Getty Realty Corp. (GTY ) is an REIT specializing in the ownership, leasing and financing of retail motor fuel and convenience store properties and petroleum distribution terminals.

Getty owns 826 of its 923 properties and leased the remaining 106 properties from third party landlords. The REIT uses triple net leases, meaning the retailers and distributors who occupy its properties are responsible for managing the operations conducted at these properties, such as repairs and maintenance.

The company’s tenants supply fuel and operate the properties directly or sublet them to operators who operate their gas stations, convenience stores, automotive repair service facilities or other businesses.

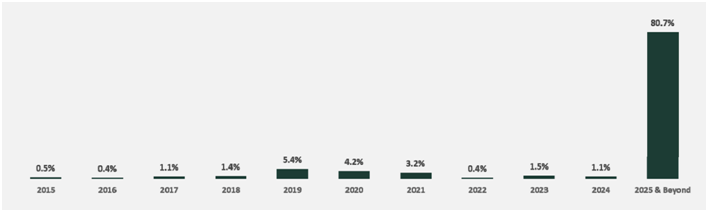

Getty’s investor presentation from June 2015 stated that 98% of its properties are occupied and more than 80% of their leases mature after 2025, as shown below. On a purely macro basis, the higher the percentage of leases that mature at a later date, the better it is for the company (if it’s a contracting economy and vice versa).

A low debt to capitalization ratio of 38% and a weighted average interest rate of 4.6% are good figures that define Getty’s balance sheet.

Is the Glass Half Full or Half Empty?

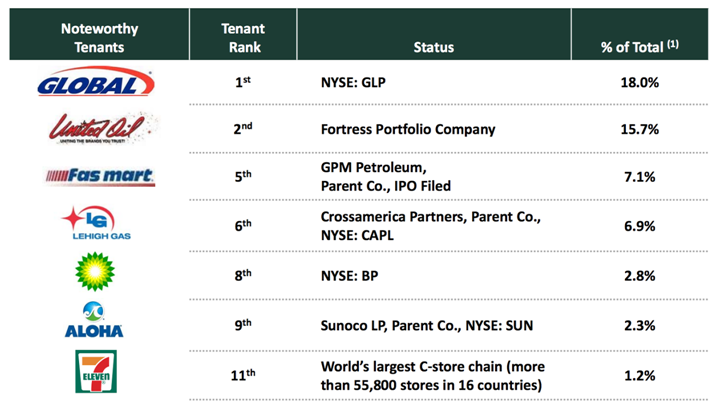

An optimist might argue that more than half of Getty’s portfolio (55%) features some of the biggest brands, taking a glass-half-full approach. On the other hand, a pessimist may question the remaining 45%, which doesn’t feature creditworthy names, calling the glass half empty.

At the same time, some of the best REITS, like O Realty Income, are in this very situation (just 44% of their tenants are investment grade). However, O Realty has a highly diversified tenant base, which reduces the risk of noninvestment-grade tenants.

Not so for Getty. Its portfolio is more concentrated and thus needs to be looked at with a grain of salt.

Gas Stations and Convenience Stores

Gas stations and convenience stores make up the bulk of Getty’s portfolio. Gasoline is a low-margin business. While it constitutes 77% of store sales, it accounts for only 35% of the company’s bottom line. Despite the fact that these retailers sell overpriced ice cream, soda and bottled water, consumers still buy them as they are at the right place at the right time. The c-store’s main selling point is its location next to high-density traffic grids, prominent intersections and freeway entrances/exits. They also double up as a banking hub or restaurant.

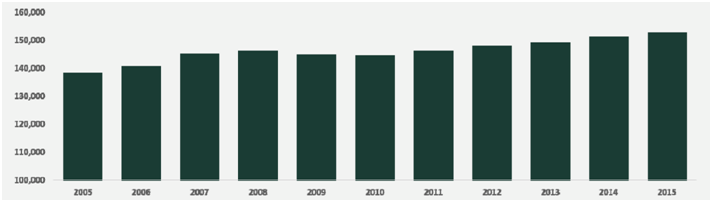

The following represents the growth in the c-store business according to the National Association of Convenience Stores.

Even during recessionary times, convenience stores managed to grow and continue their success.

One can estimate that in today’s times, there should be a small decline in gas sales due to low oil prices, followed by a decline in tobacco sales. However, those losses should be more than offset by a growth in OTC drugs, soda, milk, fast food and of course, lottery tickets!

Focused REIT in a Not-So-Niche Space

Getty has high industry concentration risk due to its exclusive focus on c-stores and gas stations. Further, this isn’t a niche space, and Getty does have competitors in the form of National Retail Properties (NNN ) and Realty Income Corp. (O). National Retail Properties has almost the same valuation at a $5 billion market cap that Getty has for a $0.5 billion market cap.

Dividend investors/income investors must keep in mind that though Getty looks interesting from a business perspective, the advent of electric vehicles and self-driving cars could mean that this business needs a radical makeover. If you are a risk taker who doesn’t mind a bit of industry concentration, then this could be your REIT for dividend income with the hope that Getty continues its ongoing portfolio repositioning to maximize value. On June 4, 2015, the REIT acquired 77 properties for $214 million by securing $300 million in financing. Yielding just about 6%, this REIT is for aggressive investors. For a more stable investment option, check out O Realty Income.

Before the first interest rate hike of this tightening cycle, Dividend.com argued that REITs are the way to go to protect your portfolio against rising interest rates, and we still maintain that stance. REIT rents are tied to measures of inflation, and higher inflation means higher rents for the trusts, which means higher payouts for dividend investors.

Check out the REIT way to forget the Fed.