Tax season is upon us, and, as always, there are countless investors scrambling to max out their IRA contributions for the previous year. Yesterday, we reminded you of the importance of making the full contributions to your retirement accounts, as the power of compound returns is only magnified over a long enough time horizon. However, there’s another piece to the retirement account puzzle that is easy to overlook.

We’re talking about the fact that investors are short-changing themselves if they wait until the last minute to max out their IRA contributions. That is to say, while it’s certainly great to be able to contribute the full $5,500 to your retirement account every year, you aren’t truly reaping all of the benefits of compounding returns if you’re always waiting until the last minute to do so.

The Cost of Procrastination

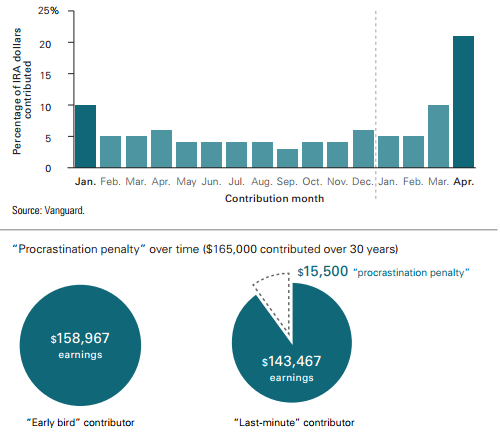

The fact of the matter is that most investors wait until the last minute, or rather month, to max out their IRA contributions for the year. According to Vanguard, more than double the amount of IRA contributions are made during the month of April than in the month of January of the previous year; meaning that, for 2015, most investors are going to max out their 2014 contributions in April rather than having done so during January of 2014.

The column chart below clearly illustrates the “last-minute” tendency of investors with regards to their retirement account contributions. Even more important are the two pie charts below that, which emphasize what Vanguard calls the “procrastination penalty”:

The Early Bird pie chart on the left assumes the investor contributes $5,500 on January 1st of the tax year for 30 years and earns 4% annually. The Last Minute pie chart to the right assumes the investor contributes the same amount of $5,500 annually over 30 years, earning the same returns; the difference here is that the contribution is made on April 1st of the following year, hence the “last minute” tendency.

The lesson is quite clear here – after 30 years of identical dollar amount contributions and identical annual returns, the Early Bird investor is left with $15,500 more than the Last Minute investor. While this is by no means an astronomical amount, the lesson here is that by waiting until the last minute to contribute to your IRA you are effectively taking less advantage of the power of compounding returns. If we assume a longer time horizon and higher annual returns, the amount that the Last Minute investor would miss out on versus the Early Bird one only increases.

Be sure to read our guide 21 Ways Investors Can Make (and Keep) More Money for more money management tips you might be overlooking.

The Bottom Line

It’s important to max out your IRA contributions each and every year; furthermore, if you have the means to do so, it’s even more important to make the contributions to your retirement account as early as possible so you can truly reap the benefits of compounding returns over the long-haul.

Be sure to follow us on Twitter @Dividenddotcom.