The technology sector is where investors can find a number of high dividend yield stocks like Cisco Systems (CSCO ), but it wasn’t always that way. The technology sector underwent a dramatic transformation since the bursting of the tech bubble. Back then, the technology sector was universally seen as a source of growth stocks, not dividend stocks. Companies resisted the very idea of distributing dividend payouts to investors, preferring instead to reinvest all their cash flow back into their businesses. It was nearly impossible to find a technology stock that paid a dividend at all.

That has all changed in the years since. Once the tech bubble burst, tech stocks crumbled, leaving shareholders with huge losses. As time passed, technology companies grew larger and became more profitable. This got the attention of shareholders, many of whom remembered how quickly wealth can be destroyed from falling stock prices. They now desired dividend payouts as a margin of safety. To keep shareholders happy, many companies across the tech sector pay high dividend yields. One of them is Cisco, which has increased its dividend by 24% and also announced a new $15 billion stock buyback.

Earnings Support Capital Returns

Cisco made the announcement regarding its capital return program on the same day it reported quarterly earnings. Cisco’s fundamental strength gave the company the confidence to increase both its dividend and stock repurchase authorization. Cisco reported better-than-expected results for the second fiscal quarter. Cisco earned $0.57 per share of profit on $11.8 billion of revenue last quarter. This exceeded analyst estimates, which projected $0.54 per share of earnings on $11.75 billion of revenue.

On a year-over-year perspective, revenue was flat, while earnings per share soared 34% from the same quarter of fiscal 2015. The pronounced earnings growth was due to lower expenses and fewer shares outstanding as a result of the company’s previous stock buyback plan.

From a geographic perspective, Cisco realized its strongest growth from the emerging markets. The company grew revenue by 10% year-over-year in the Asia-Pacific, Japan and China regions. This growth helped offset a 3% revenue decline in the Americas. Among product categories, Cisco grew revenue by 5% in routing, 11% in security, and 37% in service provider video.

Going forward, Cisco’s current-quarter revenue is expected to grow 1%-4% year-over-year. Cisco’s earnings growth will be boosted by its $1.4 billion acquisition of Jasper Technologies in February. Jasper delivers cloud-based service platforms to enterprises and service providers. The acquisition will meaningfully advance Cisco’s ambitions in the emerging Internet-of-Things category, in which all sorts of household devices can be connected and communicate with each other. As Cisco’s earnings continue to grow, its future dividends should grow as well.

Free Cash Flow Leads to Strong Dividend Growth

The reason why so many strong dividend growth stocks can be found in the technology sector is because these companies are major cash flow generators. Technology companies enjoy low capital expenditures and do not need to carry high levels of debt on their balance sheets. For example, Cisco generated $6.6 billion of operating cash flow over the first half of fiscal 2016. Its capital expenditures amounted to just $576 million in that time. Consequently, the company generated $6.1 billion of free cash flow, which represented approximately 25% of revenue in the first half of the fiscal year. That is a very high level of free cash flow generation as a percentage of revenue and speaks to the strength of Cisco’s underlying business model.

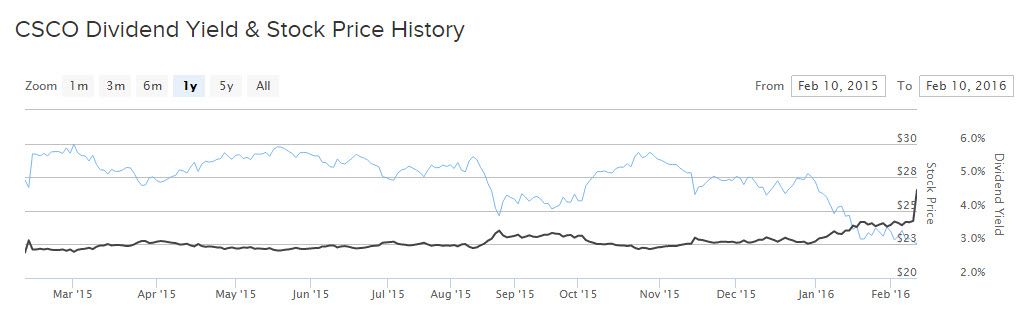

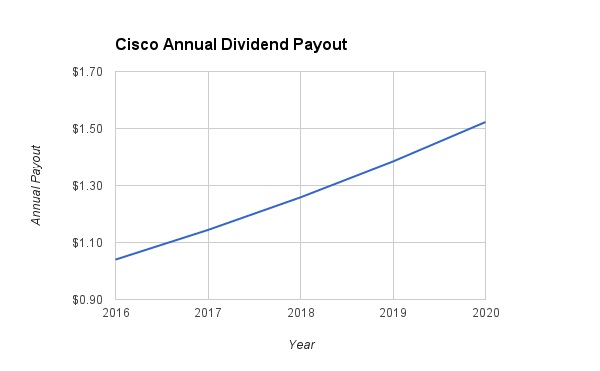

This is why Cisco can raise its dividend. The company has announced a new annualized dividend of $1.04 per share. That is a 26% increase from the previous annualized dividend rate. In addition, Cisco approved a new $15 billion stock buyback which will replace its existing authorization. This is a very significant buyback, which itself represents 12% of its current market capitalization. Furthermore, Cisco can easily afford to continue growing its dividend in future years because of its low payout ratio. Cisco’s new dividend represents 35% of its free cash flow, so there should be plenty of room for future dividend growth. Assuming 10% dividend growth per year, Cisco’s annual payout will reach $1.52 per share by 2020, a 6% yield based on the current stock price.

The Bottom Line

Cisco’s new dividend is a 4.2% yield, which is very attractive in this low-interest rate environment. High dividend yields above 4% are difficult to find, especially for companies in as strong financial condition as Cisco. Cisco generates very high levels of free cash flow and has a robust balance sheet with tens of billions in cash.

Income investors should view Cisco as a top dividend stock in the technology sector.