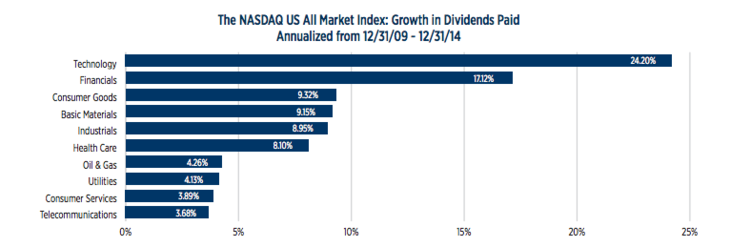

Technology stocks are generally not known to be heavy dividend payers. From the 186 dividend paying technology stocks that we track the average payout ratio comes out to be 33% adjusted for outliers. This payout ratio is actually higher than some of the traditional sectors like Industrial Goods and Consumer Goods that pay dividends. The sector has been one of the fastest growing in terms of dividend payouts as observed in the chart below. According to research from First Trust, the technology sector has collectively grown dividend payouts by 24% compounded annually over the period December 31, 2009 through December 31, 2014.

Chart courtesy of FTPortfolios.

The Federal Reserve’s low interest rate policy means that fixed income yields are low. Dividend stocks, therefore, are back on the radar of income investors as they look to capture a healthy yield.

Utilities and Financials are considered favourite sectors for dividends due to their business models. Technology stocks may be the last sector to come to an investor’s mind while searching through sectors for good yields.

Below, we screened 5 technology stocks out of the more than 180 that we track that are currently near their 52 week highs.

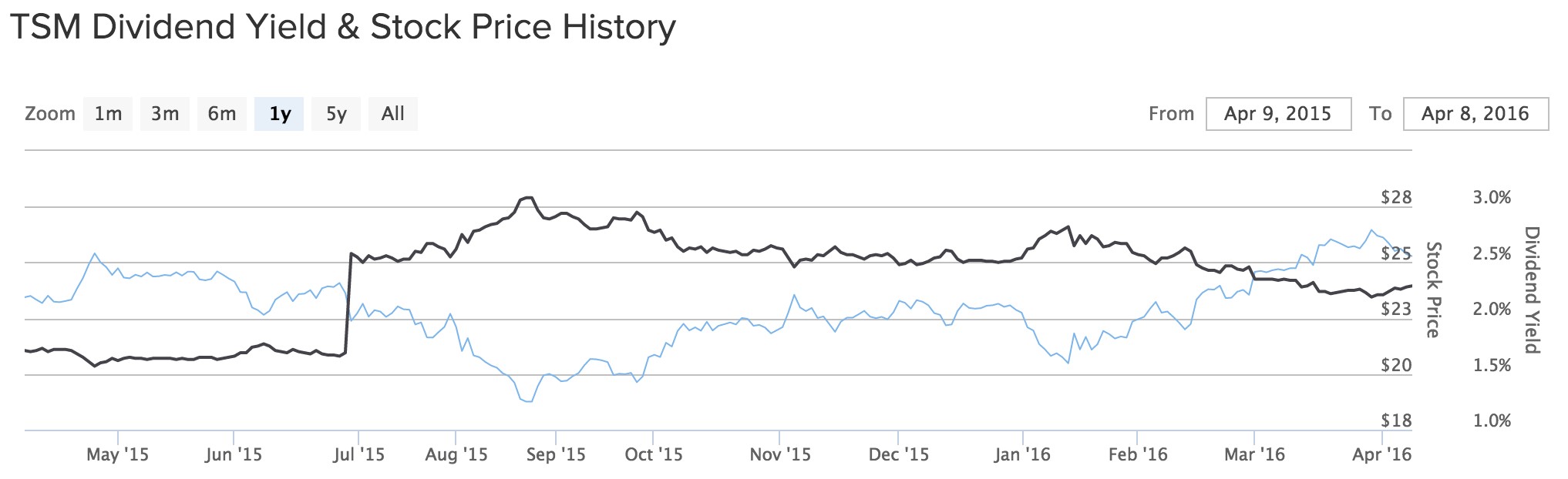

Taiwan Semiconductor Mfg. Co. Ltd (ADR)

