Symantec Corporation (SYMC ) has had a difficult start to 2016. The company, which provides security and data protection services to mobile devices and enterprise data centers, has undergone a significant restructuring in just the past few months, having sold Veritas, its information management business, so that it could focus solely on cybersecurity. This strategy makes sense since cybersecurity is experiencing rapid growth right now.

Not only that, but Symantec also restructured its capital allocation program. The company accepted a $500 million investment from technology-focused private equity firm Silver Lake to further advance its cybersecurity strategic imperatives. But this compelled the company to cut its regular quarterly dividend and instead offer shareholders a large one-time special dividend this year.

While these changes have been met with contention by investors, as the stock price has fallen year-to-date, the moves position the company to better execute on its business priorities while allowing greater financial flexibility going forward. The sale of Veritas and the dividend reduction provide enough financial wiggle room to offer a special dividend but also position the company to continue investing in growth initiatives. Below, Dividend.com explains the motives for Symantec’s dividend changes and buyback announcement.

Symantec Dividend: Addition by Subtraction

Cybersecurity is one of the premier growth engines in technology right now. In an increasingly digital world in which increasing levels of information, transactions, and data are being placed and stored online and in the cloud, security is a paramount concern. These businesses are leading Symantec’s growth. For example, last quarter the company grew revenue by 15% in information protection, 3% in website security, and 1% in enterprise security. This is largely why Symantec has repositioned itself to concentrate on these areas moving forward.

On February 4, the board of directors of Symantec announced a significant change to the company’s capital allocation program. First, the company announced a $2.3 billion share repurchase authorization, to be completed over the next one year. This is a very significant buyback as it represents 20% of the current market capitalization of the stock. A buyback of this size can provide significant earnings growth.

In addition to the buyback, Symantec announced a $4 per share special dividend, payable March 22 to shareholders of record as of the close of business on March 8. Again, this represents a very meaningful level of return for shareholders. The special dividend amounts to a 24% dividend return based on Symantec’s March 4 closing price of $16.62 per share.

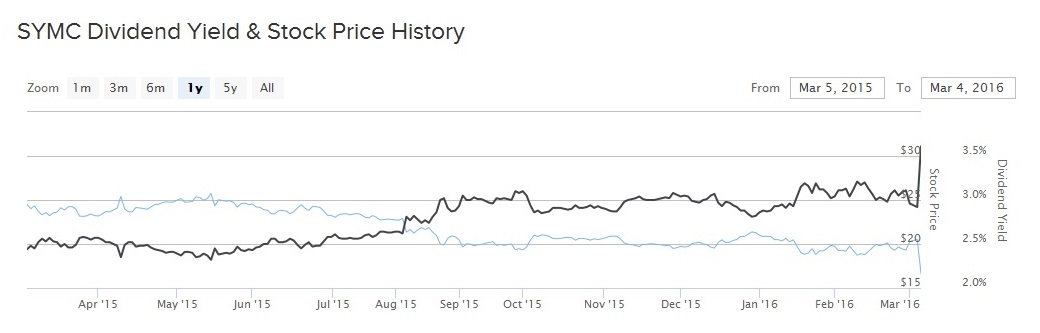

But Symantec’s announcement also included a reduction in the company’s regular dividend. Its ongoing quarterly dividend rate will be 7.5 cents per share, or 30 cents per share on an annualized basis. The new dividend is a 50% reduction from the previous annualized dividend of 60 cents per share. However, the company did keep the door open for future dividend increases, if it is able to generate in excess of its stated $400 million cost-savings initiative.

These moves are part of a broader resetting of the company’s capital allocation priorities. Symantec has made the decision to lower its future regular dividends and tilt its capital returns more toward stock buybacks. However, since Symantec knows that dividend cuts are not received well by investors and typically result in significant depreciation in stock price, the company is compensating investors for this by distributing a large special dividend this year. While it will be more costly for the company upfront, future dividend liability will be reduced.

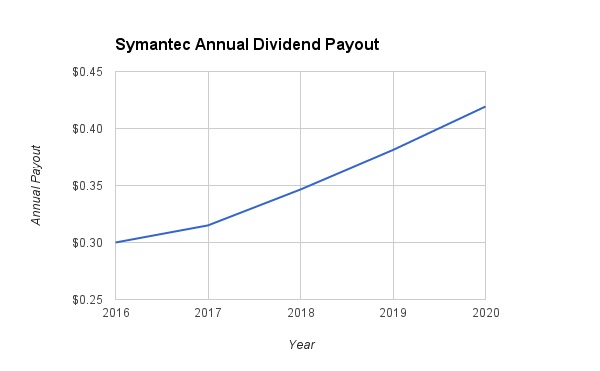

The combination of the special dividend and regular quarterly dividends will provide investors with $4.30 per share in dividend return this year. However, going forward, regular dividends will be much lower. Management sees potential for future dividend growth, so we are pricing in 5% dividend growth next year and 10% dividend growth through 2020. The following is a projection of Symantec’s regular dividends through 2020 under these assumptions.

The Bottom Line

Symantec is transitioning itself from a high-yield dividend stock to a dividend growth stock. Investors will realize a significant dividend return this year, but must be willing to accept lower levels of income over the next several years as the company utilizes a greater portion of cash flow to reinvest in its cybersecurity growth initiatives.

That being said, Symantec’s new dividend rate will still provide a 1.8% dividend yield moving forward. With its low payout ratio and growth potential, Symantec should be considered a compelling potential holding for dividend growth investors.