Against the backdrop of conflicts in the Middle East and Eastern Europe and a global economic slowdown, investors are actively seeking insights into the anticipated developments in 2024 across various asset classes, including municipal debt.

The fixed income markets are preparing for potential rate cuts by the Federal Reserve in the coming year. Additionally, investors are closely monitoring the forthcoming U.S. presidential election, recognizing the potential impact on the current administration’s tax policy stance. Despite the uncertainties and potential market volatility within the fixed income landscape, investors with a longer-term investment horizon are expected to derive benefits. In this environment, investors who have proactively taken advantage of prevailing conditions – such as high interest rates – are poised to capitalize on potential opportunities amid the unknowns and potential fluctuations in the fixed income markets.

In this article, we will take a closer look at the potential headwinds and opportunities for the municipal debt markets as we move into 2024.

Rate Cut Expectations Into 2024 by the Federal Reserve

With the continuous rate hikes in the previous years to combat rising inflation, the Federal Reserve has recently hinted towards the possibility of a few rate cuts in 2024, signaling a possible soft landing of the economy. It is widely acknowledged that abrupt interest rate increases – undertaken to counter inflation and prevent economic overheating – can precipitate a recession with profound and enduring impacts across all sectors of the economy. However, the soft landing can be seen as a possible win for the Federal Reserve, which also means that as rates come down, the borrowing cost will decrease for everyone from home buyers, corporate debt and municipal debt markets. This means that we will likely see an increase in new issues and defunding for municipal debt markets, presenting a variety of investment options for fixed income investors.

From the investor standpoint, the current interest rate environment presents a great opportunity to capitalize on the high interest rate coupons for two reasons: 1) your current investment, with a longer maturity, will alleviate the interest rate risk as rates come down into 2024 and 2) given the inverse relationship between interest rates and bond values, as the rates come down, you may be able to sell your high coupon maturities at premiums.

Resilient Revenue Sources for Local Governments

Following the aftermath of the COVID-19 pandemic, there was an anticipation of significant challenges and a decline in the credit quality of municipal revenue sources. Contrary to these expectations, municipal revenues have demonstrated remarkable resilience. Stable growth has been observed in property values and the sales tax base, which constitute major revenue streams for local governments. Additionally, public utility revenues have remained steadfast during this period.

In 2024, we may see a slowdown in the broader economy affecting the aforementioned tax revenues. However, it’s not expected to have a significant impact on the municipal credit qualities or large downgrades by credit rating agencies. The recent publication by Charles Schwab’s fixed income outlooks states that, “tax revenues would likely slow, which would be a headwind for states. However, we do not anticipate this would result in serious credit deterioration for most states, because many have used the combination of strong tax revenue growth and fiscal support since the onset of COVID-19 to build up their rainy-day and reserve balances. A rainy-day fund is akin to a savings account that a state can tap into, with some restrictions, if there’s a decline in revenues or they need to balance their budget.” The same goes for local governments, as a large portion of their revenues are the same, including property and sales tax.

The Potential Political Shift in 2024

In light of the forthcoming presidential election in 2024, it is evident that both political parties diverge significantly in their perspectives on the broader tax policy for Americans. Among various asset classes, municipal debt stands out as particularly sensitive to shifts in tax policy. Recognized for its triple-tax-exempt status, municipal debt income is often exempt from federal and state taxes, making it an appealing investment option, especially for high-income earners who stand to derive substantial benefits. Moreover, in the current interest rate environment, investors stand to gain from robust credit qualities, high coupons, and tax-exempt income associated with their municipal debt investments – attributes that may not all be readily available as we transition into 2024.

High-Yielding Municipal ETFs to Consider

These ETFs are selected based on their exposure to hgh-yielding municipal bonds. They are sorted by their 1-year total returns, which range from 0.4% to 4.6%. They have expenses between 0.35% and 1.82%, with assets under management between $239M and $2B. They are currently yielding between 3.9% and 4.3%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMHI | First Trust Municipal High Income ETF | $403M | 4.6% | 3.9% | 0.70% | ETF | Yes |

| HYMB | SPDR® Nuveen Bloomberg High Yield Municipal Bond ETF | $1.9B | 4.4% | 4.1% | 0.35% | ETF | No |

| XMPT | VanEck CEF Muni Income ETF | $239M | 0.4% | 4.3% | 1.82% | ETF | No |

Now, let’s look at an example that shows the comparison of tax-free income vs. taxable returns on investments. Imagine that you have two investment options in front of you: a corporate bond with 7% coupon and a municipal bond with 4.5% coupon. You are in a 38% marginal federal income tax bracket and 6% state income tax bracket.

Your tax equivalent yield on the municipal debt: 4.5 /(1-38 %) = 7.25

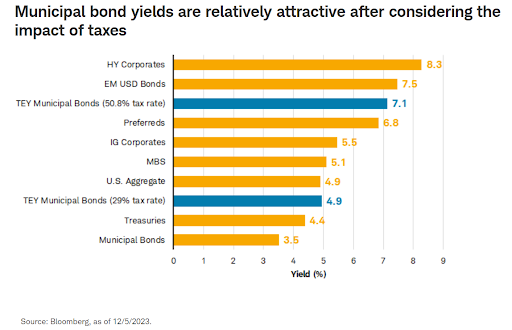

After considering the tax implications, municipal debt is a better option than the high-paying corporate debt. With the potential tax policy change at the federal level, we may see a shift in the marginal tax rates, which will affect the tax-equivalent yield calculations for municipal debt. The chart below shows the yield comparison between different asset classes and how municipal debt with a 3.5% yield fair with different tax brackets (blue bars).

The Bottom Line

From interest rate cut expectations to presidential election, 2024 is expected to be volatile for all asset classes. However, the current rate environment offers levels of municipal yields that haven’t been seen for a while and they are not expected to last. In addition, with the potential federal rate cuts, existing fixed income investments with higher coupons will benefit even more. Investors should carefully assess their current positions and near-term investments to capitalize on the potential upside in the fixed income markets.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgment of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisors prior to making any investment decisions.