The industrial sector is enduring a very difficult time right now. Due to the collapse in commodity prices, the strengthening U.S. dollar, and slowing economic growth in emerging markets like China, companies operating in the industrial sector have seen their earnings and share prices decline over the past year. As a global industrial, 3M (MMM ) is not immune to these headwinds.

Despite these notable challenges, 3M is still a high-quality company. The headwinds mentioned above are weighing down the company, but these are not self-inflicted wounds. A company such as 3M cannot control factors like foreign exchange and GDP growth in China. What it can control—namely its core operation and strategic growth priorities—have successfully helped the company grow into an industry leader.

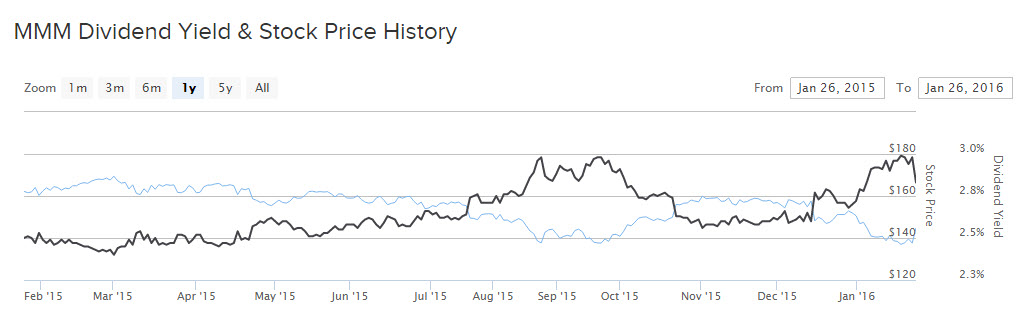

As a reflection of its strong underlying business and promising future, 3M raised its dividend on February 2. This is a sign that management is confident in the core operations of the business. Even though the stock price has not performed well over the past year, income investors should view 3M stock well for its dividend growth and significant 3% yield.

Company Overview and Fundamentals

Originally known as Minnesota Mining and Manufacturing, 3M is a multinational industrial company with a wide range of products. It is one of the largest diversified manufacturers in the world, whose products service many large commercial industries. Some of 3M’s products are quite well-known, such as its famous Post-it Notes and Scotch tape. While these products are what most people think of when they look at 3M, the company’s future growth will likely be fueled by its health care and consumer businesses.

These two businesses provided 3M with the most growth last year. Organic revenue, which excludes foreign exchange translations and the effects of divestitures and acquisitions, rose 3.7% and 3.4% in health care and consumer products, respectively. Growth in these areas helped offset a 1.9% organic revenue decline in the company’s electronics and energy businesses.

As a global company, 3M cannot avoid the strengthening U.S. dollar, which makes U.S. products less competitive overseas. The dollar also reduces the value of revenue and earnings generated in international markets. 3M saw broad-based weakness last year from a geographic perspective. Total revenue fell 13% in the Europe, Middle East, and Africa segment, and 14% in Latin America and Canada. Unfortunately, the currency headwind is not expected to ease in 2016. Organic revenue growth is expected to be just 1% to 3% this year.

This will keep 3M’s earnings growth restrained. The good news, however, is that the company is still an excellent generator of cash flow, even if revenue does not grow at high rates. 3M generated a 22% return on invested capital last year, and its cash flow will allow it to continue increasing its dividend.

Enticing Capital Returns

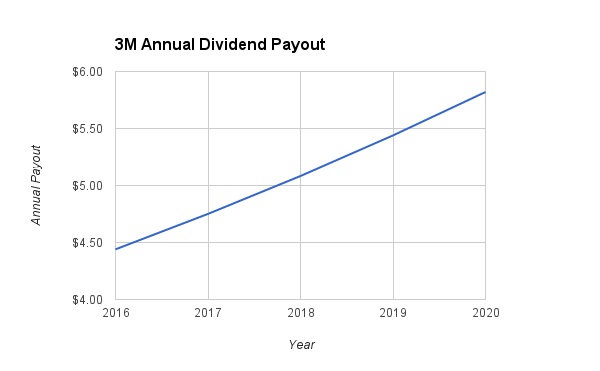

Going forward, 3M’s new annualized dividend will be $4.44 per share. That represents 8% growth from its previous dividend. In addition, 3M authorized the repurchase of up to $10 billion of its outstanding common stock. The authorization replaces its existing repurchase program and has no specified completion date. This is a very significant buyback as it represents 10% of 3M’s current market capitalization.

The company is in healthy financial condition, has a solid balance sheet, and its payout ratio is a modest 54% of earnings. Therefore, it is not unreasonable to expect 6% to 8% annualized dividend growth over the next several years. This would be in line with 3M’s dividend growth rates over the past several years, and would keep its payout ratio at less than two-thirds of earnings.

This would take 3M’s 2020 dividend to $5.82 per share. Historically, 3M has been a major capital return allocator. The company returns billions of dollars to investors each year through dividend payments and stock repurchases. According to the company, during the past 10 years, 3M returned $46 billion to shareholders through a combination of dividends and gross share repurchases. This includes $7.8 billion in total capital returns in 2015.

3M has a long history of paying a steady quarterly dividend like clockwork each year. The company has made dividend payments for more than 99 years in a row, and it has raised its dividend for 58 years in a row. This makes 3M a member of the Dividend Aristocrats as well as a Dividend King, which is a select group of companies that have raised their dividends for 50 years in a row.

The Bottom Line

The bottom line is that while 3M’s earnings are slowing right now, it is mostly because of foreign exchange. Its underlying business remains strong, and it generates significant cash flow each year. This is what will fuel 3M’s future dividend growth, making it a top dividend stock for income investors.