Lowe’s (LOW ) reported its fourth quarter results before the opening bell on Wednesday, posting significant gains in revenue and earnings compared to last year’s Q4.

LOW's Earnings in Brief

- Lowe’s reported fourth quarter sales of $12.54 billion, up from last year’s Q4 sales of $11.66 billion.

- Net earnings for the quarter came in at $450 million, or 46 cents per share, up significantly from last year’s Q4 net earnings of $306 million, or 29 cents per share.

- LOW beat analysts’ estimates of 44 cents EPS on revenues of $12.31 billion.

- For FY2015, LOW sees EPS of $3.29, which is slightly above analyst views of $3.28.

CEO Commentary

Lowe’s chairman, president and CEO Robert A. Niblock had the following comments: “I would like to thank our employees for their hard work and dedication. Their steadfast commitment to serving customers is critical to our success, and an important driver of this quarter’s strong results. We remain focused on improving our profitability even while investing in key capabilities to drive sales growth. Our transformation is gaining momentum, and macroeconomic fundamentals are aligned for modestly stronger home improvement industry growth in 2015.”

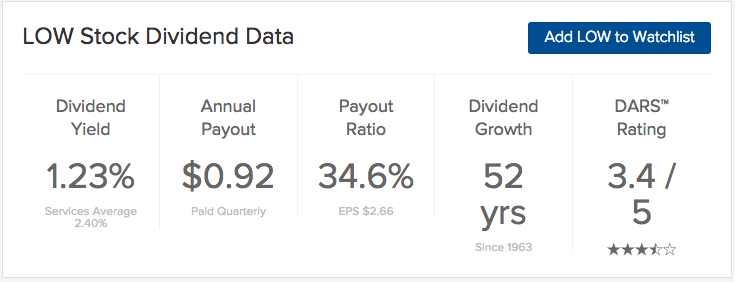

LOW's Dividend

Lowe’s paid its most recent quarterly dividend of 23 cents on February 4. We expect the company to declare its next quarterly dividend in the coming month.

Stock Performance

LOW stock was up $1.92, or, 2.57%, in pre-market trading. YTD, the stock is up 8.5%.

The Bottom Line

Lowe’s (LOW ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.