Summary

- Scotiabank acquisition of Citigroup Panama and Costa Rica banking business

- Customer base will increase to 387,000

- Panama and Costa Rica are high growth, politically stable economies

- Analyst highlights “rebalancing” of Scotia’s Latin American portfolio

- Consumer credit risk concerns

Continuing to build on their already extensive footprint in South and Central America, the Bank of Nova Scotia announced on Tuesday that they would be acquiring the Panamanian and Costa Rican banking assets of Citigroup for an undisclosed sum. This is the second regional deal between the two lenders, with Citi’s Peruvian retail and institutional business sold to Scotia in December of last year. Interestingly these transactions come at a sensitive time for emerging markets, with investor confidence shaken by deleveraging and instability.

Is the timing right for such an acquisition and what are the implications on bottom line earnings?

Deal Highlights

Let’s take a look at the deal numbers to start with and understand what will come from the acquisition. Increasing Bank of Nova Scotia’s branches by 27, the deal will ultimately translate into a trebling of the total customer base to 387,000 and the opportunity to market into high investment economies. According to the National Bank Financial, $2.2 billion in total assets will also be added to Scotia’s balance sheet. On the credit card side, the Canadian lender will now control 18% of the total retail market in Panama and 15% in Costa Rica.

Regional Outlook

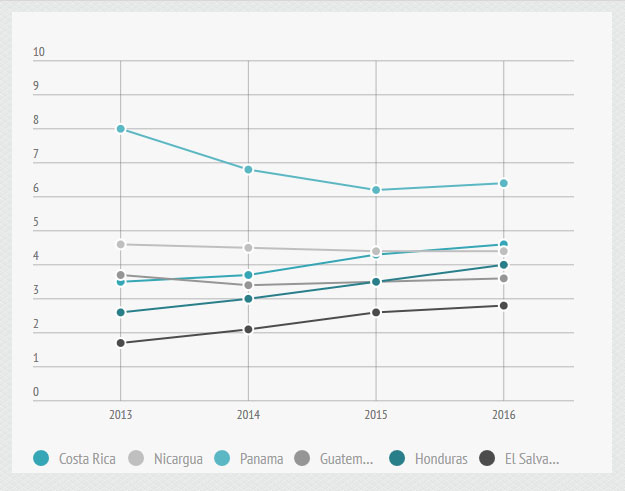

Sensitivity to a China slowdown is a concern for analysts with the commodity focused regions of Columbia, Peru and Chile relying on strong demand and base mineral prices. With an estimated growth rate of 5.90% for 2015, Panama does not fall into this category as investment and the financial sector are key GDP drivers. Debt for the small country has risen to $23 billion, which still puts it below Brazil on a Government debt to GDP basis. Costa Rica has a slightly more conservative growth outlook with the World Bank estimating 4.7% in 2015.

Analyst View

Peter Routledge from National Bank Financial covered the transaction and highlighted a number of important valuation considerations:

- Downturn in the economy could lead to significant write downs in the newly acquired credit card business.

- The transaction helps in “rebalancing” Scotia’s regional portfolio and risk.

- Panama and Costa Rica have concentrated export risk with 37% of total exports going to the US. An economic slowdown in the world’s largest economy could indirectly impact Scotia’s business in the region.

Bottom Line

The two key factors that make the Bank of Nova Scotia acquisition attractive from a valuation point of view are the upside growth forecasts for both Panama and Costa Rica, and the reduced exposure both economies have to emerging market China. In essence Scotiabank is able to use this deal and its new market share as a hedge against its exposure in the commodity sensitive markets of Peru and Chile.