Recent media speculation over emerging-market outflows has once again put the spotlight on China’s growth and its debt composition.

China’s Debt in Perspective

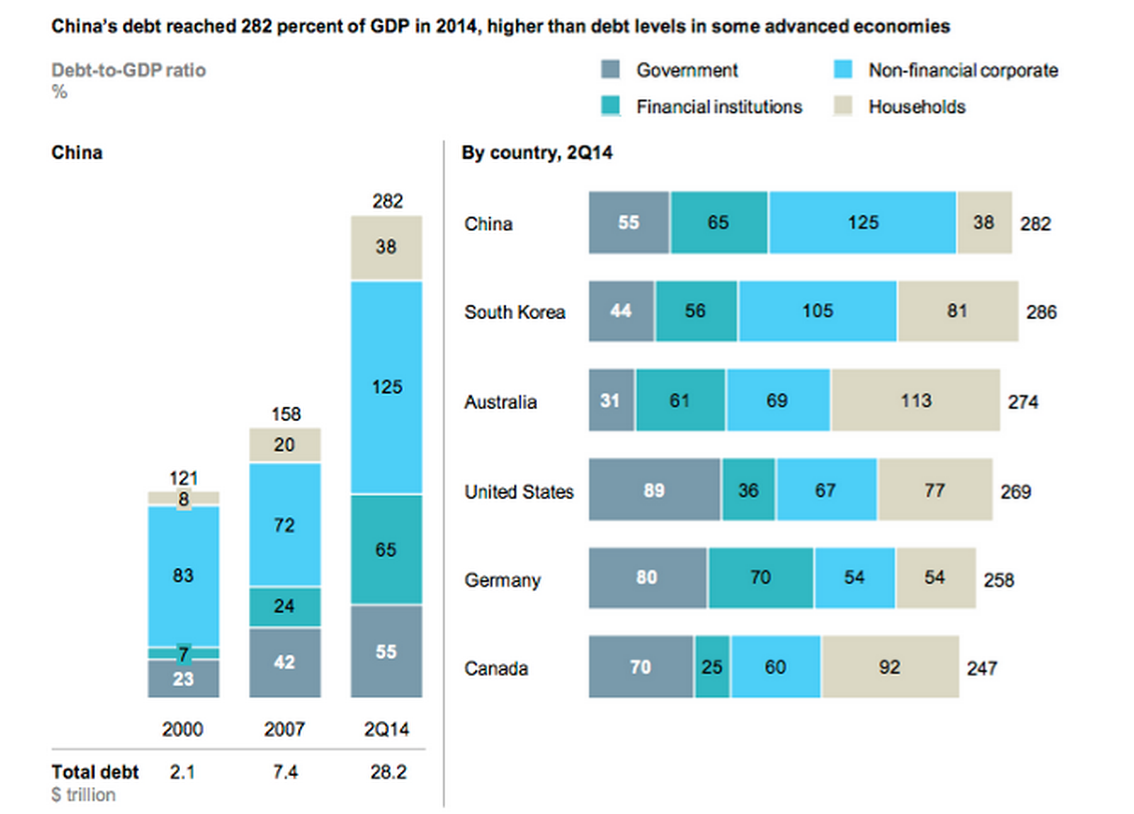

According to a McKinsey & Co. 2015 report, the country has an estimated $28 trillion of total debt, which equates to 282 times that of GDP. Taking into account corporate, household, and government levels, the figure is quite staggering, especially when compared to the developed economies of the U.S., Germany and Australia.

Two important questions have been raised in light of this rising debt: how would a softening in growth affect China’s ability to cover these obligations and what wider implications would this have on global equity markets? To better understand the stock market ramifications we identified five dividend stocks that are directly exposed to the Chinese economy.

5 Dividend Stocks with Exposure to China

1. Jabil Circuit (JBL)

With an estimated 15%-20% of total revenues coming from the Chinese market, Jabil Circuit (JBL ) is one of the leading printed circuit board providers. A key area of the business is their production of iPhone casings for Apple. Recent strong sales have highlighted an ever-growing demand for handsets in China.

Risk: Competition & Fall in demand for Apple products

Dividend Yield: 1.30%

2. Qualcomm (QCOM)

A leading semiconductor producer and supplier, Qualcomm (QCOM ) earns an estimated 20%-25% of its revenues from China. In March 2014, Chinese authorities looked into the practices of the U.S. company, citing a possible breach of the Anti-Monopoly Law (AML). Settled in February, QCOM agreed to pay $975 million in fines and adopt new licensing regimes for 3G and 4G handsets.

Risk: Government Legislation & Competition

Dividend Yield: 2.89%

3. Yum! Brands (YUM)

Yum! Brands (YUM ) is one of the leading restaurant and fast food chains in China with 6,715 stores. Brands they trade under include KFC and Pizza Hut. Though Chinese exposure accounts for 35%-40% of total revenue, the company recently announced a softening in their earnings. Analysts cited a tainted meat scandal in 2014 as a possible reason behind the drop in revenues.

Risk: Transformation in eating habits & Government Legislation

Dividend Yield: 1.79%

4. Broadcom (BRCM)

Chip manufacturer Broadcom (BRCM) focuses on supplying the handset and pay-TV markets. An estimated 30%-35% of total revenues comes from the People’s Republic. In the April earnings release to the market, the company highlighted an uplift in demand for higher end handsets from companies such as Huawei and Lenovo.

Risk: Competition

Dividend Yield: 1.04%

5. Wynn Resorts (WYNN)

A key market for Wynn Resorts (WYNN ), the Macau operations recently announced a sharp fall in earnings due to government-imposed regulation. According to Wynn’s 2014 10-K, the Macau operations brought in net revenues of $3.79 billion while Las Vegas brought in net revenues of $1.63 billion.

Risk: Government Legislation

Dividend Yield: 1.95%