and how it can help local governments combat the effects of the pandemic.

Be sure to check out our Education section to learn more about municipal bonds.

A Thorough Look Into the Allocation of Funds

The timing of this pandemic was such that both political parties, Republicans and Democrats alike, had their chance at passing some of the largest economic relief bills in American history, and some of the largest provision were carried over into each of the relief packages:

- direct payments to the American public;

- extension of the unemployment benefits;

- expansion of tax credits and financial help to small businesses.

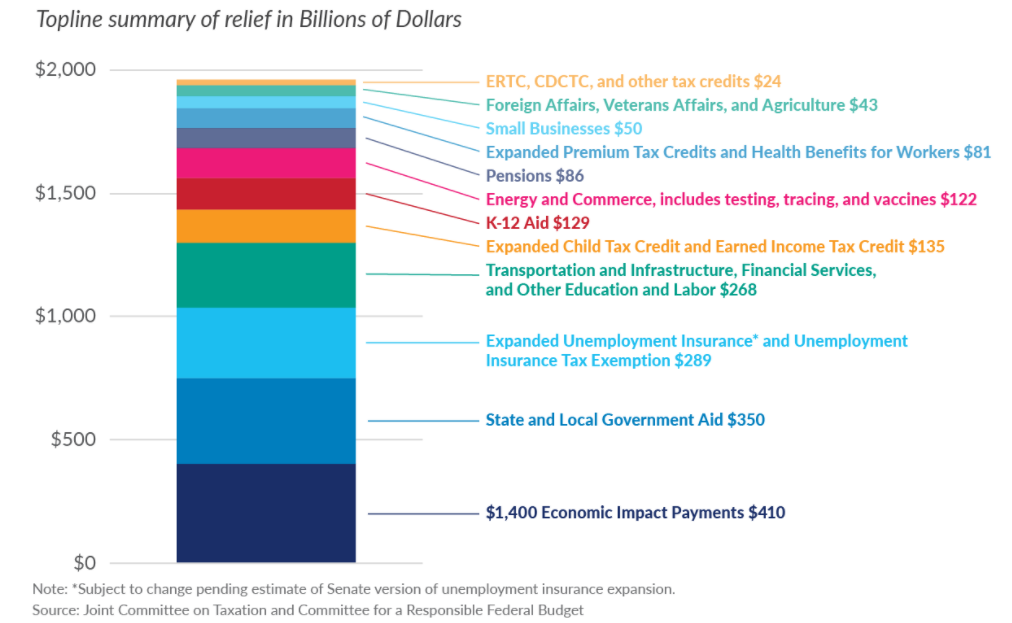

And, as shown below, over half of the $1.9 trillion was allocated towards the three aforementioned provisions, including a third round of stimulus payments of up to $1,400 for adults and any dependent. However, households with earnings of more than $80,000 for single filers, $120,000 for the head of household filers, and $160,000 for married filing jointly will not receive any payment. Here is the allocation of the most of recent financial relief bill and its various components:

Source: Joint Committee on Taxation and Committee for a Responsible Federal Budget

What’s in It for Local and State Governments?

As local and state governments have yet to see the return of their revenues to the pre-pandemic levels, the American Rescue Plan Act allocates roughly $350 billion towards assisting both levels of governments with their fiscal recovery, and also a small allocation towards capital project funds for governments to carry out projects to support work, education and health monitoring during COVID-19. All funds allocated under this relief package to local and state governments must be used by December 31, 2024, and the governments cannot use the funds towards pensions or to offset revenue resulting from a tax cut enacted since March 3, 2021.

Here are a few of the highlights from the National Law Review on how the distribution of funds will happen between state and local governments:

- $195.3 billion out of the $350 billion to states and the District of Columbia, of which $25.5 billion to be equally divided to provide each state a minimum of $500 million. The remainder will be distributed based on each state’s share of unemployed workers during the period of October through December 2020.

- $130.2 billion out of the $350 billion is allocated towards local governments, of which $65.1 billion to counties, allocated based on each county’s share of the national population. Furthermore, $45.6 billion is allocated towards metropolitan cities (cities with 50,000 or more people), and $19.5 billion to municipalities with fewer than 50,000 people (to be distributed by the applicable state), allocated based on each municipality’s share of the overall population of municipalities within that state.

It’s also important to note that many of the provisions under the COVID-19 recovery funds allocated for state and local governments are based on the assumption that local and state governments will be able to respond to the economic impacts of the pandemic, able to maintain their service levels without having to make significant cuts, provide premium pay to the essential employees of the state and local governments, and make adequate investment in essential services, like water and wastewater infrastructures.

Be sure to check out this article to know more about municipal bond due diligence process.

The Bottom Line

Although the mass vaccine roll-outs and promising decline in COVID-19 hospitalizations have shown local and state governments some kind of light at the end of the long tunnel, the road to fiscal recovery can still be a long haul. The federal stimulus funds can only provide a short-term fix to the larger issues at hand, and unless we continue to see a sustained economic shift into a positive direction, local governments will continue to face similar fiscal challenges.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.