Last week we talked about a reasonably heady topic, which is related to how to employ options in a divided capture strategy (due to the demand we’ve received about the topic). This week we’d like to dive into another hard topic: how do you value stocks? Clearly this is a loaded question, but we’ll begin to dive in with a recap of some basics which we’ll be able to build upon over the coming weeks and months.

Let’s dive in!

Traditional stock valuation models have come into question since the global financial crisis, with investors understandably wary of the accuracy of long-term growth and earnings forecasts. The Discounted Cash Flow (DCF) is one such model that falls into this category as it calculates the present value based on future cash flows and discounts these based on capital costs.

The difficulty with this model is how to calculate cash flows five or 10 years in the future. Estimates can be useful, however, the accuracy is subject to little or no revision in economic conditions. As we all know, this is not ideal. Small variations in growth rate or the discount rate can also produce significantly different valuations.

Dividend Discount Model

An alternative to DCF, the Dividend Discount Model, calculates the present value of a stock based on the total dividends over a period, discounted back. Referred to as the “Gordon Growth Model”, this valuation tool has become increasingly popular as it identifies dividends as cash flow. Analysts are able to calculate the effects of a rise in dividends and cost to capital over time.

Example

- Stock ABC is trading at $60.00.

- ABC declared a dividend of $1.50 per share.

- Estimated dividend growth rate is 3% per year.

- Discount rate of 5%.

Estimated Stock Value = Dividend ($1.50) / (Discount Rate 0.05 – Growth Rate 0.03) = $75

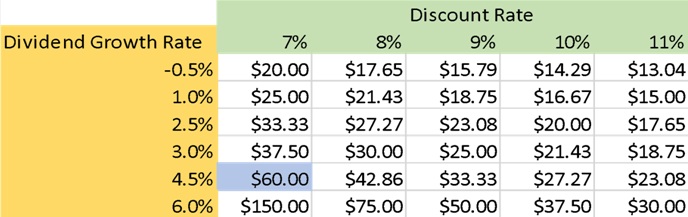

According to the Dividend Discount Model the stock is $15 undervalue at this current time. In the below table we have included some theoretical discount rates and growth rates to emphasize the importance of both on valuation.

Flaws

As with any model, though, there are several drawbacks to DDM:

- Valuation is subject to the same dividend growth rate. This can be inaccurate as company payouts can change over time.

- Sensitivity to changes in the growth rate. The stock value can be vastly different, depending on this parameter.

- It’s very difficult to value a stock if it does not have much dividend history and the growth rate is perceived.

- Discount rate fluctuations.

- Dividend growth can be misleading, particularly during times of high corporate activity. Strong companies may wish to capitalize on takeover opportunities and will keep their dividend stable.

The Bottom Line

Using the Discounted Dividend Model in conjunction with the Discounted Cash Flow Model could provide a more accurate forecast of the current value of the stock. It is important to note that both models have their flaws and should only be used as valuation guides.

Thanks, enjoy the rest of your weekend and talk to you on Monday as we get set for a vacation shortened week next week.