Citigroup (C ) reported its fourth quarter results before the opening bell on Thursday, posting flat revenues and lower earnings than last year’s fourth quarter.

C's Earnings in Brief

- Citigroup reported fourth quarter revenues of $17.8 billion, which is essentially flat with last year’s Q4 revenues of $17.78 billion.

- Earnings for the quarter came in at $350 million, or 6 cents per share, down substantially from last year’s Q4 figures of $2.5 billion, or 77 cents per share.

- C missed analysts’ expectations of 9 cents EPS on revenues of $19.22 billion.

- The bank pointed out that its legal expenses and repositioning charges were $3.5 in the most recent quarter, compared to $1 billion last year.

CEO Commentary

Citigroup CEO Michael Corbat had the following comments: “While the overall results for 2014 fell short of our expectations, we did make significant progress on our top priorities. During the year, we increased our market share among our target institutional clients, grew our core loan book, and improved both our net interest revenue and margin from 2013 levels. For the first time since its establishment, Citi Holdings was profitable for the full year and we accelerated the utilization of our deferred tax assets. We strengthened our capital planning process and made Citi a safer and stronger institution, as evidenced by the increases to our capital, leverage and liquidity ratios. Although we made some difficult decisions over the course of the year, I believe they allowed us to put our franchise in a position to have a successful 2015.”

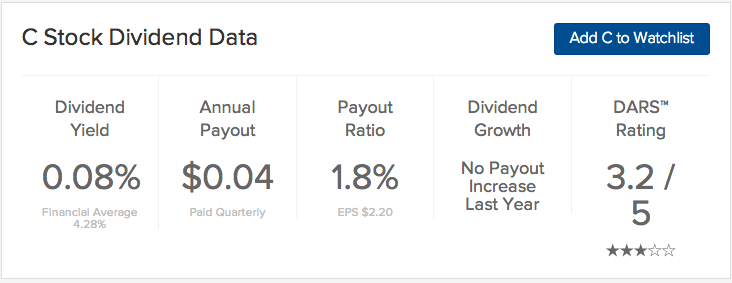

C's Dividend

Citigroup currently pays a quarterly dividend of 1 cent. We expect the company to declare its next dividend in the coming weeks.

Stock Performance

C stock was down 42 cents, or 0.86%, in pre-market trading.

The Bottom Line

Citigroup (C ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.2 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.