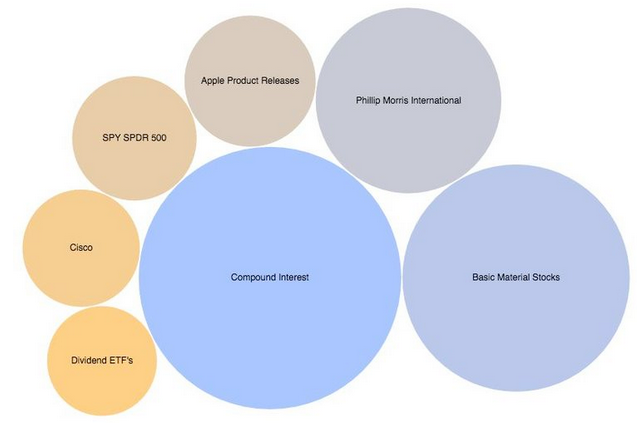

The analysts here at Dividend.com have analyzed the search patterns of visitors to our site during the week ending September 18. Below we give an analysis of how intelligently users used Dividend.com this week to help them in their investment decision-making process.

Compound Interest: The Eighth Wonder of the World

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t… pays it.” – Albert Einstein

Investors flocked to Dividend.com this week to understand the importance of compounding. Our Compounding Returns Calculator lets you do just that. In addition, here you’ll find the pros and cons of compound interest. When you pay interest on loans that compound, compounding can be your enemy, but when you reinvest your dividends into stocks, it becomes your ally.

Basic Material: Oil & Gas – The Highest Dividend Yielding Sector

Basic Materials is a very broad category of industries that deal with oil and gas drilling and exploration, oil and gas companies, steel, agricultural chemicals, synthetics, gold, aluminum, copper and silver.

Oil and gas drilling and exploration, and independent oil and gas companies, have some of the highest dividend yields on average if you compare across all sub-industries.

With the recent fall in oil prices and subsequent fall in oil stocks, many companies in this sector have shown very attractive yields. When many investors are bearish on this sector, Dividend.com users seem to take a contrarian approach to investing, researching oil and gas and basic materials stocks in depth.

Click to see our Best Oil and Gas Dividend Stocks.

Philip Morris International: The Sin Stock

If you are a Marlboro man and believe in the old adage of “investing in companies whose products you buy”, then this is a great dividend stock for you.

Philip Morris (PM ) is a leading international tobacco company. PM has a P/E of 17.23, an EPS of $4.78, and has the highest market cap of $127 billion in a sector that includes other such giants as Reynolds American (RAI) and British American Tobacco (BATS). Click here for a list of all tobacco companies that pay dividends.

Philip Morris was trending as the sin stock made dividend investors richer by increasing its dividend by 2% to an annualized dividend of $4 per share. The company has a payout ratio of 90% which is one of the highest for any company.

Apple Product Launches and Stock Market Correlations

Recently, Apple (AAPL ) launched the iPhone 6s and the iPhone 6S+ along with the iPad Mini 4. As such, investors were curious to know how Apple’s stock price reacts to new product launches. In this article we analyzed just that. Apple’s stock price has not always reacted well to product launches, but all of the products mentioned have had a major positive impact on the company in the long run.

SPY SPDR 500: Potential Buy on Dip?

Launched in 1993, SPY is the oldest U.S. ETF. It can be used as a core holding in a long-term portfolio as well as a trading vehicle. Further, it has the best in-market liquidity. SPY dramatically fell from $210 to $190 in the 1,000-point Dow Jones fall. SPY trended on Dividend.com as investors viewed it as a potential “Buy on the Dip” prospect and were hoping on market rallies pre-Fed announcement or post-Fed announcement.

Cisco Increases Dividend

The networking and communications giant announced a quarterly dividend of 21 cents per share. Cisco (CSCO ) currently yields 3.21% and has a payout ratio of 40.2%. Dividend.com hs given the company a DARS rating of 3.4 and views it as “Neutral”. Cisco has the second-highest yield in the networking and communications devices industry, one behind Silicom (SILC) which has a yield of 3.66%.

Dividend ETFs

Dividend ETFs and ETFs in general have prompted investigation after their crazy fall on Black Monday (August 24, 2015).

The following 12 dividend ETFs experienced a dramatic fall on Black Monday on an intraday basis.

| Trade Date | % Change on Intraday Basis | Symbol | ETF |

|---|---|---|---|

| Aug. 24 | -88.78% | KBWD | Invesco PowerShares KBW High Dividend Yield Financial Portfolio |

| Aug. 24 | -46.41% | DVYL | UBS ETRACS Monthly Pay 2x Leveraged Dow Jones Select Dividend Index ETN/ |

| Aug. 24 | -42.80% | FDL | First Trust Morningstar Dividend Leaders Index Fund |

| Aug. 24 | -41.07% | DES | WisdomTree SmallCap Dividend Fund |

| Aug. 24 | -40.55% | HDV | iShares High Dividend Equity Fund |

| Aug. 24 | -34.39% | SDY | SPDR S&P Dividend ETF |

| Aug. 24 | -33.88% | FVD | First Trust Value Line Dividend Index Fund |

| Aug. 24 | -33.88% | DLN | WisdomTree LargeCap Dividend Fund |

| Aug. 24 | -33.51% | VIG | Vanguard Dividend Appreciation ETF |

| Aug. 24 | -32.38% | PGF | Invesco PowerShares Financial Preferred Portfolio |

| Aug. 24 | -32.15% | ICF | iShares Cohen & Steers Realty Major |

| Aug. 24 | -30.84% | DVY | iShares Dow Jones Select Dividend Index Fund |

The dramatic dip has prompted investigation into how ETFs are constructed. ETFs are meant to mimic an index, but on a day when one dividend ETF fell 89%, and 11 others fell more than 30%, and a further 180 more fell more than 20% intraday, investors began to question their safety.

Since ETF creation is literally as easy as buying a cup of coffee, it has resulted in many zombie ETFs floating in the market. On Black Monday, one of the most volatile days in market history, there were approximately 290 ETFs that had a volume of less than 5,000 according to data from ETFdb.com.

Find a complete list of dividend ETFs here.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.

Image courtesy of Stuart Miles at FreeDigitalPhotos.net