On Wednesday morning, Office Depot and Staples (SPLS) announced that they had entered into a definitive agreement that will see Staples acquire Office Depot for $6.3 billion in a cash and stock deal.

In the acquisition agreement, Office Depot shareholders will receive $7.25 in cash and 0.2188 of a Staples share for each Office Depot share owned. Based on Staples’ closing price from February 2, the deal values Office Depot shares at $11, making for a 44% premium to its stock price as of market close on February 2.

Though the deal will still have to be reviewed by antitrust regulators, but the companies expect the acquisition to go through by the end of 2015.

SPLS chairman and CEO Ron Sargent had the following comments: “This is a transformational acquisition which enables Staples to provide more value to customers, and more effectively compete in a rapidly evolving competitive environment. We expect to recognize at least $1 billion of synergies as we aggressively reduce global expenses and optimize our retail footprint. These savings will dramatically accelerate our strategic reinvention which is focused on driving growth in our delivery businesses and in categories beyond office supplies.”

Staples stock was down $1.39, or 6.89%, in pre-market trading.

The Bottom Line

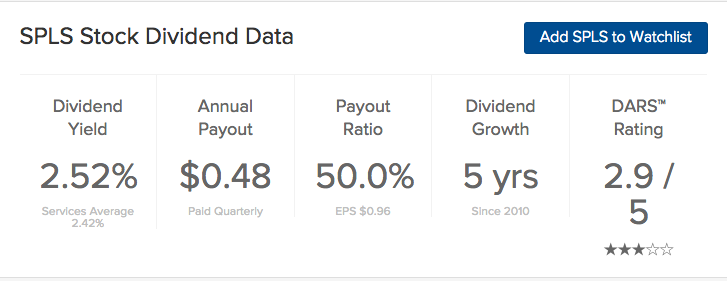

Staples (SPLS) is not recommended at this time, holding a Dividend.com DARS™ Rating of 2.9 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.