Dividend.com analyzed the search patterns of visitors to our site during the past week ending January 16, 2016. Below, we give an analysis of how intelligently readers used Dividend.com to help them in their investment decision-making process—by providing a breakdown of what was searched the most on Dividend.com ranked by volume spike to their ticker pages for last week.

1. Ford Motor Company ({% dividend F %} - $1 Billion Special Dividend Booed by the Markets

Ford has been giving record sales numbers recently—a $1 billion special dividend, amounting to $0.25 per share, in addition to its $0.15 per share regular dividend. The stock is also at a cheap valuation of just 10 times earnings. With all of these catalysts why did the market give a thumbs down to the announcement?

Reason #1 – The market is in a panic mode right now with Shanghai Composite flirting with its support level of 3,000.

Reason #2 – Would a share buyback have been a better option?

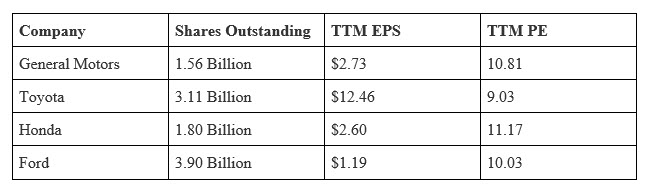

Ford’s major competitors are GM, Toyota and Honda. A quick look at their shares outstanding and EPS gives the following picture:

Ford has more shares outstanding than any of its competitors, which results in lower EPS. A share buyback would have boosted the EPS and also would have given it a strong valuation boost.

Reason # 3 – A special dividend sometimes sends a wrong signal to investors because it’s always prudent to grow your dividend slowly and steadily over years rather than paying it all out at once. It makes the investor nervous that the company might have reached the zenith of its growth and they have nothing better to do with the cash that’s available.

Read our analysis of their dividend increase here.

2. General Motors {% dividend GM %}

General Motors (one of Ford’s major competitors) did the right thing as they revved up their dividend by 6% and also announced a stock buyback program of $4 billion, in addition to a strong 2016 guidance to $5.25 to $5.75 per share. Markets loved the move, as the shares were up 4.6% pre-market. Lower gas prices have helped GM increase its sales. The tailwinds that we see are a stronger U.S. housing market, cheap oil and a strong jobs report while the headwinds that we see are an interest rate tightening cycle.

The stock, from a valuation perspective, is tremendously cheap at 5.5 Forward PE. Read our analysis of their dividend hike and buyback announcement here.

3. ConocoPhillips {% dividend COP %}

ConocoPhillips was a stock on our “Best Dividend Stocks” list until mid-2015 when it was at $53. Going by the earnings estimates for next year, and the carnage that was unfolding in oil, we removed it from our list and downgraded its rating from 3.5 to 3.4. We were right on our call, as the stock has now slid to $39.

At this time of the year, when oil prices are at multi-year lows, a contrarian can go long on Conoco with the hopes of rising oil prices in 2016. Going long on COP is also one of our trading—not investing—ideas for 2016 (see 5 trades we like for 2016.) However, after having given that call, Iran could likely add further tailwinds to oil prices as it vows to add 5,000,000 barrels a day. This prospect has further pushed brent crude below $30/bbl.

If you want to play COP through the ETF route then you can find which ETF’s COP has exposure to with ETFdb’s stock exposure tool. Currently, the iShares U.S. Oil & Gas Exploration & Production ETF has the highest exposure to COP with a weighting of 11.34%.

4. Gold

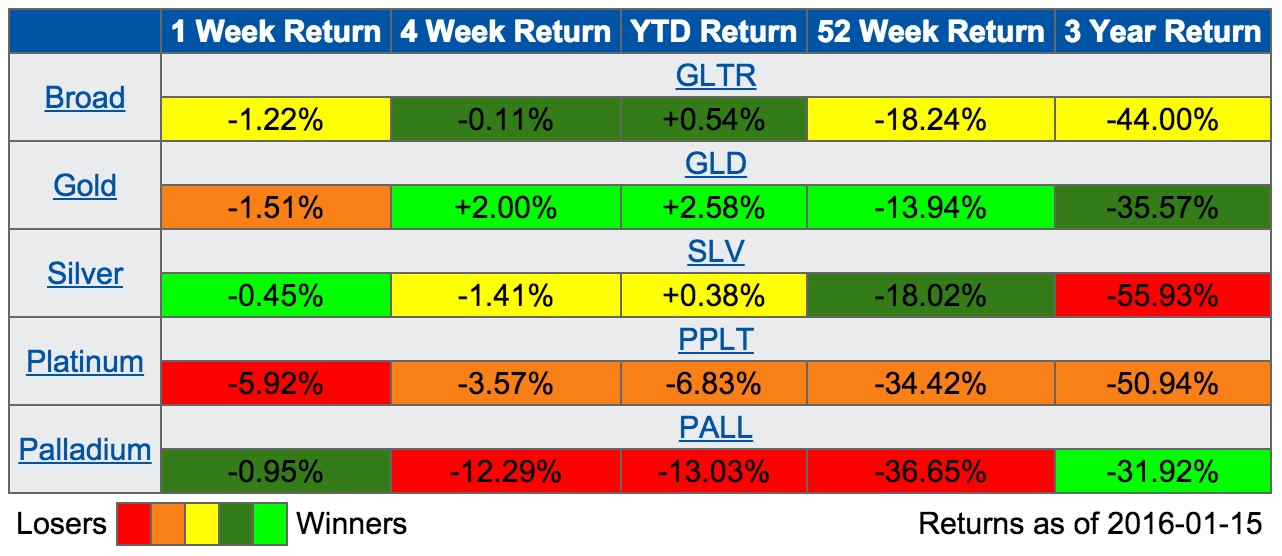

Our best gold dividend stocks page was trending last week. If precious metals are your way of hedging your portfolio against volatility, then you might want to take a look at this heat map from Commodityhq.com.

Gold, or for that matter any precious metal, has underperformed on a longer time horizon, majorly because markets were in a strong bull phase. 2016’s YTD return for gold has been +2.58%—something to cheer about for precious metals that have otherwise disappointed.

5. Apple {% dividend AAPL %}

Apple’s search volume on Dividend.com spiked through the roof last week, as they announce earnings this month. This week, we will publish our analysis of why Apple is primed to increase its dividend and why it’s a conviction buy.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the previous week in order to assist you in making insightful decisions for your portfolio.