Deere & Co. (DE ) reported first quarter results before the opening bell on Friday morning, posting lower sales and profit compared to last year’s Q1.

DE's Earnings In Brief

- Deere & Co. reported first quarter net sales of $5.6 billion, down 19% from last year’s Q1 sales of $6.95 billion.

- Net income attributable to the company came in at $387 million, or $1.12 per share, which is down significantly from last year’s Q1 figure of $681 million, $1.81 per share.

- Deere beat analysts’ estimates of 83 cents EPS on revenues of $5.54 billion.

CEO Commentary

Deere chairman and CEO Samuel R. Allen had the following comments: “Deere’s first-quarter performance reflected sluggish conditions in the global farm sector, which reduced demand for agricultural machinery, particularly larger models, and led to lower sales and income. At the same time, our construction and forestry and financial services divisions had higher profits, showing the benefit of a well-rounded business lineup. Deere’s results also demonstrated the progress we’ve made creating a more flexible, responsive cost structure.”

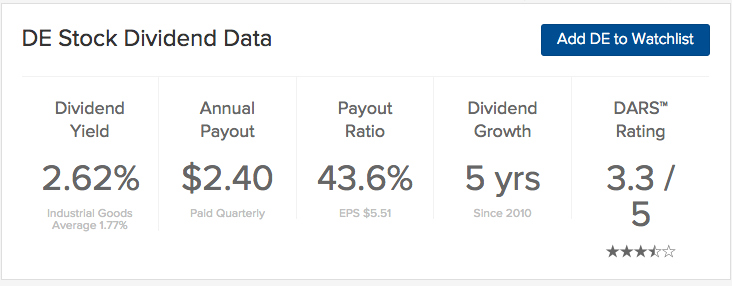

Deere's Dividend

Deere & Co. paid its most recent dividend of 60 cents on February 2. We expect the company to declare its next dividend in the coming weeks.

Stock Performance

Deere stock was down 66 cents, or 0.72%, in pre-market trading. YTD, the stock is up 3.81%.

The Bottom Line

Deere & Co. (DE ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.3 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.