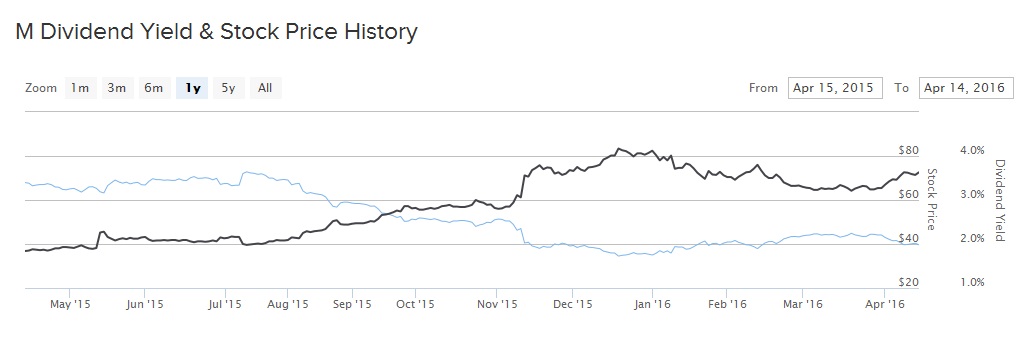

Retail stocks are among the most universally hated sectors in the entire market right now. Analysts are extremely bearish on brick-and-mortar retailers and investors have responded by selling the group indiscriminately. The negative sentiment has to do with the fear that Internet retail, led by Amazon.com (AMZN), will be the death of traditional retail. That’s particularly true when it comes to department stores like Macy’s (M ), which has seen its stock price fall 40% in the past one year based on its April 15 closing price.

However, although Macy’s is suffering a sales decline due to the strong U.S. dollar, unfavorable weather conditions, and increasing competition from Internet retail, it is still a strong brand and a leader in the retail industry. Moreover, Macy’s remains highly profitable and returns a large amount of its earnings to investors through dividends and buybacks. To that end, Macy’s recently announced a $1.5 billion addition to its stock buyback authorization, as well as the intention to raise its dividend by 5%. Macy’s also has a great deal of value on its balance sheet that the company could unlock by forming a real estate investment trust (REIT). The stock is an attractive pick for both value and income.

Why Macy's Sales Declines Could Be Temporary

Macy’s faced the perfect storm during the fourth quarter. The strong U.S. dollar negatively impacted tourism, which is a key factor for Macy’s. In addition, weather across many parts of the U.S., including the East and the Midwest, was unusually warm during the winter. This suppressed sales of warm winter clothing, which hurt Macy’s sales figures. Further, Internet competition undercutting Macy’s on price is a constant threat as well.

As a result, Macy’s sales figures were broadly weak in 2015. Total sales fell 3.7% to $27.079 billion, down from $28.105 billion in 2014. Moreover, comparable sales, a key metric for retailers that analyzes sales at locations open at least one year, fell 4.3% in the fourth quarter and 2.5% for the full year.

Macy’s is down, but it isn’t out. The company still generates healthy profitability and cash flow. Despite its various challenges, Macy’s still generated $3.77 per share in adjusted earnings for 2015. Earnings per share declined 10% from 2014. Again, while that was disappointing, it is hardly an indication of a serious deterioration in the business.

More importantly, there is good reason to think that Macy’s sales declines could be temporary. Two of the major headwinds from last year—the strong U.S. dollar and abnormally warm weather—are cyclical in nature. First, it is unlikely the U.S. dollar can stay at such extremely strong levels for an extended period. Second, when weather is warmer than expected, it typically postpones shopping, but pent-up demand will simply push out sales into future quarters.

Macy’s has responded to these challenges by closing underperforming stores, which will help preserve cash flow. The company opened a total of 26 stores but closed 40 stores last year. Another key part of its turnaround is potentially pursuing an REIT structure. This could be a major catalyst for shareholder returns going forward. Macy’s stated that it has started contacting potentially interested parties involving the company’s flagship and mall-based properties. The options on the table could include a possible real estate investment trust. These would be compelling ways to unlock some of the value of Macy’s prodigious real estate holdings.

Strong Profits, Low Payout Ratio Fuel Dividend Growth

The company demonstrated its strong cash flow and commitment to returning cash to shareholders by increasing its share repurchase authorization and also raising its dividend. It now has $2 billion remaining on its existing share repurchase program, and the quarterly dividend rate will go from 36 cents per share to 37.75 cents per share. The new dividend rate will be $1.51 per share. Based on its April 15 closing price of $40.64, the new dividend yield is 3.7%. This is a very strong yield that is well above the average S&P 500 dividend yield of approximately 2%. Macy’s forward dividend payout represents 40% of its trailing earnings per share.

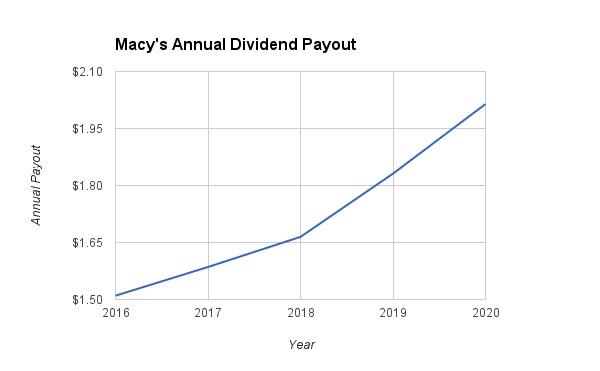

Because the company still generates strong profits and has a modest payout ratio, investors should expect future dividends to continue increasing, even if total revenue only grows in the low single-digit range. Longer term, as sales growth accelerates, the company could return to double-digit dividend growth. Therefore, Dividend.com is forecasting that Macy’s will increase its dividend by 5% in 2017 and 2018, and by 10% per year in the following two years. Under this scenario, Macy’s dividend would reach $2.01 per share by 2020.

The Bottom Line

Macy’s, like many other brick-and-mortar retailers and department stores, had a difficult year in 2015. Sales and earnings declined, but mostly due to cyclical factors that should ease with time. Until then, management has a plan to cut costs, close nonperforming stores, and the possibility of an REIT is a promising future catalyst. Macy’s has a low payout ratio and above-average dividend yield, making it a suitable stock holding for income investors.