Foreign money center Bank of Nova Scotia (BNS ) is located in Canada and does most of its business there. However, it’s also a diversified financial institution with significant operations in the international markets. This means Bank of Nova Scotia is exposed to fears surrounding slowing global economic growth. In addition, investors are doubting whether global central banks, including the U.S. Federal Reserve, will pursue monetary tightening and higher interest rate policies, which are seen as positive catalysts for banks.

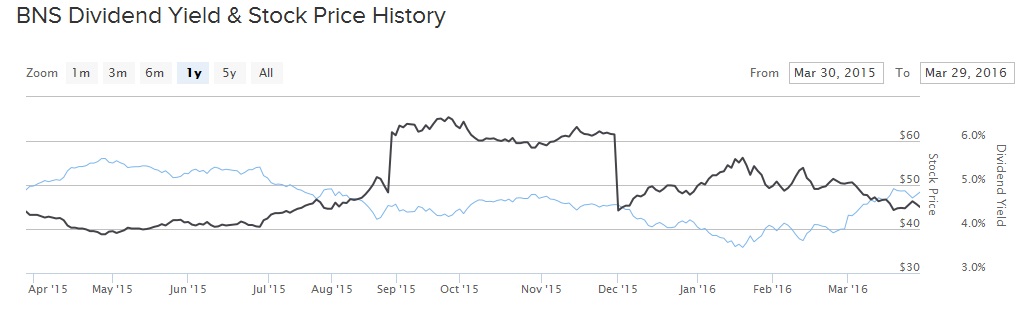

Based on all of this, investor sentiment regarding Canadian banks has eroded somewhat over the past year. Investor negativity based on these issues caused the stock to decline 2% over the past one year. Still, Bank of Nova Scotia is a well-run company. It has remained steadily profitable over the past year and is growing earnings. Therefore, BNS continues to reward shareholders with compelling cash returns, including a significant dividend.

Reflecting its steady fundamentals, Bank of Nova Scotia raised its dividend by 2.8%—in Canadian currency—after releasing its first quarter results. In U.S. dollar terms, the stock has a 4.3% dividend yield currently, which is more than twice the dividend yield of the average stock in the S&P 500 Index.

Earnings Growth Fueled by Improving Loan Portfolio

In the first quarter, Bank of Nova Scotia earned $1.8 billion, a 5% year-over-year increase. On a per-share basis, diluted earnings rose 6% to $1.43, compared with $1.35 in the prior year period. The company also did well in 2015; Bank of Nova Scotia earned $5.67 per share last year, which was slight growth from the $5.66 per share earned the previous year.

The biggest contributor to Bank of Nova Scotia’s earnings growth is its improving loan portfolio. It generated satisfactory levels of 13% return on equity and 10% Common Equity Tier 1 ratio. Bank of Nova Scotia’s provision for credit losses was down $12 million on a quarter-over-quarter basis, or 2%. The provision for credit losses as a percentage of average loans and acceptances was 45 basis points compared to 47 basis points in the previous quarter. This is an important metric for financial institutions, particularly because of the heightened risk of portfolio losses from exposure to the oil and gas sector.

Canada is an economy highly dependent on natural resources and commodities. As the industry struggles with falling commodity prices, the biggest credit risk for the major banks is losses on loans made to the energy sector. The good news for shareholders is that Bank of Nova Scotia is only modestly affected by the downturn in the commodities market.

Valuation and Dividend Catalyst: Interest Rates

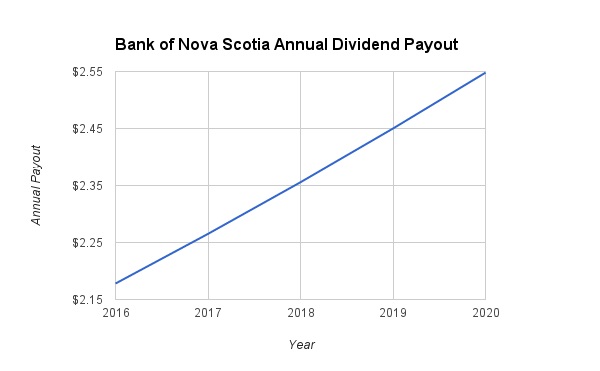

Despite the company’s strong earnings, investors are not willing to reward Bank of Nova Scotia shares with market-average valuation multiples. The stock trades for just 11 times earnings per share. By comparison, the S&P 500 Index trades for 20 times earnings. Furthermore, Bank of Nova Scotia shares trade for just 8 times forward earnings—an indication that the company is likely to grow earnings this year. On average, analysts forecast Bank of Nova Scotia to grow earnings per share by 2% this year and by 5% in 2017, according to estimates compiled by Thomson Financial. This growth should allow the company to continue increasing its dividend in future years.

To be sure, the recent dividend increase is in Canadian dollars. The U.S. dollar equivalent may not change due to currency translation. But the rally in the U.S. dollar that has taken place over the past year is likely not permanent as foreign exchange rates fluctuate and are often cyclical. Moreover, while the pace of interest rate increases could be slower than previously thought, there was already one rate hike in December, with more likely to follow this year. Higher interest rates help financial institutions like Bank of Nova Scotia grow earnings. That is because the business model is to accept deposits and use those funds to make loans. Banks then earn a spread between the interest paid on deposits and the interest generated from loans.

When interest rates rise, it increases the profit margin for financial institutions since the additional interest received on longer-dated loans grows at a faster rate than the incremental interest paid on shorter-term deposits. Therefore, when interest rates rise, Bank of Nova Scotia’s net interest margin will expand, providing a boost to earnings.

It is not likely the company will be able to achieve double-digit dividend growth because it already is a high-yield stock, but it should have little trouble achieving 3%-5% dividend growth per year. Should the company raise its dividend by 4% per year going forward, its dividend will reach an annualized $2.55 per share by 2020 in U.S. dollars.

The Bottom Line

Bank of Nova Scotia stock has endured a difficult year. Investors are still afraid of Canadian banks’ exposure to the oil and gas sector. But BNS responsibly managed its loan portfolio and it is not overly vulnerable to losses in the commodity industry. Moreover, continued global economic growth and higher interest rates will provide a catalyst for earnings and dividend growth in the years ahead.