The only ADR to feature on this list, TSM (TSM )—with a massive $125B market cap—is currently yielding 2.30% on a stock price of $25.28, which is only 5% off its 52 week high. Analysts’ estimates show that the company is expected to grow its EPS by 9.14% in 2017 from $1.86 to $2.03. TSM is an annual dividend payer and currently trades at a very low PE of 13.77 based on 2016 earnings.

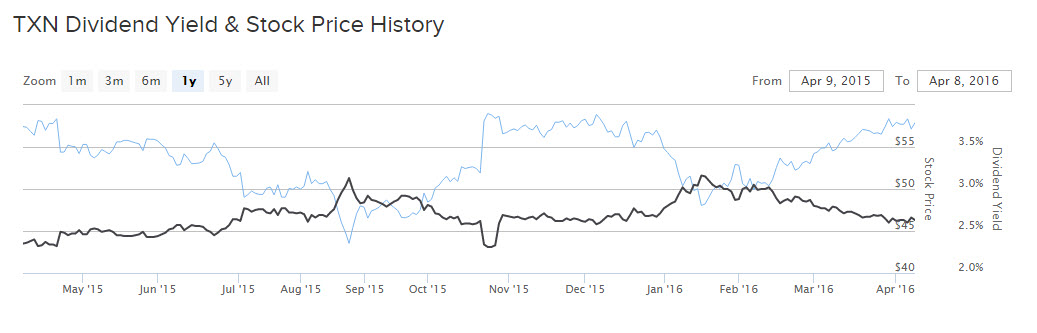

Texas Instruments

Texas Instruments (TXN ), a household name with a market cap of $59B, currently yields 2.35% with a payout ratio of 47%. Its annualized dividend is $1.36 and trades at a PE of 20. TXN is estimated to give an EPS of $2.89 in 2016 and $3.18 in 2017, which results in a 10% growth rate. TXN currently trades at $57.89, which results in it being off by only 2.20% from its 52 week high. With ample room for the company to grow its dividend considering its estimated earnings growth, the company is on a solid footing.

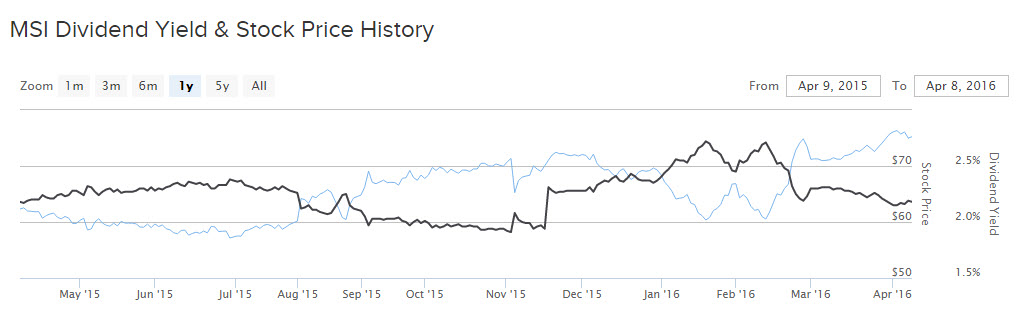

Motorola Solutions

Motorola Solutions (MSI ), currently with a market cap of $13B, has a market price of $75—off just -2.07% from its 52 week high. The stock yields 2.18%, with an annual dividend of $1.64 with a considerably low payout ratio of 38.59%. The stock trades at a PE of just 17.90 based on 2016 EPS estimate of $4.25. MSI is expected to clock in a solid 6.82% EPS growth next calendar year, as estimates suggest its 2017 EPS to be $4.54.

