Before the opening bell on Friday morning, Goldman Sachs (GS ) reported its fourth quarter results, posting lower revenues and earnings compared to last year’s fourth quarter results.

GS's Earnings in Brief

- Goldman Sachs reported fourth quarter revenues of $7.69 billion, down from last year’s Q4 revenues of $8.78 billion.

- Net earnings for the quarter came in at $2.03 billion, or $4.38 per diluted share, down from last year’s Q4 figures of $2.25 billion, or $4.60 per diluted share.

- The company’s quarterly results beat analysts’ estimates of $4.32 EPS on revenues of $7.64 billion.

- For the full year, Goldman reported earnings of $8.08 billion, or $17.07 per diluted share on revenues of $34.53 billion.

CEO Commentary

GS chairman and CEO Lloyd C. Blankfein had the following comments: “We are pleased with our performance during a year characterized by mixed global economic and financial conditions. The depth of our global client franchise and our continued discipline on expenses and capital management produced a solid return for our shareholders. Looking ahead, we see evidence of a continued pick up in momentum for the global economy that will improve the opportunity set for 2015.”

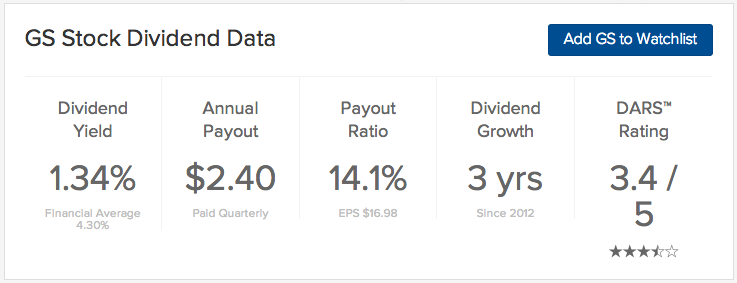

GS's Dividend

Goldman Sachs declared a quarterly dividend of 60 cents, which will be paid on March 30 to all shareholders on record as of March 2.

Stock Performance

Goldman Sachs stock was down $3.54, or 1.98%, in pre-market trading.

The Bottom Line

Goldman Sachs (GS ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.