Waste Management (WM ) is about as slow and steady as they come. The company’s business model and stock performance are not likely to be viewed as exciting—but this is not a stock to be bought for excitement. Waste Management offers waste management and environmental services to residential, commercial, industrial, and municipal customers in North America. These services include collection, transfer, recycling and resource recovery, and disposal services. It is an industry leader with a wide economic moat, meaning its industry has high barriers to entry. This provides the company with steady profits, which it uses to pay increasing dividends to shareholders each year.

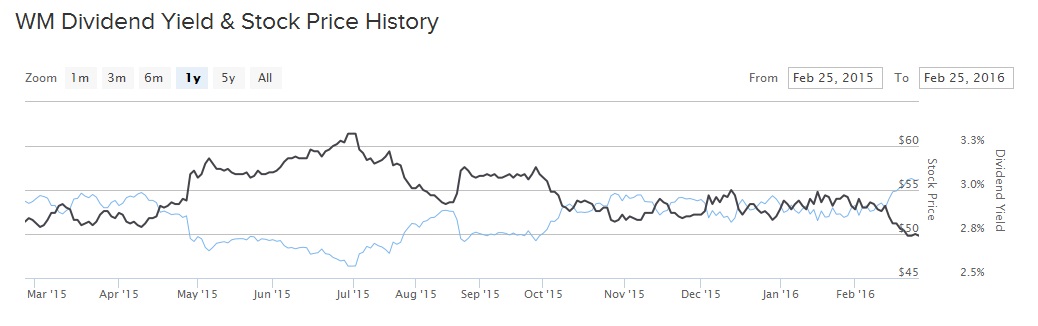

Based on the Feb. 25 closing price, Waste Management’s stock has returned 3% over the past one year, not including dividends. While this is not an overly impressive return, it is worth noting that Waste Management nevertheless outperformed the broader market. The S&P 500 Index is down 7% in the same time-frame. As a result, Waste Management actually outperformed the S&P by 10 percentage points, again not including Waste Management’s dividend payments. As a result, the stock performance was quite satisfactory over that time. Moreover, Waste Management raised its dividend on Feb. 26, further boosting its reputation as a strong dividend stock.

Earnings Growth, Low Payout Ratio Support Dividend Growth

Waste Management has announced a $0.41 per share quarterly dividend. That is a 6.4% increase over its previous dividend level of $0.385 per share. On an annualized basis, Waste Management’s new dividend will be $1.64 per share. At its most recent closing price, the payout represents a 2.9% dividend yield. Its stock provides a higher yield than the S&P 500, by approximately 70 basis points. That means Waste Management is an above-average dividend yield stock. This is the 13th year in a row of increased dividends for Waste Management. The company can afford to raise its dividend for so many years because it generates steady profits and modest growth from year to year.

Waste Management’s 6.4% dividend increase was well above its dividend growth rate over the preceding several years. For example, from 2010-2015, Waste Management raised its dividend 4% compounded annually over that five-year period. The reason why Waste Management delivered an above-average dividend increase is because the company performed above average last year. Adjusted earnings grew 13% in the fiscal year 2015, to $2.61 per share. The company managed strong earnings growth due to lower fuel expenses, significant cost cuts, and the benefits of share repurchases, even though full-year revenue of $13 billion was down 7% from the previous year.

Going forward, the company expects 2016 to be another year above expectations. Waste Management expects 2016 fiscal year adjusted earnings per share to be within $2.74-$2.79 per share. At the midpoint of its forecast, the company should generate approximately 6% earnings growth in the current year. That growth should be realized by the continuing expansion of the company’s recycling and solid waste businesses. Stock buybacks will boost earnings as well. Along with its dividend increase, Waste Management announced a new $1 billion stock-buyback authorization. This represents approximately 4% of its market capitalization, and will provide significant earnings growth in 2016.

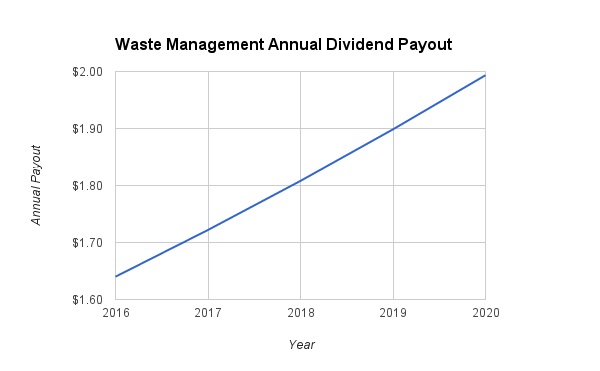

Waste Management’s $1.64 per share forward annualized dividend results in a 59% payout ratio, based on likely 2016 earnings. In general, industrial firms tend to keep dividend payout ratios below two-thirds of annual earnings. Waste Management is still well within this range. Consequently, I believe Waste Management will continue to raise its dividend each year through 2020, by 5% compounded annually. Using these assumptions, Waste Management’s dividend will reach $1.99 per share by 2020. That means investors can buy the stock today, and in four years, realize a 3.5% yield on cost.

The Bottom Line

Waste Management trades at a PE of 21 based on an annualized 2016 EPS. The stock is valued slightly higher than the industry and the Dow Industrial, but we believe that the valuation is fair (even though it’s slightly premium) given that the company is a relentless dividend payer and has one of the most stable business models. WM is in an oligopolistic market, which is primarily run by a few big companies with Republic Services (RSG ) being its closest competitor.

We recommended this stock recently at $53.98 on Feb 16, 2016, to premium members. The stock is up 4.7%, excluding the dividends. The outlook for this business and potential money flow to the stock looks healthy as investors are piling up on utilities and industrial stocks in these uncertain times.