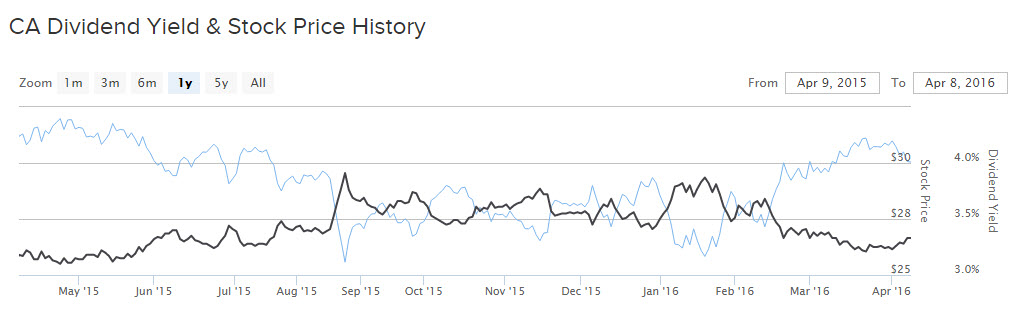

CA Inc

CA Inc Liquid error: internal operates through 3 business segments: Mainframe Solutions, Enterprise Solutions and Services. CA Inc, currently trading for $30, has its 52 week high at $32.48. The company has a market cap of $12B and pays out a dividend of $0.25 every quarter to yield a solid 3.33%. What’s even more appealing is its valuation of 17 PE on a TTM basis. The company has a history of paying dividends dating back to the 1990’s. With a payout ratio of close to 45% based on an estimated EPS of $2.24 for the calendar year, the company still has room to keep growing its dividend—albeit mildly, as the expectations for next calendar year’s EPS growth point to $2.30, which is a growth of 2.68% based on its current calendar year EPS.

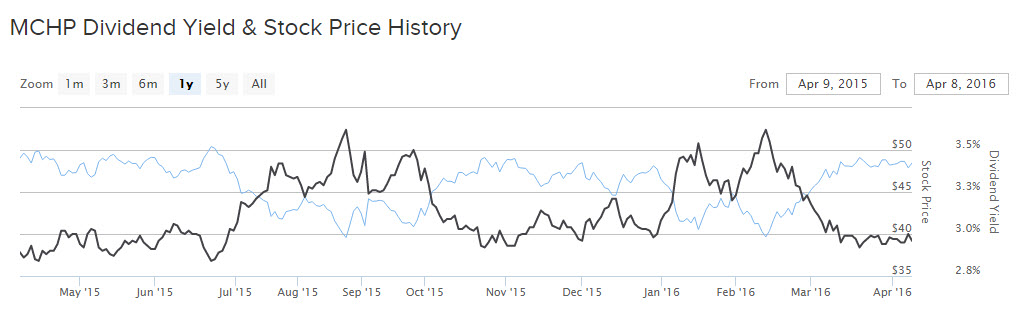

Microchip Technology Inc

Microchip Technology (MCHP ), with a market cap of $10B, is currently yielding a solid 2.96% on a considerably high payout ratio of 60%. (The average payout ratio of all the technology stocks we track is 33%.) Stock trades at a PE of 20.53 based on its 2016 EPS estimate of $2.36. Microchip is currently trading at $48.45, very close to its 52 week high as it’s off the top by only -4.46%. Next year’s EPS suggests a double digit growth of 12.71% with an EPS of $2.66.

The Bottom Line

The 5 stocks mentioned above are doing exceptionally well in the key parameters we usually track with regards to dividend paying stocks. Earnings and earnings growth are at the core of our analysis—and these stocks stand out in that aspect. They have a good yield and stock price performance coupled with attractive valuations.

Click here to read about 4 Healthcare Stocks near Their 52 Week Highs.