Time Warner (TWX) reported its fourth quarter results before the opening bell on Wednesday, posting lower revenues and adjusted earnings than last year’s Q4.

TWX's Earnings in Brief

- Time Warner reported fourth quarter revenues of $7.53 billion, which are down from last year’s Q4 revenues of $7.6 billion.

- Adjusted EPS came in at 98 cents, down from last year’s $1.07. However, not including programming charges at Turner and restructuring and severance charges, EPS came in at $1.14.

- TWX beat analysts’ estimates of $1.01 EPS, while revenues came in slightly below the expected $7.55 billion.

- Looking ahead, TWX sees FY2015 EPS in the range of $4.60-$4.70, while analysts expect $4.66.

CEO Commentary

TWX chairman and CEO Jeff Bewkes had the following comments: “We had another very successful year in 2014, with solid revenue growth and robust 18% Adjusted EPS growth – our sixth consecutive year of at least high teens Adjusted EPS growth. Our financial performance reflects the strength of our position as the world’s leading video content company. For the year, three of Turner’s networks – TBS, TNT and Adult Swim – ranked among ad-supported cable’s top 10 networks in primetime among adults 18-49. TNT was home to 6 of the top 15 original series on ad-supported cable in 2014, more than any other network, including the three most watched new series, The Last Ship, The Librarians, and Murder in the First …"

TWX Raises Dividend

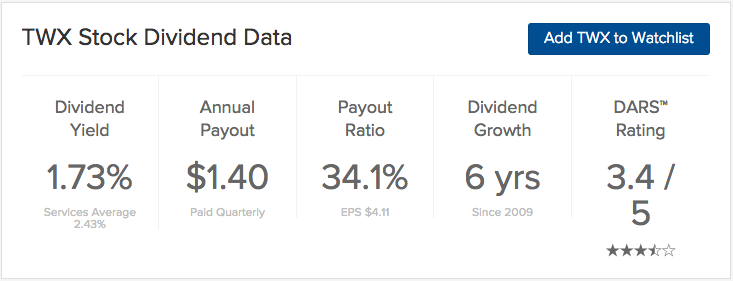

Time Warner raised its quarterly dividend to 35 cents from 31.75 cents, making for an annualized payout of $1.40. The dividend is payable on March 15 to all shareholders on record as of February 28. The stock goes ex-dividend on February 25.

Stock Performance

TWX stock was up 29 cents, or 0.38%, in pre-market trading. YTD, the stock is down 4.85%.

The Bottom Line

Time Warner (TWX) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.