No one likes to think about financial emergencies. The big ones probably entail losing your job, getting really sick or falling prey to some other disaster. In other words, they aren’t just financial disasters, they’re personal ones whose effects extend far beyond the bottom line. Maybe that’s why we’re so reluctant to start an emergency fund. It’s like a bad omen; put that money in the bank and you may just have to use it.

Though we all hope we’ll never have to face the most serious financial emergencies, the reality is that without a financial cushion, even common, minor mishaps can throw your finances off the rails. The good news is, even a little savings can go a long way. Below, we’ll take a look at how to get started.

How Much Should I Have in My Emergency Fund?

Life can take you by surprise. You might be struck by illness or a job loss. Or maybe the roof will spring a leak that costs thousands to fix. In such cases, a contingency fund can save the day and even the house. Many experts recommend that you save at least three to six months’ worth of basic expenses. That means enough to cover food, housing, utilities and other necessities. That way, if you run into an unexpected expense or income shortfall, you’ll at least have enough money to make ends meet for a while.

But as many of us learned during The Great Recession, even this general rule may not be enough for us. Now, experts believe keeping nine months to one year of income in an emergency account is a safer bet, especially in case of job loss.

The simplest way to calculate how much you will need to save for an emergency fund is to add up all of your monthly expenses, and then multiply this total by how many months you want the emergency funds to last for. There are also several free online tools you can use to calculate this number, including:

- PNC’s Emergency Fund Calculator

- Practical Money Skills’ Emergency Fund Calculator

Be sure to also check out this list of 50 Free Resources to Help Manage Your Money.

How to Start Saving for an Emergency Fund

If you aren’t currently saving for an emergency, the best thing to do is to take it slow and steady. Big commitments—and contributions—are great, but they often fizzle out. The real key to building up a big savings account is consistency. Start setting aside something from your paycheck each month through an automatic contribution from your checking account to a savings account. Start with an amount you don’t even think you’ll miss, no matter how small. Once you get used to that, increase the contribution and try to increase it gradually over time as your income grows, you pay off debts or you get better at saving. Automatically taking money off the top of your paycheck for savings is called “paying yourself first.” It’ll pay dividends if you ever run into trouble and need some extra money.

Of course, the other key to growing your savings is keeping your hands off them. Yes, sometimes our desire for something shiny and new feels like an emergency, but unlike a real financial shortfall, that feeling will probably pass. In the meantime, consider making your savings account just a little bit difficult to access by making it inaccessible through your debit card. That’ll put a small barrier in your way and make you think twice about whether you’re facing the kind of situation that really merits dipping into it.

Where to Put Your Emergency Savings

The key to emergency savings is to balance the need to have liquid cash you can access immediately with the lower returns that go along with such easy access. This is one case where it doesn’t pay to take risks with your investments. That means the goal here isn’t high returns – it’s ensuring your money is there when you need it.

That makes a simple high-interest savings account the best place to start. It’s easy to link it to your checking account, making automatic contributions simple and easy. But once your savings get a little bigger, it’s a good idea to invest at least some of them in something with a little bit of a higher interest rate, such as money market accounts or certificates of deposit. Just make sure that whatever investment you choose is something you can cash out easily without losing a lot of value. This is why things like stocks and mutual funds aren’t a great option; if your financial emergency falls on a down day in the market, you may have to sell them at a loss.

In addition, steer clear of accounts or investment options that require high fees or large tax events. Learn more about keeping banking costs at a minimum.

If you need more guidance on what types of accounts you should use, or how to grow your emergency fund, talk to your bank or use resources like HelloWallet or Mint.

The Final Piece of the Puzzle

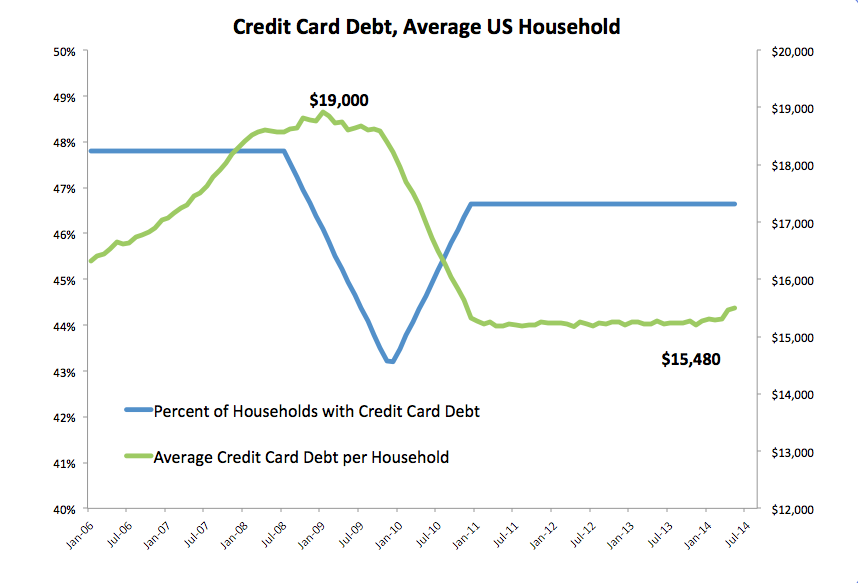

Saving money is important, but personal finance is a bit of a balancing act; savings sit on one side, but it’s really easy for debt to weigh down the other and throw the whole thing out of balance. According to the Federal Reserve, the average American family has more than $7,000 in credit card debt and more than $15,000 in total debt (as of 2014). And that doesn’t even include the mortgage.

Now back to that scale. What many people don’t realize is that if you have $7,000 in credit card debt and $7,000 in your emergency fund, you’re essentially penniless. They cancel each other out! That’s why one of the key aspects of preparing for a financial emergency is paying down debt – and keeping it low. However, you shouldn’t neglect savings to do it. Instead, try splitting your efforts between paying down debt and building up your savings.

You could go all-out to pay off the debt first, but there’s a risk to this strategy: If you do run into trouble and your emergency fund runs dry, you’ll have to go right back to racking up your credit card to bridge the gap. Building an emergency fund—even a small one—can help keep your credit card out of the equation when you have a short-term need for cash. So, while building that emergency fund, work on paying down debt too. That’ll put you in a prime position to deal with any kind of financial shortfall.

The Bottom Line

We don’t like to think that bad things will happen to us, but the reality is that sometimes they do. An emergency fund can keep a short-term financial shortfall from turning into a true financial disaster. And hey, if you’re lucky enough to avoid an emergency altogether, the worst that can happen is that you’ll have plenty of money in the bank.