The Home Depot (HD ) is the world’s largest home improvement retailer and has a very strong brand. In addition, the company is benefiting from some key fundamental tailwinds. In the United States, the labor and housing markets have recovered very strongly in the past several years. These are the economic indicators most important for Home Depot, as consumers tend to spend more or less on home repairs depending on how secure they feel in their jobs and the value of their homes. When consumers feel better about their personal incomes and if they expect home improvements will increase the price of their homes, they are very likely to spend more at home improvement retailers such as Home Depot.

As a result, Home Depot has enjoyed significant share price gains in the years since the financial crisis and the “Great Recession”. Even over more recent periods, the stock has outperformed the broader equity market. Shares of Home Depot increased 11% over the past one year, while the S&P 500 Index is down 8% in that time. Going forward, continued improvement in the U.S. economy, as well as the onset of the spring season, should allow Home Depot to continue increasing its sales and profit for the foreseeable future.

Strong Earnings Growth Prospects

Home Depot recently reported 2015 full year fiscal earnings—and the results were outstanding. Sales for the fiscal year grew 6% to $88.5 billion. The company reported strong results on comparable store sales, a key metric for retailers that analyzes performance at stores open at least one year. Total company comparable store sales for fiscal 2015 increased 5%. In particular, the United States was a source of strength for the company. Comparable sales for U.S. stores were up 7% percent for the year.

Earnings per diluted share in fiscal 2015 grew 15% to $5.46, compared to $4.71 per diluted share in the previous year. Earnings benefited from strong revenue growth, as well as cost controls and a large stock buyback program. The company expects to have another good year in fiscal 2016. Management’s guidance calls for 5%-6% sales growth, 3.7%-4.5% growth in comparable sales, and at least 12% earnings growth. This should provide plenty of growth to continue increasing its dividend at a high rate, and allow the company to maintain a dividend payout ratio at or below 50% of earnings per share.

Home Depot Is a High Dividend Growth Stock

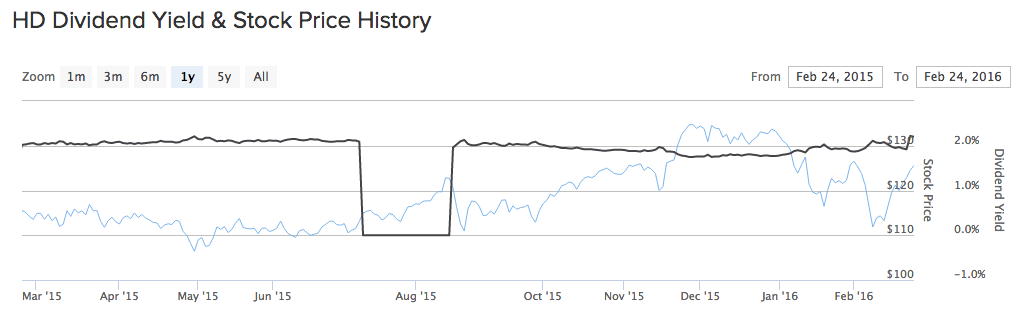

Home Depot recently raised its quarterly dividend from $0.59 per share to $0.69 per share. That represents a 17% increase to the dividend and is the seventh consecutive year of a dividend increase for the company. On an annualized basis, Home Depot’s new dividend will be $2.76 per share. Based on Home Depot’s Feb. 23 closing price of $124.53 per share, the dividend provides a 2.2% yield. That is above the average yield in the S&P 500 by approximately 10 basis points. This increase brings Home Depot’s rolling five-year compound annual growth rate to 22% per year.

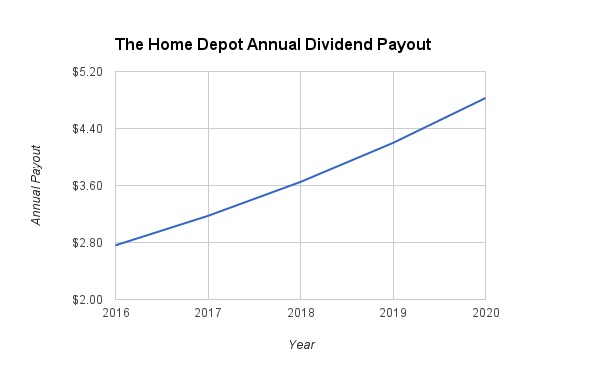

Home Depot has been a very aggressive dividend-grower over the past several years, which is a testament to strong earnings growth, shareholder-friendly management, and commitment to returning more cash to shareholders. These factors should remain in place for several years, which is why investors should fully expect the company to continue delivering double-digit dividend growth going forward. For modeling purposes, we are projecting 15% compound dividend growth through 2020. Under those assumptions, Home Depot’s annualized dividend would reach $4.83 per share by 2020. That amounts to a 3.9% yield on cost for investors buying in at current prices. As a result, Home Depot should be viewed as a strong dividend stock pick for current dividends and an excellent dividend growth stock.

The Bottom Line

Home Depot is growing sales and earnings at high rates, and this outstanding growth is fueling the stock’s attractive stock buybacks and dividends. Home Depot has managed double-digit increases to its dividend for several years in a row, and because of its low payout ratio and high earnings growth, there is a very good chance it can maintain that level of dividend growth going forward.

Home Depot shares have come off their 52-week high, which has elevated its dividend to 2.2%. Thanks to the stock decline so far this year, investors now have a good buying opportunity for what is one of the top dividend stocks in the retail industry.