The Gap (GPS ) reported Q4 comps and January sales after the closing bell on Monday. The company’s January sales were down slightly, while Q4 comparable sales were up.

The clothing retailer reported that its January comparable store sales were down 3% – last year’s January comps were up 1%. Gap Global sales were down 9% in January 2015, Banana Republic sales were up 2%, and Old Navy sales were up 3%.

For fourth quarter sales, GPS reported a 2% gain, compared to last year’s Q4 gain of 1%. Gap Global sales were down 6%, Banana Republic sales were up 1%, and Old Navy sales were up 11%.

In addition to announcing its January and Q4 comps, The Gap also raised its fiscal 2014 EPS guidance, and now sees diluted EPS in the range of $2.86-$2.87. For Q4, the company sees EPS in the range of 73 cents to 74 cents, while analysts expect 68 cents.

Stock Performance

GPS stock was down 30 cents, or 0.73%, in after hours trading. YTD, the stock is down 2.4%.

The Bottom Line

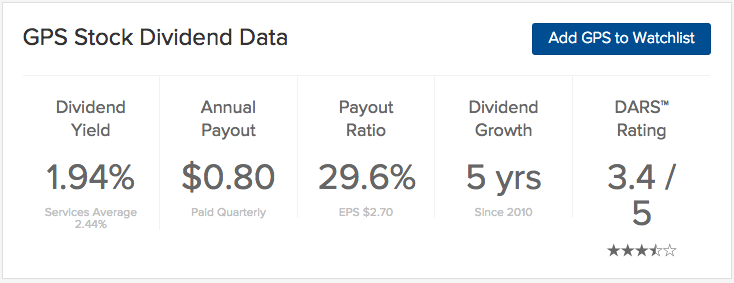

The Gap (GPS ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.