Credit card giant Visa (V ) announced its first quarter results after Thursday’s closing bell, notching an earnings win and sending shares soaring.

V's Earnings in Brief

- Net income rose to $1.57 billion from $1.41 billion a year earlier.

- The company reported earnings of $2.53, beating analyst estimates of $2.49.

- Revenues for the quarter came in at $3.38 billion, topping analyst expectations of $3.34 billion.

- The company also announced a 4-for-1 stock split.

CEO Commentary

CEO Charlie Scharf had the following comments: “While the challenges of the macro global environment don’t seem to abate, our results have remained consistent and reflect the strength and underlying resilience of our business model. Our focus remains squarely on investing in our long-term strategic initiatives, driving new technologies and ways to pay as we continue to work collaboratively with governments, issuers, acquirers, and merchant partners.”

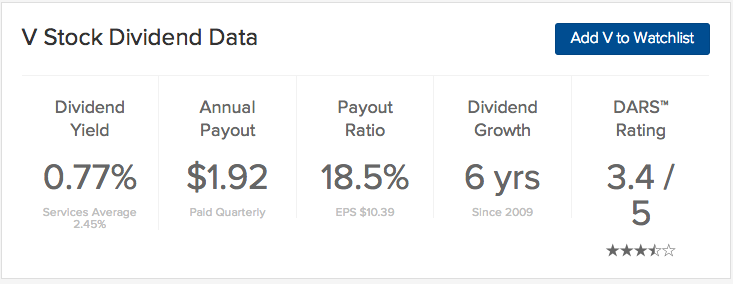

V's Dividend

The company made no specific mention of its dividend payment, as the stock split was its major announcement. The stock split will be paid out as a dividend on March 18 of this year; investors will receive an additional three shares of V for every one that they already own. The stock will trade on March 19 at its split-adjusted price. V will pay a dividend of $0.48 per share on March 3 to all shareholders on record as of February 13.

Stock Performance

Investors cheered on the results from Visa, as its stock shot up as much as 3.6% in after-hours trading.

The Bottom Line

Visa (V ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.