For decades, many large U.S. metropolitan cities have seen their rental markets reach new heights with sky-high rents and shortage of living spaces – however, all of which came to a screeching halt during 2020.

Initially thought to be short term, work-from-home directives became the new norm. With this new reality, increasingly more large cities are seeing young professionals leaving for mid-to-small sized cities throughout the U.S. – creating vacancies and driving down the rent prices in larger metropolises like NYC and San Francisco . On the contrary, the flight of population from large cities can be a worrying sign for local and regional governments, as much of their finances depend on the flourishing real estate markets and consumer spending.

In this article, we will take a closer look at a few of the large metropolitan cities and how the COVID-19-related migration may impact their fiscal positions.

Be sure to check out our Education section to learn more about municipal bonds.

The Correlation between Rental Market and Local Government Health

As aforementioned, a large portion of local and state economies depend on two important factors: consumer spending and strength of the real estate economy, both of which share a common thread, as indicated by population growth.

Furthermore, these two factors often make up more than half of the revenues for these local governments. Now, as the national rent indices show, the large coastal cities have seen a continued decline in their population throughout the pandemic, which has severely impacted the rental markets in these cities. It’s also important to note that these cities have often been viewed as the tech hubs of the United States.

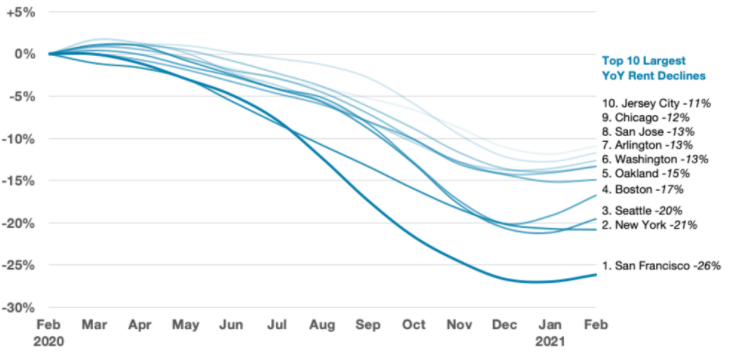

The chart below shows the year-over-year rent change among the top ten U.S. cities with the largest rent decline:

Source: Apartment List, Rent Estimate and Research

As shown in the graph, San Francisco and New York have seen the largest rent declines in the county and, prior to the pandemic, these cities were known for their unaffordable rental markets. Although we can see a flattening of the curve for many of the cities, it’s likely the beginning of the new normal as rent prices may never get back to their pre-pandemic levels.

On the contrary, more and more mid-to-small sized cities, and more inland vs. coastal locations, are seeing an increase in their population and an uptick in rental prices in their respective markets. The Apartment List National Rent Report and research published by Apartment List solidifies the aforementioned claim, “As the expensive coastal cities discussed above watched rents plummet, a separate group of mid-sized markets were experiencing rapid increases in rent prices as the pandemic and remote work spurred demand for the space and affordability that these cities offered. Boise [Idaho] currently ranks #1 for fastest year-over-year growth, and although growth there was fairly flat throughout most of the fall, this month brought an increase of 1.8%, the #4 largest monthly increase among the 100 largest cities in the U.S. Rents in Boise are now up by 13.5 percent year-over-year. All of the 10 cities with the fastest year-over-year rent growth saw prices increase this month.”

In most cases, rent growth in these markets has been fueled by a tightening of supply; we have observed local vacancy rates plummet as more renters compete for fewer available apartments.

Be sure to learn more about the impact of COVID-19 on local and state governments here.

The Direct Impact on Local Economies

Before analyzing the population migration impacts, it will be prudent to look closely at the budget for many of the large cities and their revenues. It’s also important to note that not all revenue sources will be equally impacted by the population migration. For example, local economies may/will see sales tax decrease faster than any adverse change in the property values that’ll impact the property tax revenue streams.

FY2020 major general revenues for few of the largest cities in the United States:

- City and County of San Francisco: property tax revenues – 37%, business taxes – 11.2%, sales and use tax – 3.7%

- City of New York: property tax revenues – 31%, sales and use tax – 9%

- City of Seattle: property tax revenues – 37% , sales and use tax – 19%

- City of Boston: property taxes, excise taxes, and payment in lieu of taxes – 67%

In a comparative analysis, the four largest cities with the largest YOY rent decline rely heavily on a strong real estate market and strength of consumer spending. With the continuous population decline, we will see a decline in some of their general revenue sources, further leading to spending cuts – unless, of course, we see a reverse migration back to the large cities post-pandemic.

Click here to learn more about the municipal debt due diligence process.

The Bottom Line

At the start of the pandemic, we witnessed normal disruptions in everyday life: social distancing, stay-at-home orders, and hardship for individuals and local economies. And, even with the mass vaccine roll out and declining COVID-19 cases, the relocation of America’s population may turn out to be more permanent.

The inevitable shift in resources, services and realignment of budget is already underway for many local economies and may likely to continue in the future.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.