The second full week of trading in the New Year is now behind us, and market volatility is making investors miss the “buy the dip” pattern that dominated Wall Street in 2014.

Earnings season is also officially underway, bringing the spotlight back onto corporate quarterly performance results. In light of company earnings taking over headlines in the coming weeks, it’s a great time to remind ourselves about the importance of maintaining a well-diversified portfolio.

Right Stock, Wrong Sector

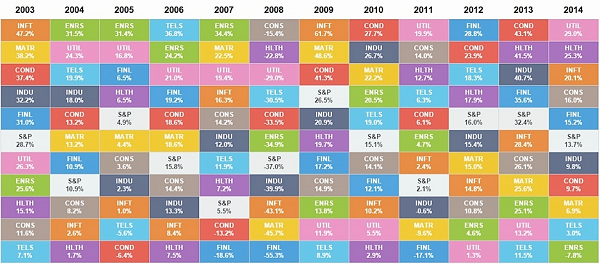

Ben Carlson, a well-respected blogger and seasoned portfolio manager, pieced together some excellent visuals this past week that illustrate the utter importance of having a diversified portfolio of stocks. For starters, let’s consider the varying returns that each sector of the U.S. equity market has logged since 2003:

All of this returns data might be overwhelming at first glance and readers can certainly extract more than one takeaway, but there is one lesson that is perhaps noteworthy above all: last year’s winners aren’t always able to stay in the lead, just like the worst performing sectors are not doomed to be serial laggards. For example, in 2013, consumer discretionary stocks were at the top of the list but then managed to underperform the broad market the following year; the same goes for the utilities sector, which was a dog in 2013 that turned into a shining star in 2014.

Be sure to also see our guide: Choosing a Sector to Invest In.

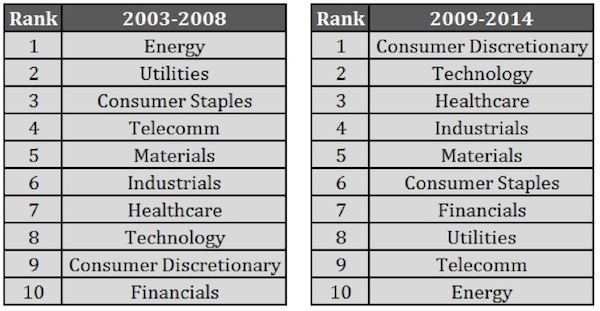

The following table, which ranks the sectors from best to worst in the periods spanning 2003-2008 and 2009-2014, truly illustrates why you should be wary of over-allocating your assets to any one corner of the market, no matter how well it has been performing historically:

As you can see, energy and utilities dominated during the 2003-2008 bull run; this may have in turn prompted investors to pour even more money into these sectors in 2009 and beyond. However, Mr. Market has a cruel way of reminding us that no trend lasts forever; as you can see in the period spanning 2009-2014, utilities and most notably energy have since been among the biggest laggards from the sector lineup.

Likewise, if you ignored consumer discretionary and technology stocks in 2009 because they were among the worst performers in 2003-2008, your portfolio has likely been left in the dust (and you’ve been kicking yourself in the head).

The Bottom Line

Anyone who bases their sector allocation decisions on past performance has likely been burned more than once and will continue to suffer until they embrace the concepts of portfolio rebalancing and diversification. Simply put, if your investment horizon is longer than one year, it’s absolutely imperative you maintain a diversified portfolio.

Have a great weekend and remember to check us out on Twitter @dividenddotcom.