The analysts here at Dividend.com analyzed the search patterns of visitors to our site during the past week ending October 16, 2015. Below we give an analysis of how intelligently users used Dividend.com to help them in their investment decision-making process.

Wal-Mart

The staple in many dividend portfolios was the top trender on Dividend.com, with a 116% spike in traffic to its ticker page.

Wal-Mart (WMT ) often referred to as the recession-proof stock, suffered it’s worst intraday fall in 25 years as the company predicted earnings will decrease 6% to 12% in fiscal year 2017, which ends in January of that year.

The announcement is due to two things on which Wal-Mart is currently spending big.

1. Website improvements: Wal-Mart is planning to spend nearly $2 billion on website improvements and e-commerce initiatives. The company needs more avenues to keep growing and e-commerce currently accounts for only 3% of its overall sales.

2. Wages: Wage hikes are going to account for nearly 75% of the EPS reduction; the company raised wages to $10/hour.

Wal-Mart has a beta of 0.43 and is a classic well-established dividend payer. Technically speaking it has a very strong support at $60. Its stock hovered between $45 and $60 from 1999 to 2012 before breaking its resistance at $60 to reach $90 in early January 2015. It’s back to $60 now and dividend investors who have never had Wal-Mart in their portfolio might find the $40-$60 range an attractive entry point.

The Truth About the Dividend Payout Ratio

A question our users often email us with is how come our dividend payout ratios are different from those reported on other websites?

Our EPS on ticker pages is forward looking in nature and so are our dividend payouts.

Basic Payout Formula: Dividend per share/Earnings per share.

Dividend.com Formula: Forward looking dividend/Forward looking annual mean estimate of earnings per share.

Example: Wal-Mart’s payout ratio is 43.4%, which is $1.96/$4.50.

Let’s break it down:

Numerator: WMT’s latest dividend was $0.49 and is a quarterly payer, hence the payout comes to $1.96 ($0.49*4).

Denominator: Wal-Mart has a forward looking EPS of $4.52, which is the mean from 29 analyst estimates reported on Thomson Reuters for FY ending January 2016. Dividend.com takes it as the denominator when calculating the payout percentage.

A trailing payout ratio is of no value to a dividend investor, therefore we’ve decided to use this approach instead.

Philip Morris International

The Sin Stock was trending this week on Dividend.com because of its October 14 payment date. Philip Morris (PM ) offered a dividend of $1.02. The company raised their dividend by 2%, the smallest dividend increase since the company’s spinoff from Altria. The stock still yields 4.66% while the consumer goods average is 2.44%.

Foreign Dividend Stocks

One of the most popular tools on Dividend.com, Foreign Dividend Stocks, was trending this week as investors looked at foreign companies that re-listed in the U.S. and have dividend payouts.

With China and India leading GDP growth rates across the world, we recently published two articles: Chinese ADR’s: Which Ones Are Best for You and The Tiger and the Dragon: India’s GDP Growth Outpaces China. India could be a potential buying opportunity with its GDP growth outpacing China and expected to land at 7.6% YOY in FY2016 from 7.3% in FY2015. With a period of low inflation, a Prime Minister elected with overwhelming majority pushing his agenda of ”Red Carpet, Not Red Tape,” and one of the shrewdest central bankers in the world, Raghuram Rajan (he received Euromoney’s Best Governor Award in 2014), India looks like a very sweet spot.

Johnson & Johnson

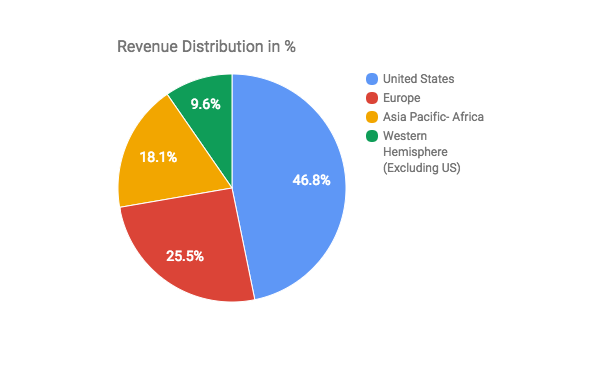

Another stock feeling the heat due to a strong greenback was Johnson & Johnson (JNJ ). Below, you’ll find JNJ’s revenue distribution by geography. More than 50% of their sales are non-USD.

The problem, in large measure, is the strong U.S. dollar, which distorts the company’s overseas strength. The revenue miss was due entirely to the dollar’s might, which company officials said imposed an 8.2% drag on the top line (JNJ’s revenue actually grew on a constant currency basis). The earnings shortfall was also due largely to the muscular buck. For a detailed analysis of the situation check out Why JNJ Is Under the Weather, by our Contributing Editor Evan Cooper.

Dividend.com tracked the strengthening dollar and its impact on U.S. Equities. On July 24, we highlighted some of the best all-American companies (with all their revenues in USD).

Not surprisingly four of the six recommended have given handsome returns for investors during the same time that the Dow Jones clocked a poor -2.43% return.

| Ticker | Company | Price on July 24 | Price on October 15 | Change |

|---|---|---|---|---|

| TSCO | Tractor Supply Company | $93.57 | $84.69 | -9.49% |

| FLO | Flower Foods Inc. | $20.79 | $25.34 | +21.88% |

| GAS | AGL Resources Inc. | $47.28 | $61.99 | +31.11% |

| ES | Eversource Energy | $47.21 | $51.83 | +9.78% |

| WCN | Waste Connections Inc. | $47.58 | $51.22 | +7.65% |

| JBHT | JB Hunt Transport Services Inc. | $82.22 | $74.92 | -8.87% |

Gold Rallies

Our Best Gold Dividend stocks page was trending this week; gold prices rallied to the highest level in nearly seven weeks as the Fed minutes indicated that unless their inflation targets are met they won’t consider raising interest rates.

What Is a Dividend?

A Dividend Investing 101 article was trending this week.

Why do companies pay a dividend? What are cash dividends? What can investing returns buy you? S&P 500 or S&P Dividend Aristocrats? These were some of the questions users were asking us this week. This article will help in explaining the basics of dividend investing.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.