For many investors, municipal bonds are as good as gold. This is because the vast bulk of bonds issued are general obligation bonds and backed by the taxing ability of the various state and local governments. At the end of the day, Texas or New York can raise taxes to avoid a default.

But, if their taxing authority starts to dry up?

This is one of the issues that is facing several major states and issuers of muni bonds. With commercial real estate valuations starting to dip, several pundits have voiced their concerns. The question is whether or not the concerns are valid and munis are in danger.

A Commercial Real Estate Slowdown

While it may be in the rearview mirror at this point, the COVID-19 pandemic has had some lasting effects on a variety of sectors. How we work, play and shop have been changed forever, including a hefty dose of online work and shopping. The consequence of this is that office buildings and plazas as well as strip malls have begun to empty out.

Adding fuel to this fire has been recessionary forces and the death of “start-up” culture in various hot spots like San Francisco, Austin and New York. With these key office and retail hotspots struggling, vacancies are on the rise. According to Moody’s Investors Service, the national office vacancy rate was 17.9%. That’s a record level, with pre-pandemic figures maxing out at 12%. Moody’s and other analysts expect the number to continue rising throughout the rest of 2023.

Naturally, the vacancies and declining demand have hit property values as well.

While that figure is very bad for banks that have underwritten the commercial mortgages and investors who own the buildings, it’s also bad for the state’s coffers. Property taxes are derived from a property’s value. The surging real estate boom of the last decade or so has enriched a variety of state’s bottom-lines. According to Nuveen, property tax revenues across the U.S. at the end of 2022 were up 6.9% versus 2021, thanks to surging home and commercial real estate values. 1

And it’s those property taxes that help pay for municipal bond’s rich coupons. For example, for the fiscal year 2022, property taxes accounted for 28% of New York City’s general fund revenues. The decline in property values within the city hit NYC’s tax revenues by about 6% last year.

With this, many analysts and pundits have begun to worry about the health and ability of many cities and states to pay for their muni bonds.

Better Than It Seems

However, cities and state governments may be in better shape than some analysts give them credit for and the slowdown in commercial real estate values may be a bit overblown.

For one thing, many of the affected cities’ property taxes come from residential housing, not office buildings. According to data from Nuveen, San Francisco only receives about 17% of its taxes from offices, while NYC shows a similar number. Chicago followed suit, with recent shifts to assessments and planning. At the same time, many cities have five-year phase-out plans with regards to property taxes. This allows them to gently wean themselves from the effects of lower property values. Rising residential, retail and entertainment property values have more than offset the decline in office values this year. NYC, for example, is projecting a 1.9% increase to its tax base because of this.

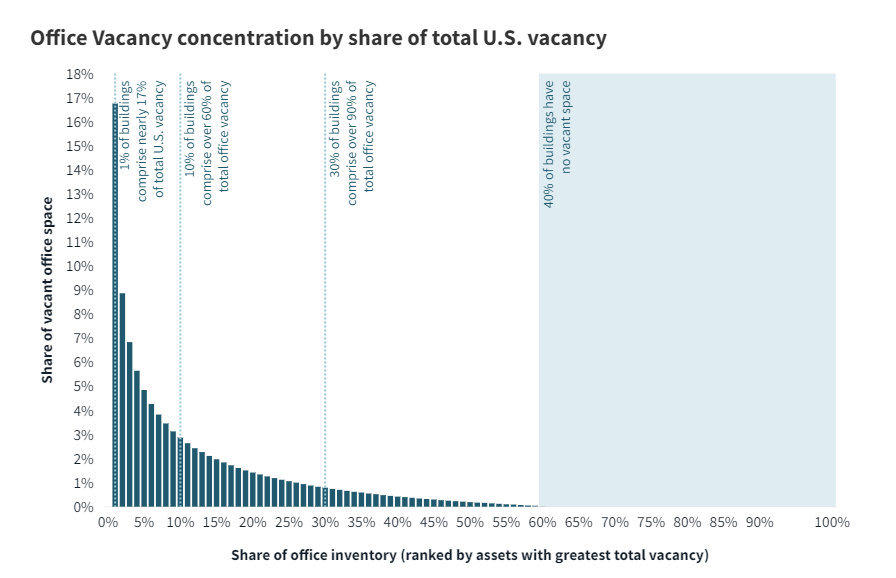

Then there are vacancies themselves to consider. Here, it looks like much of the damage is actually muted. According to real estate brokerage and services firm Jones Lang LaSalle Inc., more than 60% of office vacancies in the nation are concentrated in just 10% of buildings. You can see by this chart from the firm, just a small handful of buildings are causing the spikes in vacancy rates. And, in fact, the vast bulk of office buildings either have no vacancies or are within historical norms. 2

Source: JLL

Finally, rainy day funds and budget surpluses are now the norm for many states and cities. Thanks to the last few years of rising values, strong labor markets and other positives. Many municipalities are flushed with cash. This will go a long way to making sure that muni bonds are paid.

Munis Are Good Deal

So, investors should be cautious of the commercial real estate market, declining property values and municipal bonds. Things could get worse with growing concerns of a recession. However, the outlook is pretty good for muni bonds and the ability of states/cities to help pay off those debts. To that end, investors may still want to consider them for their portfolios. Yields remain high and the tax-free nature of their coupon payments could prove to be invaluable.

An interesting play could be the investing in those state-specific muni funds that could see trouble with regards to commercial property values, namely California, New York, Texas and Illinois. There are numerous funds that track these states. For example, the iShares California Muni Bond ETF and the Vanguard NY Long-Term Tax-Exempt Fund are just two low cost examples offering exposure.

State Specific Muni ETFs & Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| CMF | iShares California Muni Bond ETF | $2.259B | -0.4% | 0.25% | ETF | No |

| OPNYX | Invesco Rochester® AMT-Free New York Municipal Fund Class A | $581.3M | -0.1% | 0.84% | MF | Yes |

| NYF | iShares New York Muni Bond ETF | $569.3M | 0.2% | 0.25% | ETF | Yes |

| NCHRX | Nuveen California High Yield Municipal Bond Fund Class I | $542.3M | -4.2% | 0.61% | MF | Yes |

| VCITX | Vanguard California Long-Term Tax-Exempt Fund Investor Shares | $526.4M | -0.4% | 0.17% | MF | Yes |

| VNYTX | Vanguard New York Long-Term Tax-Exempt Fund Investor Shares | $441.5M | -0.1% | 0.17% | MF | Yes |

At the same time, many of the states that could be impacted by commercial real estate values are already the largest holdings in many broader muni funds. Realistically, aside from seeking values and the extra tax benefits from being a resident of these states, there is not a need to focus on these funds. Simply buying a broad muni vehicle might be enough to capture much of the value in these bonds.

The Bottom Line

The pandemic has hit commercial real estate values in the office sector as work-from-home and recessionary worries have grown. For muni bonds, this directly affects taxing authority. However, many of the worries may be overblown, and these muni bonds could be a big value. Investors have an opportunity to grab them while they are hot.

1 Nuveen (May 2023). Property, water and power impact muni bonds

2 JLL (June 2023). More than 60% of office vacancy concentrated in 10% of buildings