Income investors are in a difficult position. On one hand, the economy remains stuck in a zero interest rate policy. The Federal Reserve is likely to increase interest rates this month, for the first time since 2006—but that is likely to only be a quarter-point rate hike, with a slow-and-steady pace of rate increases thereafter. That means investors starved for yield in fixed income and certificates of deposit are not likely to see a meaningful rise in rates for some time.

The end result of all this is that high yield is hard to find, particularly if the goal is to find secure, sustainable high yield dividend stocks. In the stock market, there are high yields to be found, but those high yields often prove fleeting. In many cases, an abnormally high yield is a sign of danger that investors have sold the stock in anticipation of a dividend cut.

The implications are that investors who are searching for above-average yields should tread carefully. One sector of the stock market that is highly regarded for secure dividends is utilities.

A Highly Secure Business Model

One utility stock that could be an attractive pick for income investors is The York Water Company (YORW ). York Water is a small-cap with a market capitalization of just $292 million. This has placed it underneath the radar for some, but investors should take notice of this high-quality company. Despite its small size, York Water has a long track record of consecutive quarterly dividend payments without interruption.

In fact, last month York Water raised its quarterly dividend by 4% to $0.1555 per share. That comes out to $0.62 per share annually, a 2.7% yield based on the stock’s recent closing price. This makes 200 consecutive years of quarterly dividend payments dating all the way back to York’s first quarterly dividend payment in 1816—and, the company has raised its dividend for 19 years in a row. According to a company press release, York Water is believed to have the longest track record of consecutive dividend payment of any company in America.

The investment case for York Water is fairly straightforward. York Water is engaged in the business of impounding, purifying and distributing water. The company serves 47 municipalities and an estimated population of 180,000, through approximately 64,000 service connections. As a water utility, the business model is easy to understand and is regulated. Regulated utilities are allowed to pass along moderate rate increases to consumers each year. This results in steady earnings growth over many years.

In addition, the product is both essential and irreplaceable, and the business model enjoys a “wide economic moat”, a popular term coined by legendary investor Warren Buffett. A strong economic moat refers to a business model that has sustainable competitive advantages which limit the risk of competitors taking away market share.

Fundamentals Support the Dividend

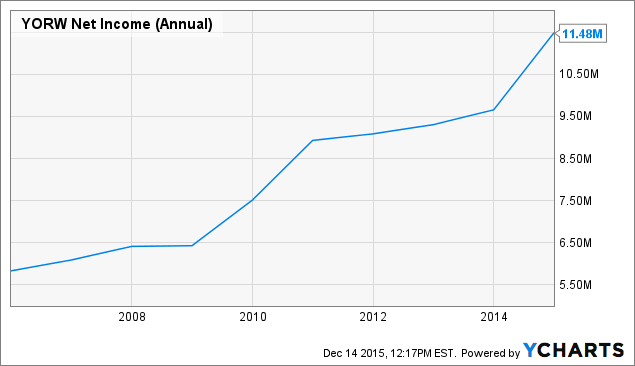

Investors should perform a great deal of due diligence to make sure a company’s dividend is supported by underlying profits. This helps the investor determine whether a company’s dividend payout is sustainable over the long term. In York Water’s case, its fundamentals are strong. Over the first nine months of 2015, revenue and earnings per share grew 3% and 14%, respectively. This growth was due to higher revenue and controlled expenses. York Water’s revenue growth was attributed to a previously announced regulator-approved rate hike in February 2014, as well as increases in the number of water and wastewater customers.

Going forward, the increase in new customers is expected to result in higher investment costs by the company. For example, York Water expects to invest an additional $2.5 million in 2015 on improvements to its pipes, filtration systems, facilities and dams. This investment will help improve York Water’s infrastructure, and help pave the way for future revenue and earnings growth.

York Water’s dividend payout ratio, a term that analyzes how much of a company’s regular profits are distributed to investors as a dividend, stands at 63% over the past one year. This is a healthy level; a well-run utility company should not need to retain much more than one-third of its earnings. The rest can be funneled to investors as a dividend, and still produce a good level of reinvestment back into the business for future growth opportunities.

York Water also maintains a healthy balance sheet. Its current ratio is 1.6, which implies strong liquidity. Moreover, York Water’s long-term debt to shareholder equity ratio is 81%. That is fairly high, but its long-term debt should be manageable because the company generates more than enough profit to service its debt.

The Bottom Line

It goes without saying that life as we know it cannot exist without water—that in itself should make investors feel very comfortable about the water utility business model. York Water has been around for two hundred years, an incredible history for the company. It has rewarded shareholders with steadily rising profits and dividends along the way.

York Water’s revenue and earnings per share have grown this year, which means the company should have no trouble continuing its stellar track record of dividend payments to shareholders. York Water’s fundamentals remain healthy, with a manageable payout ratio and a strong balance sheet. Investors interested in a reliable dividend stock should perform additional research on York Water Company.