With 2020 in our rearview mirror, the year 2021 will likely be a year of change along with adjusting and repairing the damages caused by COVID-19 in all facets of life.

In addition, with the recent results from Georgia’s senate run-off elections, the Democratic Party will now have control over all three branches of government – streamlining their efforts to get various legislations passed and, most importantly, undoing some of the things enacted by the previous administration.

In this article, we will take a closer look at the financial health of the municipal governments and the outlook for municipal debt in 2021.

Be sure to check out our Education section to learn more about municipal bonds.

Economic Activity and Fiscal Health of Municipalities in 2021

During the first economic shut down, many analysts and economists predicted a gloomy future for many of the municipal debt issuers and questioned their ability to make their debt service payment – leading to a wider expectation of muni defaults.

Although there wasn’t a widespread municipal defaults in 2020, every local and state governments felt the extreme strain caused by a significant decrease in revenue sources that were linked to the economic activity: sales tax, fare revenues for transportation agencies, TOT tax related to tourism and many more. Furthermore, all the credit rating agencies in the municipal debt world have been extra busy during 2020 in their rating assessments and handing down credit rating downgrades throughout the year – which impacted a municipality’s ability to access the capital market at reasonable prices.

- Return of Economic Activity: As we embark on the year 2021, there is hope in all areas of the economy and the return of some state of normalcy – beginning with economic activity. With COVID-19 cases still on the rise throughout the US, the prospects of both FDA-approved vaccines and quick distribution to the general public are strong – which will be a critical step in restarting economic activity, in turn supporting the revenue sources of most municipal debt issuers.

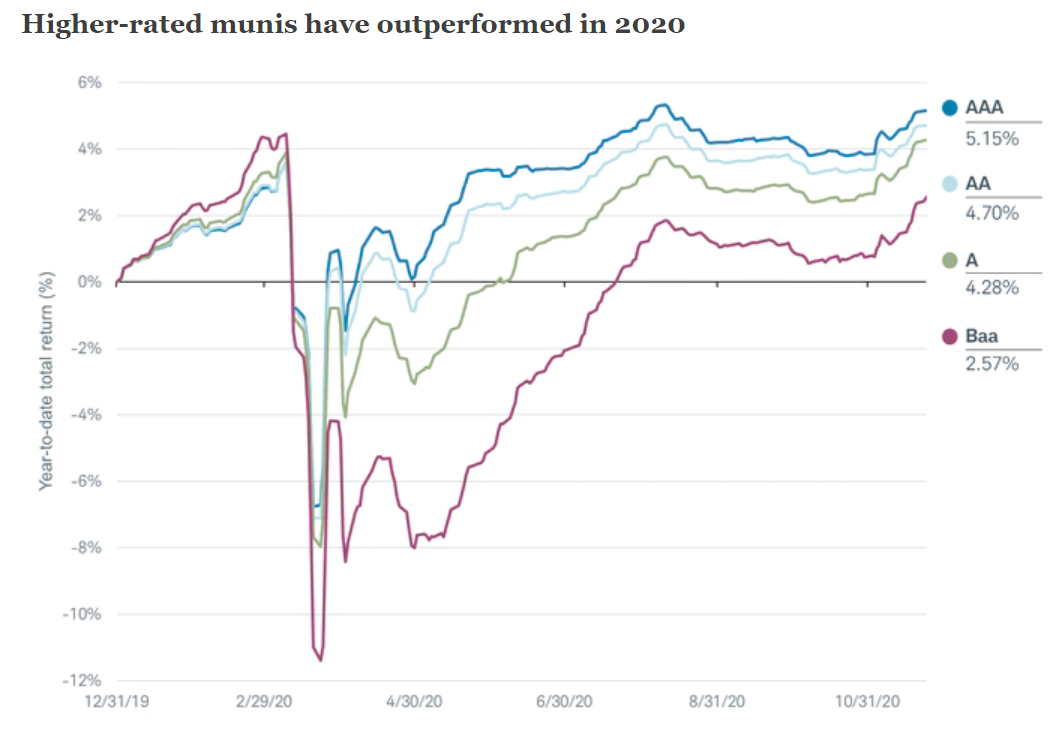

- Identifying and understanding the recovery of different muni issuers: The halt of economic activity wasn’t uniform for all municipal debt issuers. Issuers with strong reliance on economic activity for their operations and revenues will continue to lag behind certain cities and counties on the economic recovery curve. These muni issuers include: transportation agencies, airports, municipalities with heavy reliance on the tourism sector and debt issued for sporting arenas etc. Similar to 2020, debt issued with broad tax pledges will fare better in 2021 and be favored by the credit rating agencies. The chart below shows how higher-rated municipal debt instruments outperformed the lower-rated munis due to their strong revenue pledges and better ability to handle the revenue declines provided less volatility:

Source: Bloomberg Barclays Municipal AAA, AA and A indices

Click here to see a recap of how muni bonds fared in 2020.

