From serious inflation concerns to the Omicron variant, the fears of the world economy facing more setbacks are very real going into 2022.

The inflation concerns became even more clear recently when Federal Reserve Chair Jerome Powell warned that inflation may persist into 2022 and the central bank is likely to taper its bond-buying program – alluding to the notion that inflation isn’t transitory, as most believed throughout 2021. In addition, the 2021 low yield and tight spread environment in the municipal bonds market presented challenges for investors to find attractive returns – which may change coming into 2022 as the interest rates start to rise. We are also likely to see the impacts of the government interventions into 2022, as infrastructure spending starts to take shape for local and state governments.

In this article, we will take a closer look at the trends and forces affecting municipal bond markets going into the year 2022.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Reviewing 2021 With 2022 Outlook

In early 2021, nearly all financial markets were still struggling with the ongoing pandemic and the uncertainty about the future. In the municipal debt market, investors were worried about their municipal debt holdings and whether the local and state economies would be able to sustain the prolonged effects of the shut down and/or the decrease in their revenue streams. This was especially challenging for municipal debt backed by airports and various transportation agencies throughout the U.S. Although air travel has made a significant recovery when compared to pre-pandemic levels, some transportation agencies, including local bus and light rail systems, have yet to see the return of their ridership. Some analysts covering the American transportation sector argue that as more and more companies are adapting the work-from-home models, or even hybrid schedules, the light rail and bus systems may never see their ridership return to the pre-pandemic levels.

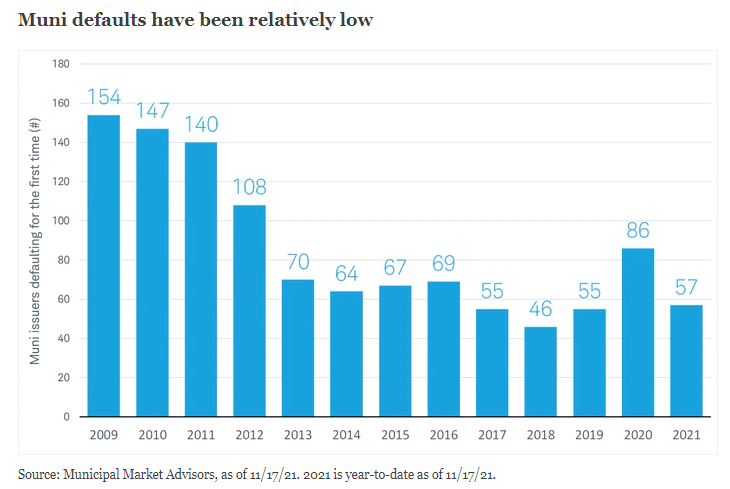

Although the municipal downgrade fears were valid to a certain extent for muni investors, the markets didn’t see a wide range of municipal credit downgrades – and the economy recovered much more quickly than originally expected. The graph below shows how the municipal defaults have been historically low even during COVID-19.

Furthermore, the aforementioned government programs to help local and state governments provided a lifeline for many to address things like their revenue loss due to COVID-19, help with personal protective equipment for essential workers and provide a level of funding to address any short- and long-term challenges posed by the pandemic. It’s also important to note that many of the main revenue sources for local and state governments that include sales tax revenues and property tax revenues were hardly impacted by the pandemic as consumer spending and property values witnessed strong increases in 2021. This allowed for two things to happen in 2021:

- Having gone through the 2020 pandemic year, local governments budgeted the impacts of the pandemic to continue into 2021. And, as a precautionary measure, many local and state governments budgeted for a significant reduction in their revenues, which prompted them to cut expenditures to address the budget imbalances. However, the expected revenue declines didn’t really materialize, and the less year-over-year expenditures generated hefty fund balances for some local governments.

- The government funding related to the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and the American Rescue Plan (ARPA) have provided additional streams of revenues that will likely replenish the COVID-19-related impacts for years to come. The credit rating agencies are looking for government interventions to be highly fruitful for local and state governments and their operations. Furthermore, the new infrastructure bill will likely have spending provisions that will need a collaboration with local and state governments to rebuild the American infrastructure, which will likely add to the financial prosperity of local and state governments through new jobs and spending.

The Supply and Demand Issues To Resolve In 2022

The current imbalance of supply and demand, precipitated by the global impacts of the pandemic, will likely ease in 2022.

As previously published research shows by Beacon Economics, it’s clear that global supply chain problems will continue to persist for the next few months before they get better. “Logistical problems, soaring transportation costs, and the pandemic are combining to make life difficult for exporters. The coronavirus pandemic is not close to being finished with us. In recent weeks, global trade has been repeatedly disrupted by factory closures and port shutdowns, virtually all reportedly linked to outbreaks of COVID-19’s Delta variant. Exports to China and Southeast Asia have been especially affected. At home, hospitalizations and deaths from the virus have been rising at alarming levels, especially in areas with low vaccination rates.”

It’s also important to watch the effects of Omicron, the new Covid-19 variant, on the global economies and whether it will get to the same severity as Delta and other variants of the virus.

Don’t forget to check our Muni Bond Screener.

Taxable Municipal Debt Performance in 2022

The taxable municipal debt issuances and their appeal has continued from 2020 into 2021 and will likely continue into 2022.

The total market for taxable municipal debt is approaching above $750 billion and there is continued interest from all kinds of investors. In the recent publication by PIMCO, author David Hammer reviews the taxable municipal debt from both the issuer and the investor standpoint, “Following a record year of supply in 2020, taxable municipal new issuance remains robust in 2021 with over $81.8 billion issued as of 30 September. Notably, we have seen many first-time issuers of taxable municipals participating in the marketplace – low interest rates and the inability of issuers to advance refund outstanding tax-exempt debt with new tax-exempt issues have proven a potent combination. Although the potential restoration of tax-exempt advance refunding remains a key risk to taxable supply, the Bipartisan Infrastructure Framework maintains the status quo for now.”

The Bottom Line

The overall outlook for the municipal debt market is strong going into 2022 – supported by the renewed investor sentiment in municipal debt, the Fed’s position on tightening the monetary policy, continued economic growth and the fear of a hike in marginal tax rates for high earners in the U.S. The current struggles related to the supply chain will likely ease into 2022. Investors are encouraged to review the financial statements and credit ratings reviews of municipal debt issuers before making any investment decisions.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.