For income investors, these could truly be the halcyon days. Yield is easy to find with a variety of bonds and fixed income assets paying coupons not seen since before the Great Recession. Building a fixed income portfolio is easier than ever. But what if you’re looking for a little more?

According to Vanguard, the answer could be in humble municipal bonds.

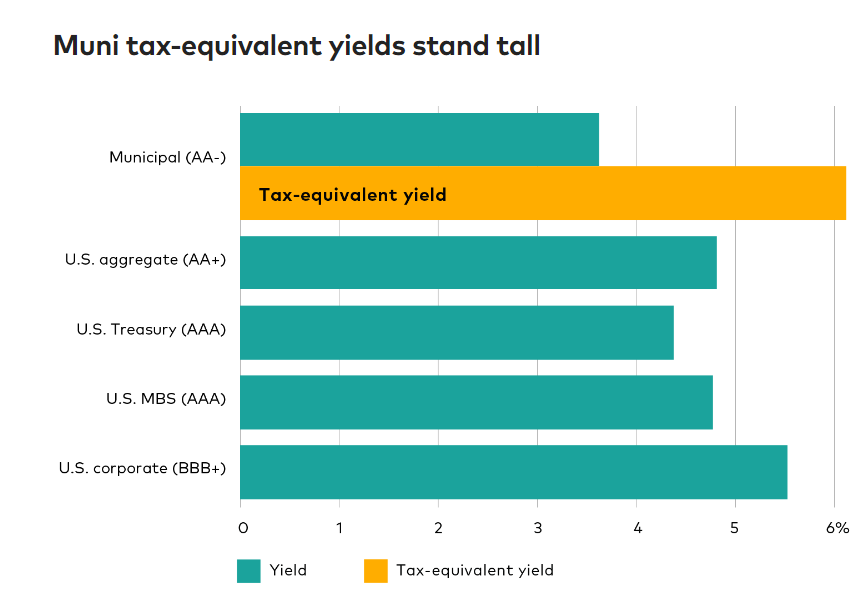

The key is to look at taxable equivalent yields. For investors with a wide variety of income and tax bands, munis offer some of the best after-tax yields around. Meanwhile, credit quality remains strong and default rates low. For investors looking for a bit more yield, munis are where it’s at.

Yields Surge

Bond investors certainly have a lot to cheer about these days. After last year’s drubbing, the Fed’s path to higher benchmark rates has produced some very high yields across the board. Overall, fixed income assets—from Treasury bonds to junk—are all paying yields not seen since before the Great Recession and the near zero benchmark yields of the last decade.

The high across-the-board yields offer plenty of choices to find strong income. Even cash and T-bills are paying over 5%. But according to Vanguard, there’s one fixed income asset class that offers the highest overall yield. And that’s investment-grade municipal bonds.

The investment manager suggests that when considering taxes, munis are the best bonds to buy these days for investors looking for the right combination of yield and quality. This is particularly true for those investors in high tax brackets. However, all investors can benefit from munis, no matter what they pay in taxes.

Right now, investment-grade municipal bonds are paying around 3.5%. Investors may be quick to pass that yield by as other investment-grade choices are yielding more. For example, the Bloomberg U.S. Aggregate Bond Index yields 4.67%, while U.S. investment-grade corporate bonds pay 5.5%.

The key for munis comes in their after-tax yields, which Vanguard shows are at some of the highest levels in over a decade. Muni’s power relies on their ability to be free from Federal and some state/local taxes. Because they are issued by states, Uncle Sam is willing to give their interest a break when it comes to federal taxes. This break creates an after-tax yield, meaning investors would have to earn this much in another asset class to be comparable.

You can see by this chart an investor in the highest tax bracket—40.8% with the extra 3.8% Obamacare surcharge—would have to earn over 6% to get the same yield offered by munis.1

Source: Vanguard Advisors

Better still is that Vanguard shows investors in lower tax brackets still do better with munis on an after-tax yield basis than other bonds.

Strong Credit Quality

The real win for investors is that munis’ credit quality is very strong.

Despite the recent downgrade by Fitch, U.S. federally-backed Treasuries are still considered the gold standard when it comes to fixed income. The odds of the United States defaulting on its debt is very slim. However, there is still a slightly larger chance that Texas or New York could default on their debts; munis aren’t rated as high.

However, the vast bulk of munis are rated investment-grade. And thanks to their ability to raise taxes, states and local governments have a very limited chance of defaulting on these bonds. Citing Moody’s data, Vanguard again reports that munis have had low default rates. Looking at 10-year rolling periods since 1970, investment-grade munis only have a default rate of 0.09%. This compares to a 2.17% default rate for the global corporate market. 2

Moreover, when digging into ‘investment-grade’ ratings, only 6% of munis are rated BBB- or the lowest investment-grade rating. This compares to over 50% for corporate bonds.

With munis, investors are getting a comparable credit quality bond at a higher yield than Treasuries. And when looking at corporate bonds, they beat them on both accounts.

Buying Munis Hand Over Fist

With that, Vanguard suggests investors should seriously consider adding and increasing their exposure to municipal bonds for their taxable accounts. Not only will their after-tax income increase, but they can use tax-sheltered accounts for equities and long-term growth. Moreover, future tax policies could make munis even more valuable than they already are. For investors of any tax bracket, it’s a serious win-win.

As one of the hallmark bond asset classes, there are a lot of ways to get exposure to muni bonds. The iShares National Muni Bond ETF, Vanguard Tax-Exempt Bond Index Fund, and SPDR Nuveen Bloomberg Municipal Bond ETF are the three big index ETFs on the block and offer cheap exposure to the theme. Choosing one of these funds could be all investors need.

A better bet?

Pair broad index exposure with an active choice. Munis are one of those fixed income sectors where active managers can make a difference. Vanguard’s own Intermediate-Term Tax-Exempt Fund has managed to outperform the index over the course of its history. Meanwhile, investors can now get plenty of active management muscle in ETF wrappers, with funds like the PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund and Dimensional National Municipal Bond ETF quickly gathering assets.

Muni Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 1.69% | 0.35% | ETF | Yes |

| VWIUX | Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares | $70.6B | 1.33% | 0.09% | MF | Yes |

| MUB | iShares National Muni Bond ETF | $32.8B | 1.20% | 0.07% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond Index Fund ETF | $30.6B | 1.19% | 0.05% | ETF | No |

| TFI | SPDR Nuveen Bloomberg Municipal Bond ETF | $3.82B | 0.42% | 0.23% | ETF | No |

| DFNM | DFA Dimensional National Municipal Bond ETF | $0.89B | 0.16% | 0.19% | ETF | Yes |

Ultimately, adding muni exposure provides a high yield and strong credit quality. Right now, investors are able to get both at decade highs. That’s a great deal for any investors looking to boost their income.

The Bottom Line

Thanks to the rise in interest rates, a variety of fixed income securities are paying high yields. But municipal bonds could be king of them all. According to Vanguard, their high after-tax yields and strong credit quality make them a top draw for portfolios and income seekers. Adding a dose of munis via passive or active means makes for a smart portfolio move.

1 Vanguard (June 2023). Looking for more yield? Munis yields are still going strong

2 Vanguard (January 2023). Municipal bonds through a potential recession—What to expect