Income investors commonly view real estate investment trusts, otherwise known as REITs, very highly. There is good reason for this. REITs are favored by their investors because they pay high dividend yields. In exchange for favorable tax status, REITs must distribute at least 90% of taxable income to shareholders as dividends.

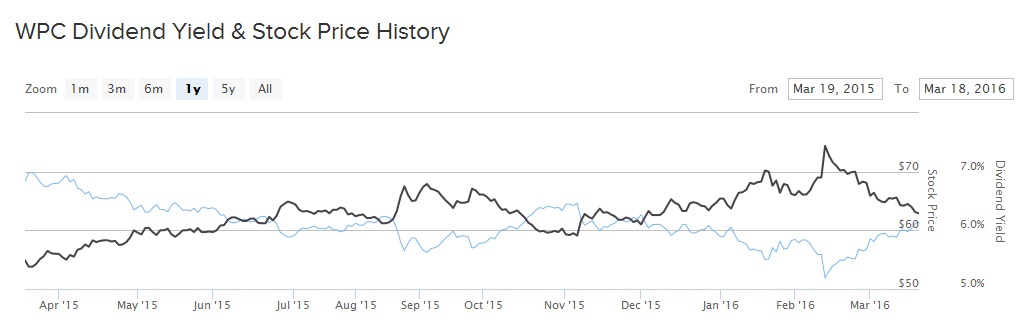

W. P. Carey (WPC ) is an REIT and a Best Dividend Stock. The company recently raised its dividend to 97.42 cents per share. This was a 1% increase from the previous dividend level and takes the new annualized payout to $3.89 per share. Recently, the stock underperformed the S&P 500 Index as well as many others in its REIT peer group. As of its March 18 closing price, the stock is down 12% over the past one year. But REITs are generally regarded as steady dividend payers, and due to WPC’s very high 6.2% yield and track record of proven dividend growth, it is one of the best in the asset class.

Valuation and Dividend Are Positive Catalysts

W. P. Carey stock fell last year due largely to the prospect of higher interest rates in the United States. REITs operate highly debt-heavy capital structures, and when rates go up, interest expense goes up too. But the U.S. Federal Reserve has reiterated that the pace of interest rates will be slow and gradual. Therefore, W. P. Carey will have plenty of time to prepare itself and its balance sheet. The good news is that the company is solidly profitable with a strong tenant portfolio and generates enough earnings to cover its high dividend payout.

The company enjoyed a very high occupancy rate last year of 98.8%, and its strong brand within the industry means W. P. Carey enjoys pricing power. In fact, 95% of W. P. Carey’s annualized base rent came from leases with contractual rent escalations, such as raises linked to CPI or through fixed rent increases. And the portfolio’s weighted average lease term stood at nine years, which is up slightly from the prior quarter.

This has provided the company with strong revenue growth. W. P. Carey grew revenue by 11% last quarter and by 14% in 2015, year over year, driven by additional lease revenues from properties acquired. The company has maintained an aggressive pace of property purchases, which are providing new revenue. W. P. Carey conducted three investment acquisitions in the fourth quarter for $145 million, bringing total investment volume to $688 million for the year.

These accretive acquisitions helped the company grow in a key metric: funds from operation, or FFO. This is a critical measure that investors should use to analyze REITs. It is the non-GAAP alternative to traditional earnings per share for REITs. For the full year, W. P. Carey’s adjusted funds from operation, or AFFO, rose 3.7% to $4.81 per share. Based on W. P. Carey’s funds from operation generated last year, its 2016 projected dividend payout ratio is a comfortable 81% of AFFO. This means W. P. Carey should be able to maintain its high dividend yield, which is attractive for income investors.

In addition, W. P. Carey is attractive because it is undervalued. The stock currently trades for approximately 12 times its trailing 12-month AFFO. By comparison, the S&P 500 Index trades for 21 times trailing earnings per share. This indicates there could be a significant opportunity for multiple expansions, making W. P. Carey a potential value stock.

W. P. Carey has $5.1 billion in total debt on its balance sheet. Fortunately, the REIT generates enough earnings to reward shareholders with dividends and pay down its debt over time. Only $309 million of debt matures in 2016. This is entirely manageable because the company has $1.2 billion of total liquidity, which includes cash and cash equivalents and the un-drawn resources on its credit revolver, in addition to profits generated by the business.

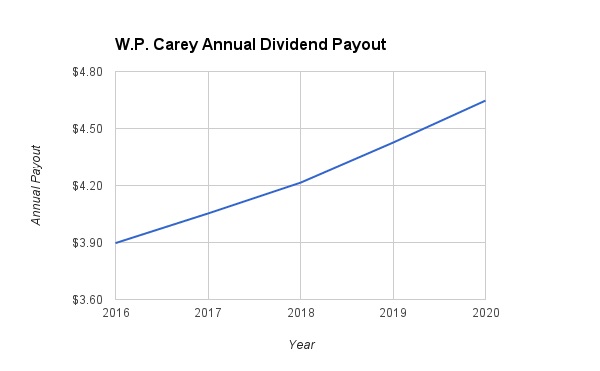

Investors are worried about rising interest rates, but REITs typically carry higher levels of debt than the average company because they need to borrow in order to purchase properties. These properties then generate cash flow of their own, which creates a snowball effect of earnings and dividend growth for well-run REITs like W. P. Carey. Going forward, Dividend.com expects W. P. Carey to raise its dividend by 4% per year next year and in 2017, and then move to 5% dividend growth in the two years afterward. This would take the dividend to $4.65 per share in 2020.

The Bottom Line

W. P. Carey underperformed last year due to rising fears of higher interest rates this year and next year. Although it is true that higher interest rates would be a headwind for W. P. Carey, it is a high-quality REIT with a solid tenant portfolio. The recent dividend increase is a sign of management’s confidence in the health of the underlying business, and the stock appears undervalued. Income investors should continue to view W. P. Carey as a Best Dividend Stock.