New Administration, New Tax Rules

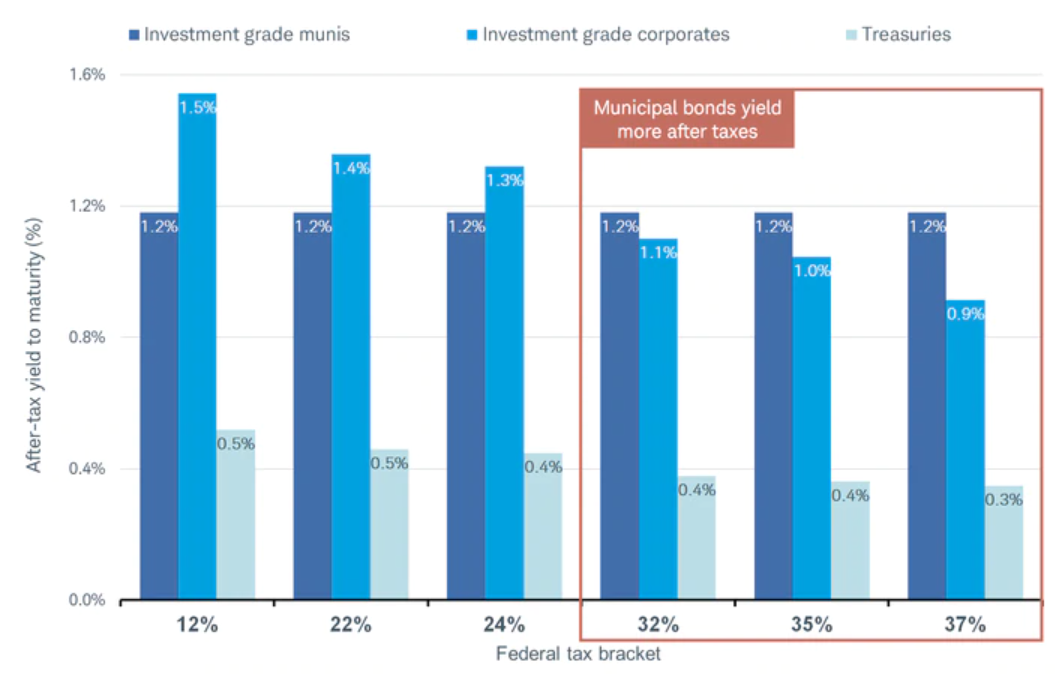

As many know, tax considerations play a huge role for an investor looking to invest in municipal debt obligations – as municipal debt typically generally generates tax free income, which provides a larger tax benefit for high-earners in the top tax brackets. As seen in the diagram below, the after-tax yield for corporate debt or treasuries was less than the municipal debt yield for high earners in the United States, and that will continue to be the case into 2021. Furthermore, with the incoming Biden administration, it’s likely that we will see some sort of a repeal of or amendment to the tax plan enacted in the beginning of President Trump’s presidency.

With potential changes in the tax code and possible tax increases for high earners on the way, municipal debt instruments will become much more attractive for these investors and possibly put a downward pressure on the muni yields. It’s imperative to note that President-elect Biden ran his campaign on promising a change to the tax code so that high-earners are taxed at a higher marginal tax rate – which means, in 2021, we are likely to see an influx into municipal debt investments.

Source: Bloomberg Barclays Municipal Bond, Corporate Bond, and Treasury Bond Indices

Key Takeaways for Municipal Debt into 2021

- Interest Rates in 2021: With the expectation of economic conditions improving, we are likely to see an increase in interest rates, which means that if you are holding a longer duration municipal debt instrument, you may see an adverse effect to your portfolio. It’s important to keep your duration low – which will not only limit your exposure to the interest rate risk, but also give you an opportunity to capitalize on the high interest rates by reinvestment.

- Not all municipal debt is the same: As mentioned earlier in this article, it’s imperative to understand the municipal debt issuer and their reliance on the economic recovery and most importantly how the credit rating agencies view their outlook. Some muni issuers will see a longer recovery than others, so it becomes even more important to assess the credit risk. Furthermore, throughout 2020, the federal government provided billions of dollars in stimulus funds for various municipal sectors to help alleviate the fiscal strain, which will be unlikely to continue as recovery begins.

- Corporate Debt versus Municipal Debt versus Taxable Municipal debt: The main difference, from an investor perspective, between a corporate and a municipal debt is their tax treatments. However, many municipal issuers are now turning towards issuing taxable municipal debt that can be yield-competitive with corporate debt, but provide a safer investment option in-terms of the credit risk. In 2021, we are likely to see a larger issuance of taxable municipal debt, and it can be a great addition to a diversified portfolio.

Click here to learn more about the municipal debt due diligence process.

The Bottom Line

In 2021, investors should expect some significant changes in all financial markets. The beginning of the year may still feel like a continuation of 2020, but with the COVID-19 vaccine and a new government taking office, change is inevitable. Investors should pay close attention to all financial disclosures related to their municipal debt holding and credit rating opinions – as they can give an insight of how the economic health of your respective municipality is improving.

With the return of economic activity, we will see more and more issuers accessing the capital markets – which will present more investment opportunities.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.