Wal-Mart (WMT ) reported its fourth quarter results before the opening bell on Thursday morning, posting higher sales and earnings compared to last year’s Q4.

WMT's Earnings in Brief

- Wal-Mart reported fourth quarter revenues of $131.6 billion, up from last year’s Q4 revenues of $129.7 billion.

- Income from continuing operations came in at $4.97 billion, or $1.53 per diluted share, up from last year’s Q4 figures of $4.35 billion, or $1.36 per diluted share.

- On an adjusted basis, WMT’s EPS for the quarter came in at $1.61, which is up slightly from last year’s $1.60.

- WMT beat analysts’ EPS estimates of $1.54, while revenues came in below the expectations of $132.29 billion.

- Looking ahead, WMT sees FY2015 EPS between $4.70 and $5.15, while analysts expect $5.19.

CEO Commentary

WMT president and CEO Doug McMillon had the following comments: “We had a good fourth quarter to close out our fiscal year, with underlying EPS of $1.61. Walmart U.S. delivered better than expected comp sales. Sam’s Club had its best performance of the year, and Walmart International had solid sales and profitability. Like many other global companies, we faced significant headwinds from currency exchange rate fluctuations, so I’m pleased that we delivered fiscal year revenue of $486 billion. But, we’re not satisfied.”

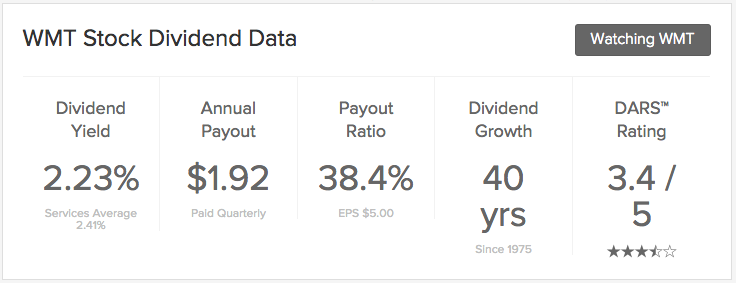

WMT's Dividend

We expect Wal-Mart to announce a raise to its dividend, and declare its 2015 dividends in the coming days.

Stock Performance

Wal-Mart stock was down $1.14, or 1.32%, in pre-market trading. YTD, the stock is up 0.45%.

The Bottom Line

Wal-Mart (WMT ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.