Discount retail company Wal-Mart Stores (WMT ) has enjoyed tremendous growth over its existence. It started out as a small, single-store company in Arkansas and has since grown into the largest retailer in the world.

However, in recent years, Wal-Mart’s growth has slowed down considerably. The company is facing a number of challenges that have inhibited its growth, including increased scrutiny from consumers over the treatment of its employees, the cleanliness of its stores, the strengthening U.S. dollar, and escalating competition from Internet retailers like Amazon.

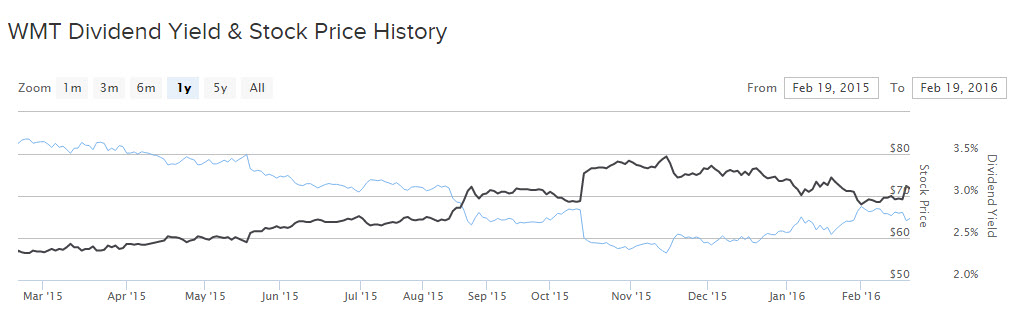

These headwinds have caused Wal-Mart’s earnings to decline. Not surprisingly, this has weighed on the company’s stock price as well. Investors are not willing to pay a market multiple for a stock whose earnings are in decline. As a result, Wal-Mart’s valuation and stock price have contracted over the past one year. Its earnings are likely to remain under pressure throughout the year, which could continue to weigh on its share price. Despite this pressure, WMT’s investments are likely to pay off over the long term. In addition, the company continues to generate strong profitability, which it uses to reward its shareholders with higher dividends.

Wal-Mart: Declining Earnings Are a Key Concern

Wal-Mart earned $4.57 per share in diluted earnings in fiscal 2016. That represented a 9% decline from the previous year. One of the major reasons for this decline was unfavorable currency translations. The stronger U.S. dollar is expected to further reduce Wal-Mart’s sales by $12 billion this fiscal year, meaning that this particular headwind is not likely to ease any time soon.

Separately, Wal-Mart has suffered lower customer traffic because of worsening consumer attitudes regarding the quality and cleanliness of its stores. Shoppers are increasingly turning to Internet retailers and other brick-and-mortar retailers because Wal-Mart stores have been known to be dirty, with cluttered aisles and messy shelves. Because of this, Wal-Mart once again cut its future sales forecast. The company now expects flat sales for the fiscal year, down from previous expectations of 3%-4% sales growth in constant currency. Further, Wal-Mart is closing underperforming stores; this includes 269 store closures in fiscal 2016. Costs associated with these closures reduced full-year earnings by 20 cents per share.

At the same time, the company is investing billions of dollars to renovate its stores, improve its employee training, and raise wages. These investments will hurt the company in the near term but will help WMT regain consumer trust. Wal-Mart is also investing in its e-commerce and small-store format, both of which are promising forward catalysts. Last quarter, comparable sales increased 7% at the Neighborhood Markets small-format stores, which was much better performance than the 0.6% overall comparable sales increase from Wal-Mart’s U.S. business. Wal-Mart’s e-commerce sales rose 8% last quarter in constant currency.

The company now expects earnings of $4-$4.30 per share for the current fiscal year. At the midpoint of that forecast, its earnings per share would decline another 9% in fiscal 2017 from the $4.57 per share earned last year. Fortunately, Wal-Mart should be able to continue increasing its dividend during its turnaround phase, and if the turnaround proves successful, its dividend growth should reaccelerate in the future.

Future Dividend Growth Expectations

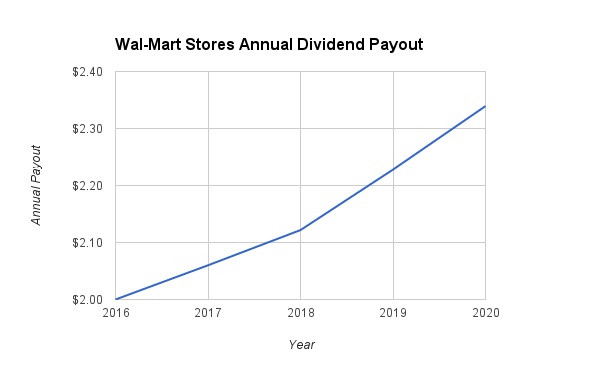

Wal-Mart raised its dividend from $1.96 per share annually to $2 per share for 2016. This was a 2% increase and represents the 43rd year in a row of consecutive dividend increases for the company. Such a long streak qualifies Wal-Mart as a Dividend Aristocrat, which is a rare feat and a sign of the company’s commitment to paying increasing dividends to shareholders each year.

Despite WMT’s operational challenges, the company still generates plenty of underlying profits to support its dividend. It also carries a modest payout ratio. The new dividend rate still represents less than half of its annual earnings per share. A payout ratio below 50% means that not only can it sustain its current $2 annualized payout, but it should also be able to keep raising its dividend each year, as it has for more than four decades.

However, investors should temper their expectations for future dividend increases. Wal-Mart has made it clear that it intends to use excess cash flow provided by the business to reinvest into its core strategic initiatives. Wal-Mart is investing billions of dollars in renovating its stores and improving its employee training and wages. This means investors will have to be content with dividend increases in the low single-digits going forward, at least until the company returns to ideal earnings growth.

For modeling purposes, I will project a 3% annual dividend growth over the next two years, and a 5% dividend growth thereafter through 2020. Under these assumptions, Wal-Mart’s annual dividend payout will reach $2.34 per share by 2020. Even if Wal-Mart’s earnings remain flat at the 2016 guidance of $4-$4.30 per share for the full year, its payout ratio would not exceed 58%.

The Bottom Line

Wal-Mart is currently struggling, but it has a long track record of steady profits and reliable dividend increases. It has hit a bump in the road, but it also has successfully navigated tough times before. Although it may not be an attractive growth stock, Wal-Mart’s attractive valuation and 3% dividend yield should remain attractive to dividend investors.