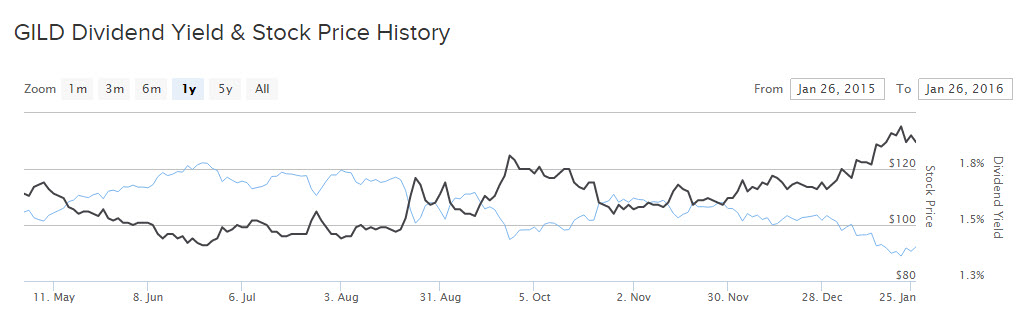

Biotech giant Gilead Sciences (GILD ) is a very appealing pick for income investors. The stock price has declined significantly from its 52-week high of over $120 per share. It now trades for $83 per share, which is a notable decline from its recent highs.

This has pushed up its dividend yield to over 2%, which now beats the average yield in the S&P 500 Index. Gilead is also a strong dividend growth stock. When the company recently released quarterly earnings, it announced a 10% dividend increase. That means its dividend yield will soon rise to 2.2%. In addition, Gilead generates tremendous cash flow, which it can use to invest in future growth or buyback stock. Along with its dividend raise, Gilead announced a new $10 billion stock buyback authorization. This is a significant buyback, which represents 8% of its market capitalization.

Investors have punished the stock based on fears of escalating regulatory risk and worries over Gilead’s future product pipeline—but these fears are overblown. Gilead’s earnings power and cash flow generation are not being properly appreciated by the market, and investors should take advantage of this buying opportunity.

Gilead's Excellent Earnings Power

Gilead reported fourth-quarter net profit of $4.68 billion, or $3.18 per share. That represented excellent growth of 45% from $3.49 billion, or $2.18 per share, in the same quarter one year ago. Earnings, adjusted for one-time items, came to $3.32 per share. That result easily beat analyst expectations, which called for earnings of $2.99 per share. Revenue was also a strong beat. Sales grew 16% year over year, to $8.51 billion for the quarter, while analysts expected $8.11 billion.

Still, investors remain very cautious. The market is not convinced that Gilead can continue growing earnings going forward. There is a great deal of concern over Gilead’s top two Hepatitis C drugs, Harvoni and Sovaldi. These products represent 58% of Gilead’s total revenue by themselves, which is a concern because their growth is slowing due to high costs. Insurers are likely to demand significant price cuts since the cost of the drugs is so high. As a result, investors aren’t convinced in Gilead’s future earnings trajectory—but the worries appear overblown. As of the end of 2015, Gilead held $26.2 billion of cash, cash equivalents, and marketable securities on its balance sheet. The company also generated $20 billion of operating cash flow last year. This means Gilead generates so much cash flow that it can simply acquire a company to supplement its future drug pipeline.

Gilead expects at least $30 billion in product sales in 2016. Compared to 2015, that would indeed represent a decline, but just a 6% decline year over year. It would not be difficult to offset this with organic growth from new products currently under development, as well as bolt-on growth through acquisitions.

Future Dividend Growth Expectations

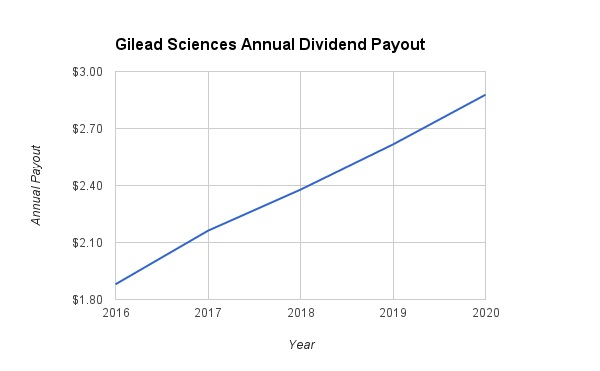

As demonstrated earlier, Gilead is a tremendous generator of cash flow. This in itself will help fuel dividend growth going forward. Another factor that will boost its dividend growth is that its payout ratio is very low. Gilead’s current annualized dividend represents just 14% of its trailing 12-month earnings per share. That means the company could continue to raise its dividend at significant rates, even if earnings growth stalls, and still would not jeopardize its financial position.

As a result, it is not unreasonable to expect 15% dividend growth each year going forward. Under this assumption, future dividend growth will take the annualized payout to $2.88 per share by 2020. This represents a 3.4% yield based on today’s stock price.

The Bottom Line

Gilead stock should be very attractive to value and income investors. Shares trade for just 7 times trailing 12-month earnings per share and 6 times forward EPS estimates. In addition, Gilead’s 2% dividend yield and the likelihood of at least 10% dividend growth in the next several years provide significant future income potential.

Investors are highly concerned about the future earnings trajectory for Gilead, but this seems like a short-term change in sentiment. It should easily be able to obtain revenue growth by acquiring a smaller competitor. It can generate future earnings growth by realizing cost synergies from any potential takeover, as well as from the benefits of its $10 billion stock buyback program. This will allow Gilead to continue increasing earnings and dividends. Therefore, Gilead should remain a top dividend stock pick.