Throughout the current bull run, investors have been bombarded with recession predictions and reasons why today’s market is due for an epic collapse. None of these predictions have come true thus far, and the perma-bears have missed out on quite an impressive market rally. Still, there are some who are cautious about the near-term future and the ability for markets to continue their upward momentum.

A Look at Treasuries

Income investing is always an excellent way to protect your portfolio from any capital losses, but dividend stocks can still be roped into the overall volatility of the surrounding markets, which can be frustrating at times. Treasuries are one outlet for those that are wary of the near-term future yet still want to maintain their income stream.

Treasuries are certainly not the sexiest of investing options, as they typically offer lower yields than dividend stocks, with less potential for capital appreciation. But when markets start to get choppy and investors look for a more stable option, Treasuries offer a great way to keep an income stream in your portfolio while downsizing your volatility from equity positions.

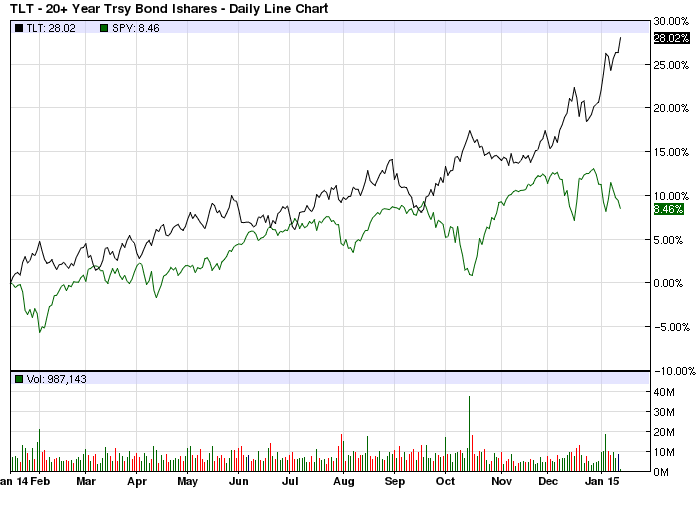

Over the past year, a number of factors have led to these assets making a bigger jump than the broad markets. With inflation subdued, rates held at near-zero levels, and investors embracing the safe haven appeal of Treasuries, these securities were able to make a nice run, as evidenced by the performance of the 20+ Year Treasury Bond ETF (TLT):

As evidenced in the chart above, Treasuries boasted a fairly inverse relationship with equities while trending higher, making them the perfect safe haven for rocky roads amid the ascent.

Using Treasuries in Your Portfolio

As a dividend investor, your portfolio likely already consists of carefully chosen, strong dividend paying securities; Treasuries probably have not been a big factor. But if you are of the mindset that markets may be headed for more volatility, adding a Treasury position to your portfolio can offer protection.

For those who do decide to take a closer look a these securities, be sure that you keep a close eye on the Fed and rate decisions; a raise in rates will push up the yield for Treasuries, but it will also likely simultaneously push down prices.

Be sure to check us out on Twitter @dividenddotcom.