Before the opening bell on Wednesday morning, General Motors (GM ) reported its fourth quarter results, posting slightly lower revenues but higher earnings compared to last year’s same quarter.

GM's Earnings in Brief

- General Motors reported Q4 revenues of $39.6 billion, down from last year’s $40.5 billion.

- Net income for the quarter came in at $1.1 billion, or 66 cents per share, compared to last year’s Q4 net income of $0.9 billion, or 57 cents per share.

- On an adjusted basis, GM reported fourth quarter EPS of $1.19, up from last year’s adjusted EPS of 67 cents.

- GM beat analysts’ EPS view of 83 cents, while revenues fell short of the $40.22 billion expectation.

CEO Commentary

GM CEO Mary Barra had the following comments: “A strong fourth quarter helped us deliver very good core operating results in 2014 despite significant challenges we and the industry faced. By keeping our customers at the center of all our decisions, we addressed those challenges head-on and outlined a customer-focused strategic plan that will guide our company well into the future.”

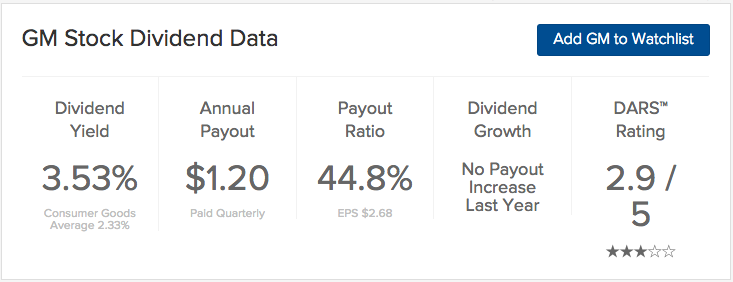

GM Plans to Raise Dividend

General Motors reported that it plans to boost its second quarter dividend by 20% to 36 cents per share. The decision will be made at the company’s regular second quarter dividend declaration procedure.

Stock Performance

GM stock was up $1.47, or 4.33%, in pre-market trading. YTD, the stock is down 2.47%.

The Bottom Line

General Motors (GM ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 2.9 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.