Utility stocks are known as dependable, slow-and-steady investments. They have earned this reputation with their consistent financial performance. Utilities are highly recession resistant since electricity is virtually a matter of national security. People will always need to keep the lights on, regardless of the economic climate. This allows utility companies to generate consistent profits and pass along the bulk of their earnings in the form of high dividends. Many utilities can even raise their dividends each year because many of them are regulated and are allowed to raise rates annually.

Southern Company (SO ) raised its dividend on Apr. 21, to $0.56 per share each quarter. On an annualized level, the new dividend rate is $2.24 per share. That is a 3.2% increase from the previous dividend level. Southern has a long history of consecutive dividend payments without interruption. This increase makes 274 consecutive quarters—a streak going back more than 68 years all the way to 1948—that the company has paid a dividend equal to or greater than the previous dividend level.

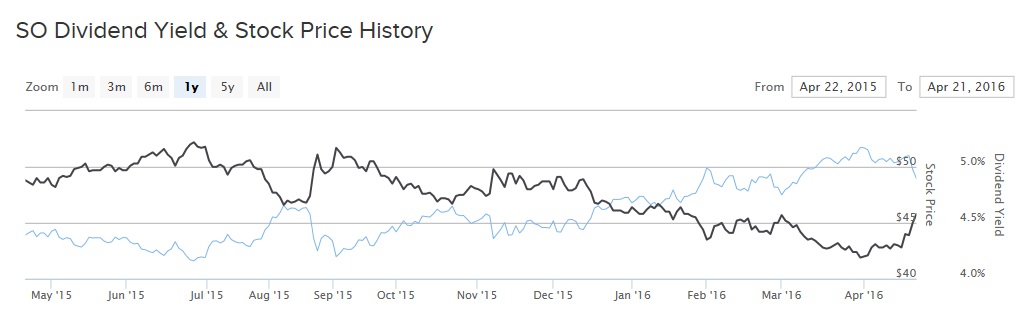

The current dividend yield for Southern is 4.5%. That is a high level of income, which is more than double the average yield in the S&P 500. As a result, Southern remains a top dividend stock choice for income investors.

Fundamentals Remain Challenged

Southern built a massive plant, called Kemper, to generate power from lignite coal. Generating power from lignite was a cornerstone of the clean coal movement because it supposedly produced fewer harmful emissions than traditional coal burning techniques, as well as at a lower cost. But the Kemper project has been besieged by start-up delays and a seemingly never-ending string of huge cost over-runs.

In 2014, Southern Company took a $729 million charge against earnings due to increased cost estimates for construction of the Kemper project, in addition to $553 million in extra costs related to construction of Kemper’s integrated gasification combined cycle (IGCC) project. Last year, the company was hit with $226 million in increased cost estimates for Kemper. Overall, the project is expected to come in several billion dollars above initial projections.

Still, Southern Company has a highly profitable business and enjoys the benefits of a utility—specifically, its highly regulated operations, steady rate increases, and defensive business model. This provides enough earnings to continue to raise its dividend, despite the Kemper issues. Even though Southern’s earnings per share fell 3% in the fourth quarter, the company still earned $2.60 per share in 2015. That is enough to more than cover its dividend, even after the dividend increase. The new payout level represents 86% of Southern’s trailing earnings. That is a high payout ratio but is manageable.

Excluding the several one-time costs and charges against earnings, Southern’s financial position looks better. Stripping out these items, Southern’s earnings per share rose 15% year over year in the fourth quarter. That is a very impressive growth rate for a utility. And, excluding the one-time items, Southern would have earned $2.89 per share. Therefore, it is hoped that once the Kemper project is finally complete, Southern’s earnings will improve significantly. This could lead to better dividend growth as well over the next several years.

Future Dividend Growth

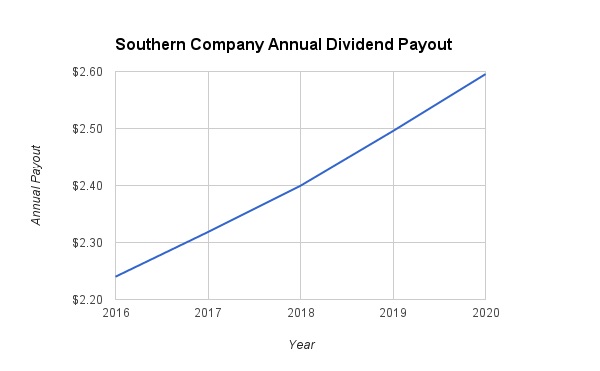

With the recent increase, Southern Company has raised its dividend for 15 years in a row. Southern Company’s dividend growth this year was slightly less than its annual dividend increases in recent years. I believe this is due in part to the problems at its Kemper plant. The company presumably is limiting dividend increases to retain more cash flow, in an attempt to cushion the blow from further cost overruns at Kemper. But going forward, as the company nears completion of the project, it will free up additional cash flow available for dividend increases. With that in mind, Dividend.com is projecting that Southern’s dividend growth accelerates slightly, to 3.5% over the next two years, followed by 4% dividend growth thereafter. Under that scenario, Southern’s annualized dividend will reach $2.60 per share by 2020.

The Bottom Line

Utilities are not the most exciting stocks to buy. They do not provide a great deal of growth. But they do provide something just as valuable: stability. Risk-averse investors should consider safe haven plays such as utilities. Utility stocks are famously known as “widow-and-orphan” investments, because of their ability to pay quarterly dividends like clockwork, regardless of the direction of the markets.

Southern Company has encountered challenges in recent years, but its reliable business model more than provides the necessary earnings to support its dividend. With a high yield and consistent annual dividend growth, Southern should remain a top stock pick for investors who desire income, such as retirees.

Check out our recent article on how Southern Company stands out from 70 stocks that Increased Dividends.