Before the opening bell on Tuesday morning, United Parcel Service (UPS ) reported its fourth quarter results, posting higher revenues and flat adjusted earnings compared to last year’s Q4 results.

UPS's Earnings in Brief

- UPS reported fourth quarter revenues of $15.9 billion, up from last year’s $15 billion.

- Net income for the quarter came in at $453 million, or 49 cents per diluted share, compared to last year’s Q4 net income of $1.17 billion, or $1.25 per diluted share.

- On an adjusted basis, UPS reported EPS of $1.25, which is flat with last year’s Q4 EPS.

- UPS met analysts’ EPS estimates of $1.25, while revenue came in slightly above the $15.8 billion expectation.

- Looking ahead to FY2015, UPS sees EPS in the range of $5.05-$5.30, while analysts expect $5.17.

CEO Commentary

UPS CEO David Abney had the following comments: “UPS customers were delighted with the high quality service we delivered during the holiday season. However, the financial results were below our expectations. As we move into 2015, we will address this disparity with both cost and revenue actions,” continued Abney. “We will take actions necessary to improve profitability by increasing operational efficiency and adjusting price where appropriate. Our growth strategy is sound and we reaffirm our long-term target of 9%-to-13% earnings per share growth.”

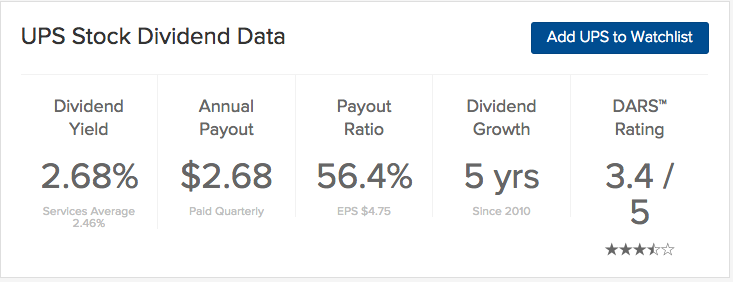

UPS's Dividend

We expect UPS to announce a raise to its quarterly dividend in the coming week.

Stock Performance

UPS stock was up 29 cents, or 0.29%, in pre-market trading. YTD, the stock is down 9.29%.

The Bottom Line

United Parcel Service (UPS ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.