Arguably, one of the most important pieces of investing is allocation. Getting the right assets classes in the right amounts is a major part of reducing risk and getting the returns you need. For high-net-worth investors and those looking for tax-free income, an allocation to municipal bonds is a must-have.

But how much in muni bonds should an investor really hold? And what kind of munis?

The answer may not be so simple. However, insurance giant and asset manager New York Life may have some answers depending on what investors want out of their municipal bond portfolio. Their guidelines could serve as a base for advisors and individuals looking toward muni bonds.

Munis Become the Asset Class of the Moment

Municipal bonds are enjoying their day in the sun as investors look toward the bonds for a variety of income needs. After last year’s bond rout, munis now offer tantalizing yields in the 3% to 4+% range. These yields are even better when considering the tax aspects.

Munis are issued by state and local governments to fund projects and spending. In order to help on this front, Uncle Sam allows the interest from muni bonds to be tax-free. Munis can also be free from state and local taxes. This pushes the tax-equivalent yield for high-income earners into the 6%+ range for some muni bonds. Even for those not in the highest tax brackets, munis are paying more than Treasury bonds without that much more risk.

With such high yields, many investors are looking toward the bonds to help drive income and returns. Overall, inflows for muni bonds have been positive this year.

The question is, just how much should an investor put into muni bonds? And, how should they allocate their capital among the various types.

Building an Allocation Based on Need

For many investors, building an allocation of muni bonds takes place in their taxable account, which makes sense given their tax-free interest status. And here, many advisors and investors use munis in proportion to their overall stock/bond mix. So, if they have a 60/40 spilt, they may own 60% of their taxable account in stocks and 40% in muni bonds. Often that muni bond allocation is set in a broad-based national muni fund.

That is a good start, but insurance giant New York Life has some additional allocation recommendations. Investors should be thinking about need when it comes to their municipal bond allocations. Municipal bonds can serve a variety of applications for an investment portfolio. To that end, going willy-nilly or holding just one kind of bond variety or duration may not make sense.

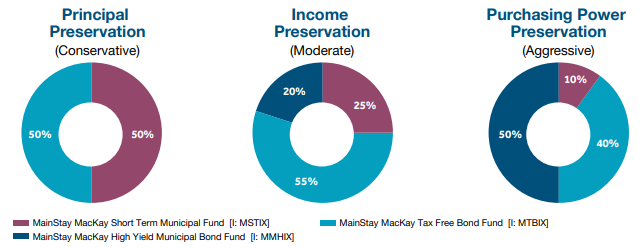

In a new white paper, the insurer and asset manager break down investor needs into three categories based on risk profile:

- Principal Preservation

- Income Preservation

- Purchasing Power Preservation

Here a combination of short-term, intermediate-term and high-yield municipal bonds are used to build out portfolios and allocations.

Conservative investors who are worried about return of capital rather than return on capital should focus on principal preservation. This can include investors who are looking to save for a purchase just a few years out or very wealthy investors whose balance is already very large.

Investors seeking to generate income or generate strong total returns over a longer period of time may want to focus on income preservation. High interest payments contribute to the overall return of the muni portfolio.

Finally, those looking to live off their muni portfolio while generating significant income that beats rates of inflation should consider using a purchasing power preservation method. Here, both high yields, short bonds that react to changes to inflation and total returns drive income and the ability to keep purchasing power above rates of inflation. It’s also the riskiest of the portfolios and includes bonds subjected to the alternate minimum tax (AMT).

Putting It All Together

So, how to put it all together? According to New York Life, it’s as simple as using two or three broad municipal funds. In this case, it’s own sponsored MainStay MacKay Short Term Municipal Fund, MainStay MacKay High Yield Municipal Bond Fund and MainStay MacKay Tax Free Bond Fund can serve the purpose.

This chart illustrates the breakdown for the three needs-based portfolios.

Source: New York Life

You can see how the allocations work with regards to yields and returns. Across the portfolios in order, they yield 3.4%, 3.66% and 3.91%. This is the current yield and not tax-equivalent. As for returns, since 2015, the three strategies have produced average annual returns of 1.84%, 2.8% and 3.335%, respectively. This underscores the concepts of principal preservation for the most conservative investors and beating inflation for the riskiest.

The beauty is while New York Life is using its own funds to build out this allocation, the concept could work across a variety of fund issuers. For example, investors could use the T. Rowe Price Summit Municipal Intermediate Fund to replace the intermediate muni fund in the allocation model or the PGIM Muni High Income Fund for the high-yield portion. While overall returns and yield will change based on different funds security selection, the concept is the same.

Moreover, the allocation based on need can be tweaked for those investors in high-tax states. For example, those investors in California looking at principal preservation may want to focus on PIMCO California Short Duration Municipal Income Fund and PIMCO California Municipal Bond Fund to take advantage of the extra tax savings.

Likewise, investors have plenty of choice in index ETFs to achieve similar allocations and results. For example, the iShares Short-Term National Muni Bond ETF and iShares National Muni Bond ETF are two low-cost index ETFs that can be used within this framework.

Muni Bond Mutual Funds & ETFs

These funds were selected based on their low-cost exposure to various municipal bond sub-asset classes and sorted by YTD total returns, which range from 0.1% to 1.9%. They have expenses between 0.07% and 0.85% and assets between $130M and $33B. They are currently yielding between 1.8% and 5%.

| Ticker | Name | AUM | YTD Price Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PRHAX | PGIM Muni High Income Fund-Class A | $686M | 1.9% | 4.0% | 0.85% | MF | Yes |

| MSTIX | MainStay MacKay Short Term Municipal Fund I | $994M | 1.7% | 3.2% | 0.43% | MF | Yes |

| PCDIX | PIMCO California Short Duration Municipal Income Fund Institutional Class | $142M | 1.6% | 2.7% | 0.33% | MF | Yes |

| MTBIX | MainStay MacKay Tax Free Bond Fund Class I | $7.76B | 1.4% | 4.9% | 0.5% | MF | Yes |

| PCTIX | PIMCO California Municipal Bond Fund Institutional Class | $134M | 1.4% | 3.6% | 0.45% | MF | Yes |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 0.9% | 1.8% | 0.07% | ETF | No |

| PRSMX | T. Rowe Price Summit Municipal Intermediate Fund Investor Class | $5.17B | 0.7% | 2.6% | 0.52% | MF | Yes |

| MUB | iShares National Muni Bond ETF | $32.8B | 0.1% | 2.9% | 0.07% | ETF | No |

Overall, for investors looking to add munis to their portfolio, focusing on “need” to develop an allocation makes sense. Whether that’s preserving capital or generating inflation-protected income, munis can serve a wide variety of roles in a portfolio. New York Life’s framework is a good starting point for finding the role you need.

The Bottom Line

Municipal bonds are quickly becoming a portfolio staple. But investors may be confused on how to allocate capital to the sector. According to New York Life, the answer is focusing on need. By determining this, investors can easily build a muni bond allocation.