Income investors should consider water utilities because many of them are attractive stocks for dividends. American Water Works (AWK ) is a top pick in the sector. The reason water utilities are great investments is because they are regulated, similar to electric utilities, which allows them to pass along modest rate increases to customers each year. This consistency allows them to pay high dividends to shareholders and increase their dividends regularly.

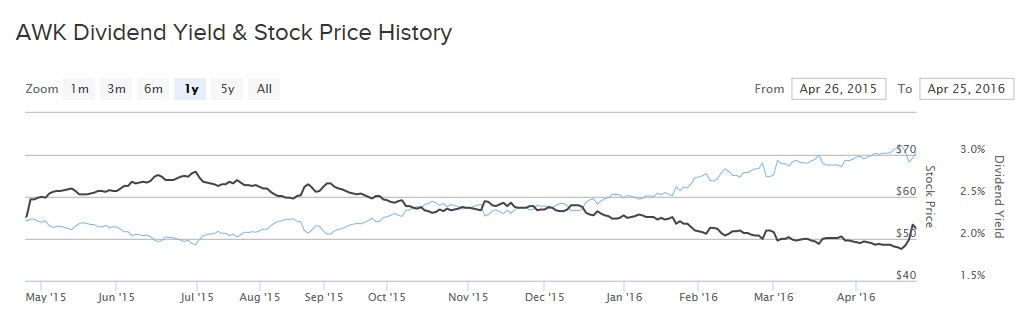

On April 22, American Water raised its dividend 10% from 34 cents per share to 37.5 cents per share quarterly. Its annualized dividend rate moves up to $1.50 per share. Based on its April 25 closing price, the stock provides a 2.1% dividend yield. American Water has increased its dividend every year since its 2008 initial public offering. This year’s raise is the fourth in a row of double-digit increases to the dividend. The increased dividend will be payable on June 1, 2016 to all shareholders of record as of May 9, 2016.

American Water shares have performed extremely well over the past year. The stock has returned 27% in the past 12 months, not including dividends. Investors have bid up valuations across the water utility industry, thanks to their extremely stable financial performance. This makes American Water a compelling investment option for income investors.

Defensive, Regulated Business Model

In order to pay the kind of steady dividends that American Water has since its IPO, maintaining steady profitability is a must. Perhaps the best aspect of American Water’s business is that it has a highly consistent stream of earnings each year, regardless of the state of the broader economy. Water is about the most recession-resistant business one can find in the market. Further, AWK is the largest publicly traded water utility company and has been in business for 130 years. It services approximately 15 million people spread across 47 states and Ontario, Canada. American Water has exhibited impressive growth in recent years, especially for a utility, which are traditionally seen as slow-and-steady types of companies.

American Water benefits most from its regulated business, which constitutes approximately 83% of its annual revenue. For the full year 2015, profit from continuing operations in the regulated segment rose 9%. This was slightly better performance than its market-based business, which grew 7%. Overall, American Water realized growth from its capital investment program, as well as lower operational and maintenance expenses. The company has improved upon its ability to make investments in needed capital improvements without significantly impacting customer bills. For 2015, earnings per share increased 12% year over year.

Going forward, American Water should continue to grow at high single-digit to low double-digit rates for many years. It will realize organic growth thanks to its investments plus new customer additions as a result of its aggressive acquisition strategy. American Water’s regulated businesses made 14 acquisitions during 2015, which added nearly 24,000 customers. In addition, the company added over 9,000 customers through organic growth. And as of the end of last year, American Water had pending acquisition agreements that stand to add another 9,000 customers to its customer base if the agreements receive regulatory approval. Management expects 2016 earnings to reach $2.75-$2.85 per share, which would represent 6% earnings growth at the midpoint in 2016.

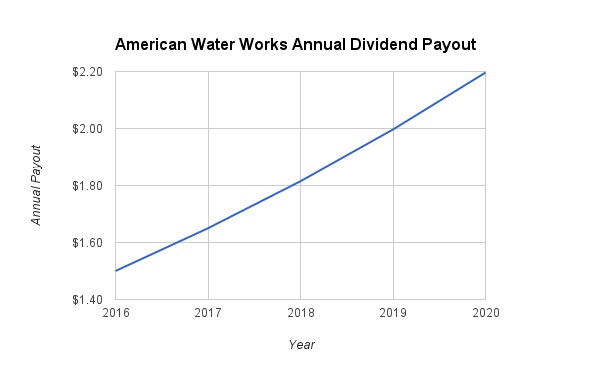

Over the long term, management expects to grow annual earnings by 7%-10% per year. That will give the company more than enough growth to keep raising its dividend each year. Plus, American Water has a low payout ratio. The company earned $2.64 per share in diluted EPS last year. Its new dividend rate of $1.50 per share represents 56% of its trailing earnings. This is a healthy payout ratio that leaves plenty of room for future dividend growth. Company management maintains a long-term policy of a 50%-60% payout ratio.

As a result, Dividend.com is forecasting the company to continue raising its dividend by 10% per year. That would match the 10% dividend raises in each of the past two years. Under this growth rate assumption, the dividend will reach $2.20 per share by 2020.

The Bottom Line

Water is a basic necessity of human life. That means water utilities like American Water will enjoy steady profits for many years to come. American Water is similar to other traditional electric utilities but offers diversification into a sub-sector which should see continued growth. Each year a significant chunk of its earnings flow through to its investors as a dividend, which makes American Water a top dividend stock for income investors.