Maintaining a diverse portfolio is one of the most basic principles of investing, but every now and again, investors need a reminder of why. It can be easy to fall in love with a particular security or strategy and forget to build out the remainder of your portfolio, but this sort of mistake can be a costly one.

One of the best examples we have seen as of late has been the performance of the BRIC nations (Brazil, Russia, India, and China). These four countries are among the most popular emerging markets and have been investor favorites for some time. But the allure of these four economies can lead some down the wrong path as far as a diverse portfolio is concerned.

Lessons Learned from the BRIC

Over the last year both Brazil and Russia’s economies have dealt with heavy struggles. All the while, India and China have been roaring forward after a few years of slow growth. Prior to that, the growth scenarios were almost the exact opposite for these four nations. The net result has been a lackluster performance for funds that focus on just the BRIC nations, the so-called “sexy” investment of recent times. But investors that have cast a wider net over the emerging markets world have been rewarded with better (albeit negative) results over the last few years.

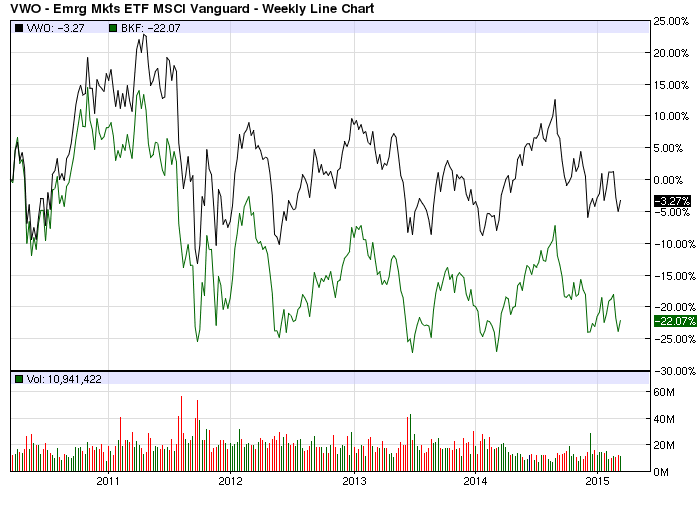

The chart below juxtaposes the Vanguard Emerging Markets fund (VWO) and the MSCI BRIC Index Fund (BKF) over the trailing five years. The former invests in a handful of emerging market nations while the latter invests in just the four BRIC nations.

There have been periods in the short term where BKF has outperformed VWO, but the long-term trend has shown that diversity has been the best choice for investors.

The same principle should apply to your entire portfolio. This example shows what a difference diverse country exposure can make; add in asset classes and balances and the equation becomes a bit more complicated. The result is still the same, however; a diversified portfolio is your best bet for the long-term.

The Bottom Line: Tying it All Together

Though the majority of your portfolio is likely focused on income-producing equities, you still should maintain a geographically diverse set of holdings to ensure you are well-positioned for the long-term. As we stated above, it can be easy to pick a portfolio darling, so its important that you don’t fall into that trap. Darlings can experience a downturn just like any other security, and if that happens you certainly do not want it to be the majority of your portfolio.

Be sure to follow us on Twitter @Dividenddotcom.